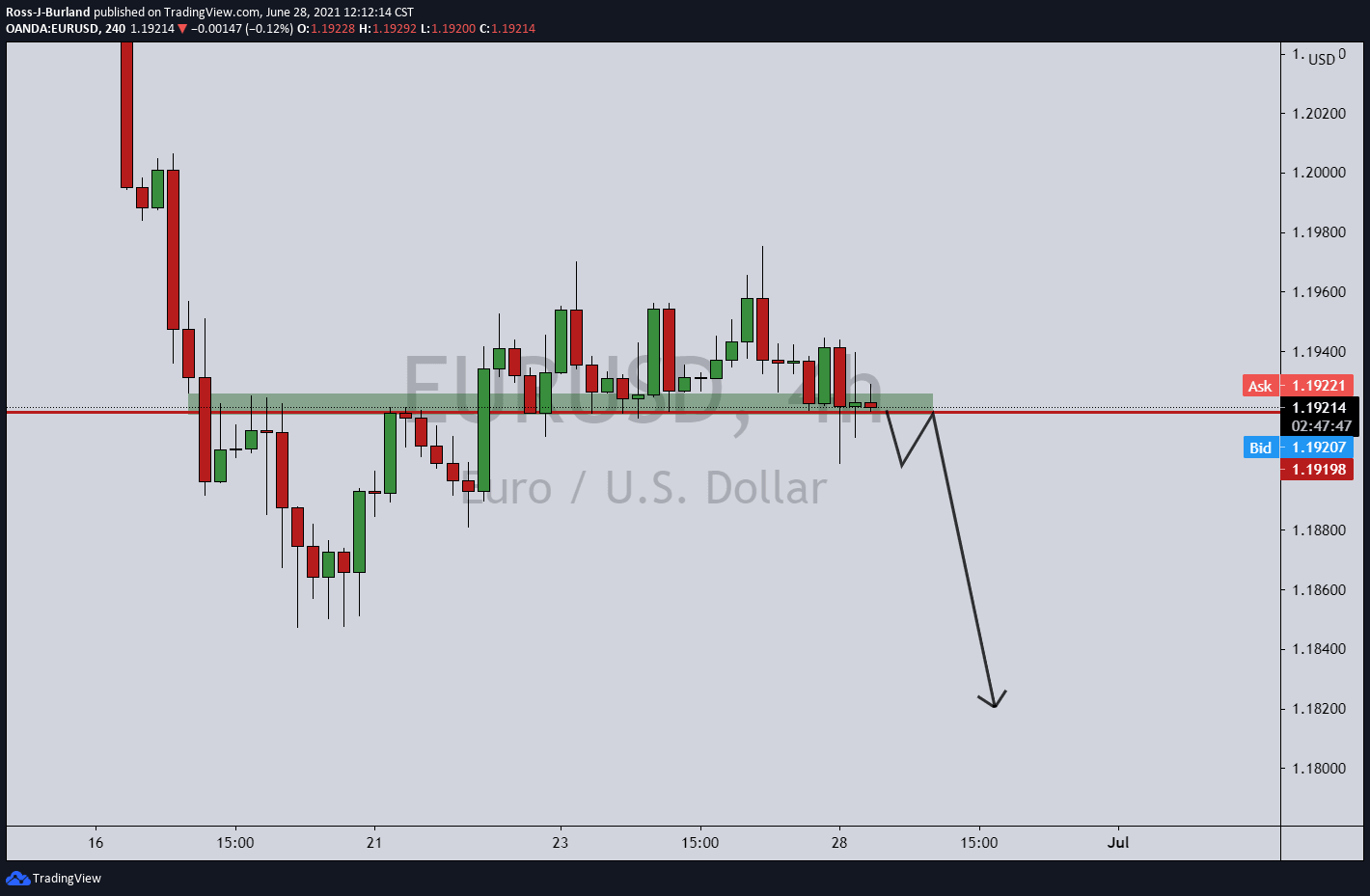

EUR/USD Price Analysis: Bears on the next leg towards 1.1805/12

- EUR/USD bears are taking control below the 4-hour resistance.

- EUR/USD would be expected to let towards 1.1805/12 and prior daily structure.

As per the prior analysis, EUR/USD bears seeking break of 4-hour support, the euro has indeed melted to the downside following a breach of the 4-hour support.

Prior analysis, daily chart

Bears have been monitoring for a shorting opportunity from within the build-up of lower highs within the daily correction that had been losing momentum in prior sessions.

From a lower time frame, such as the 4-hour chart, bears were monitoring for bearish structure on a break of the support as follows:

Prior 4-hour analysis

''First, the 4-hour support of 1.1920 needs to give first, breaking the 4-hour dynamic supporting line.''

Prior 4-hour analysis, critical support

''While the support holds, there is still a high probability that the price will remain contained between there and resistance in a sideways channel.

However, on the break of support, the bias falls heavily into the bear's hands for a downside extension.''

Live analysis, 4-hour progress

On the break of the 4-hour support, the zone will now be expected to act as resistance and so far it has.

Corrections are stalling below and thus forming a new bearish structure and confirmed resistance between 1.1912/23.

There is now a high probability that the price will continue to melt and make for a daily downside extension towards 1.1805/12 as follows:

Daily chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.