EUR/USD Price Analysis: Bears occupy driver’s seat on the way to 1.1100

- EUR/USD began the week’s trading with downside gap, licks its wounds around daily lows off late.

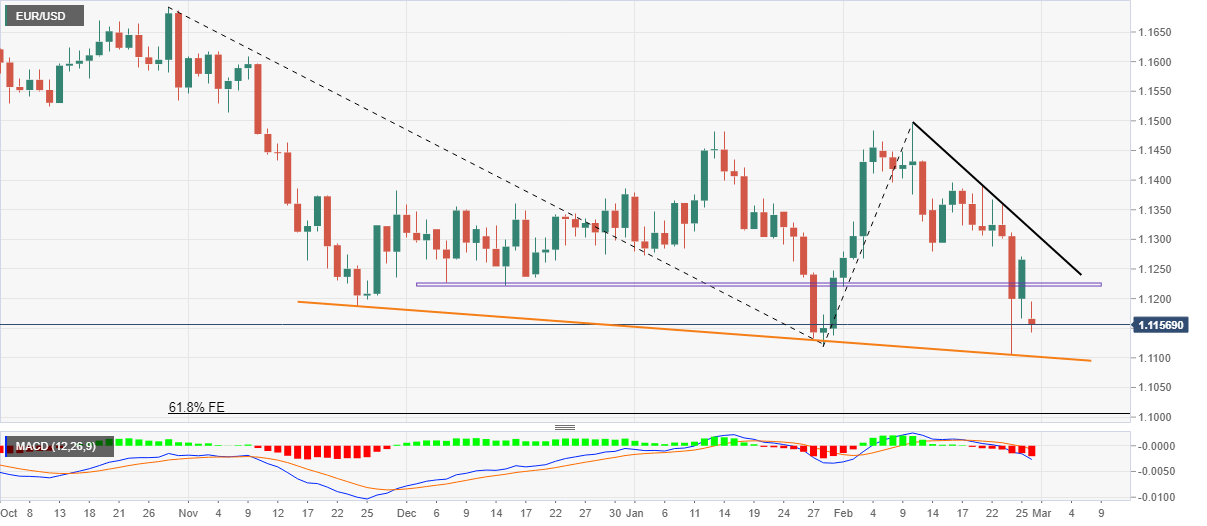

- Horizontal area from early December limits recovery moves, bearish MACD favors sellers.

- Three-month-old descending trend line challenges sellers targeting the 1.1000 level.

EUR/USD struggles to extend the rebound from intraday low around 1.1160 as traders brace for Monday’s European session.

The major currency pair portrayed a downside gap to begin the week’s trading as the risk-aversion wave favored the US dollar.

Also keeping the EUR/USD bears hopeful is the pair’s sustained trading below a horizontal resistance zone from early December 2021, around 1.1220-25, as well as the bearish MACD signals.

That said, the pair’s latest weakness drives it towards a downward sloping trend line from late November 2021, around 1.1100.

However, a clear downside break of the stated support line will make the pair vulnerable to test the 1.1000 threshold, surrounding the 61.8% Fibonacci Expansion (FE) of the EUR/USD moves between October 2021 and February 2022.

Meanwhile, a corrective pullback beyond the 1.1225 immediate hurdle won’t be an open invitation to the EUR/USD bulls as a 12-day-old descending trend line, close to 1.1315 by the press time, adds to the upside filters.

Even if the pair rises past 1.1315, the double tops marked around 1.1480-85 will be the key hurdle for the quote.

EUR/USD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.