EUR/USD bears seeking break of 4-hour support

- It is a quiet start to the week ahead of a busy schedule for forex.

- EUR/USD bears looking for a breakout and eye a downside extension.

At the time of writing, EUR/USD is trading at 1.1923 and virtually flat towards the closing hours of the US session in a quiet start to the week.

Last week's news of optimism about a bipartisan US infrastructure agreement helped risk appetite. The infrastructure plan is valued at $1.2 trillion over eight years, of which $579 billion in new spending.

However, so far, the euro has ranged between 1.1902 and 1.1944 within a more risk-averse tone on Monday attributed to a spike in COVID-19 cases.

The lacklustre mood started out in Asia as Australia's most populous city, Sydney, went into lockdown. Indonesia is also battling record-high cases while a lockdown in Malaysia is set to be extended. Thailand also announced new restrictions in Bangkok and other provinces.

Moreover, traders are digesting the mix of Fed sentiment, conflicting data releases, Biden's infrastructure bill, month-end and are also looking ahead to Friday's US payroll data (economists expecting an increase of 675,000 jobs) to determine the direction of currency markets.

''That said, now that the market understands that labour supply has been containing the recovery in US jobs growth, it is possible that another weak report on non-farm payrolls will fail to diminish speculation about inflation risks in the US economy,'' analysts at Rabobank explained.

''This could mean that the USD recovers swiftly on any post payrolls sell-off and that on a risk-reward basis it may not pay to be short USDs into this release,'' the analysts at Rabobank argued.

Meanwhile, in the wake of the hawkish tilt from the FOMC the previous week, speculators decreased their net short dollar positions in the latest week.

The market was poorly positioned for the shift in tone from the Fed and overcrowded net EUR speculators’ long positions have also dropped back heavily as a consequence.

''Assuming the US data remains broadly supportive, we expect the USD to grind moderately higher vs. the EUR though the course of the year,'' analysts at Rabobank said.

EUR/USD technical analysis

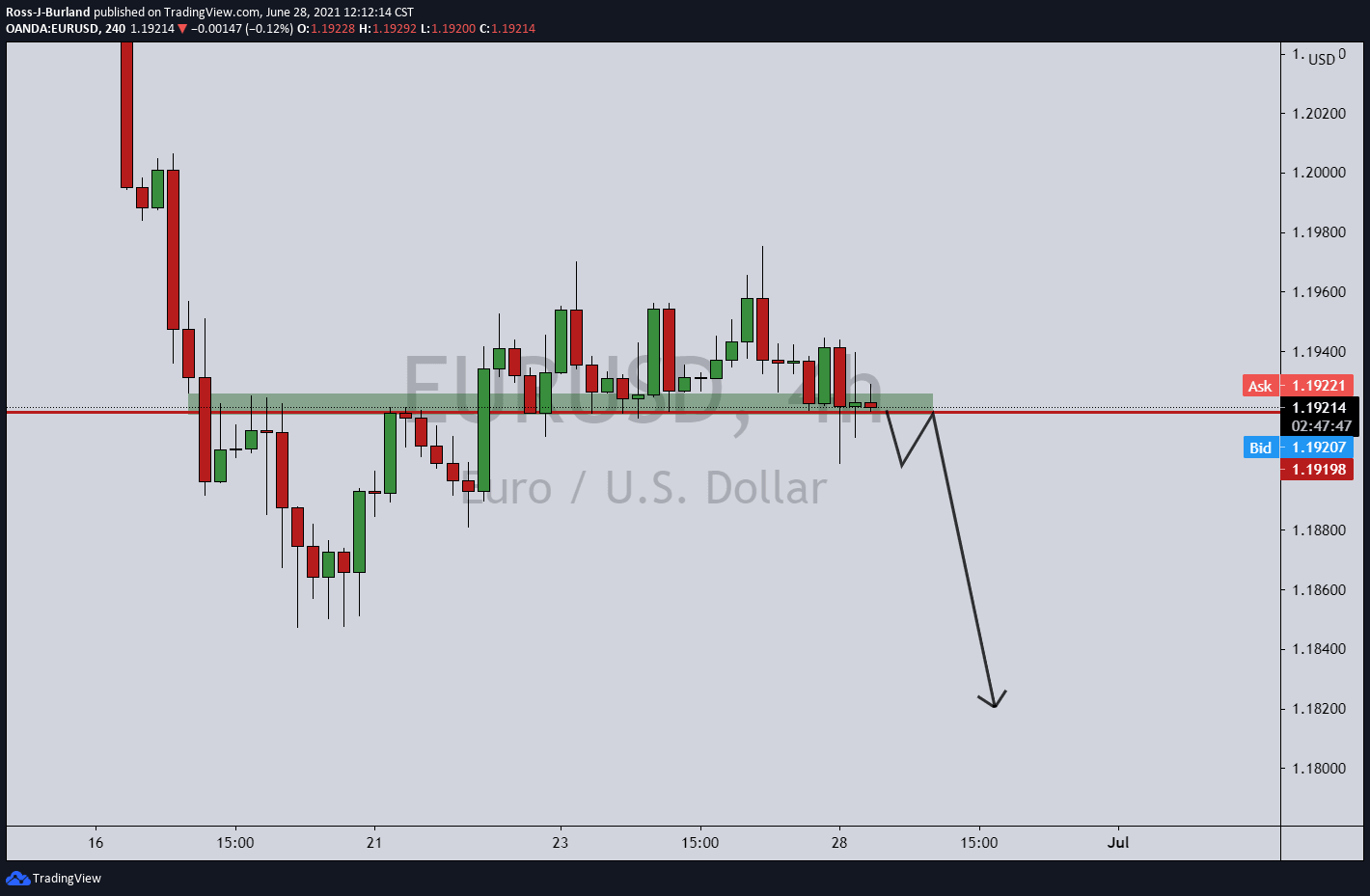

As per the prior analysis, EUR/USD Price Analysis: Bears seeking a daily downside continuation, the bears have made headway in pressuring the bullish commitments and have carved out a line in the sand on the 4-hour chart.

Prior analysis, daily chart

Prior 4-hour analysis

First, the 4-hour support of 1.1920 needs to give first, breaking the 4-hour dynamic supporting line.

Live 4-hour analysis

While the support holds, there is still a high probability that the price will remain contained between there and resistance in a sideways channel.

However, on the break of support, the bias falls heavily into the bear's hands for a downside extension.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.