EUR/USD Price Analysis: Bears eye a move to 1.0050

- EUR/USD bears are lurking within a key peak formation.

- 1.0050 is eyed for the day ahead if the price remains below 1.0130.

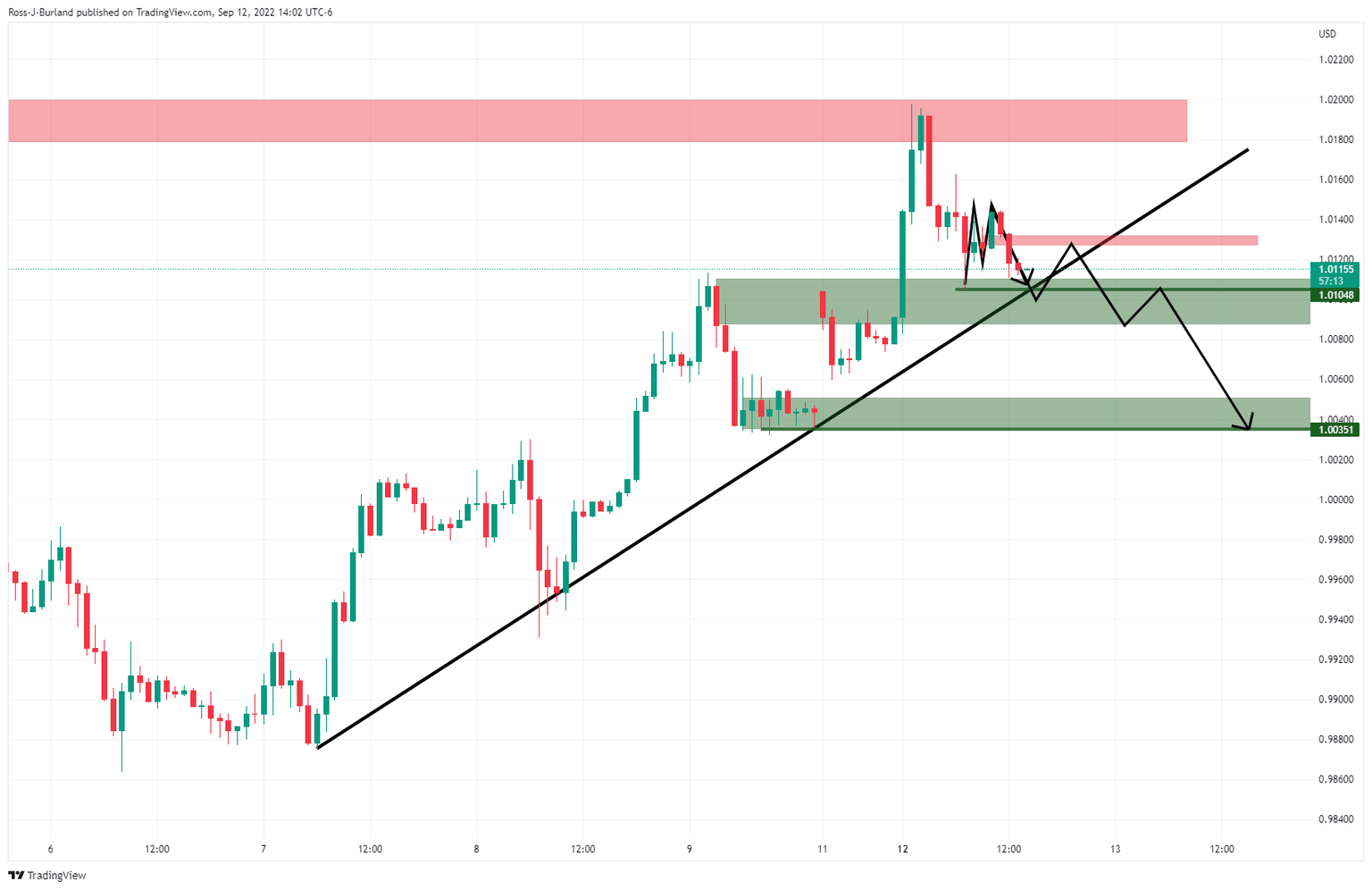

EUR/USD has been higher by some 0.7% in late North American trade as the bulls commit to trendline support, so far. However, the single currency is well below the start of the week's highs and peak formations are being printed on the hourly chart. The following illustrates a bearish bias from a short-term perspective as markets await the US inflation data on Tuesday:

EUR/USD H1 chart

The price has formed a peak formation near 1.0200 and again at 1.0150 with the M-formations. While below 1.0130, this leaves the focus on the downside for the sessions ahead. The above chart illustrates the potential flight path for the single currency with 1.0050/35 eyed as a potential downside target and structure respectively.

First, 1.0105 needs to give. A retest of the current M-formation's neckline could be first in line and if that were to hold, the bears will have the ammunition required to take on the bull's commitments around 101 the figure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.