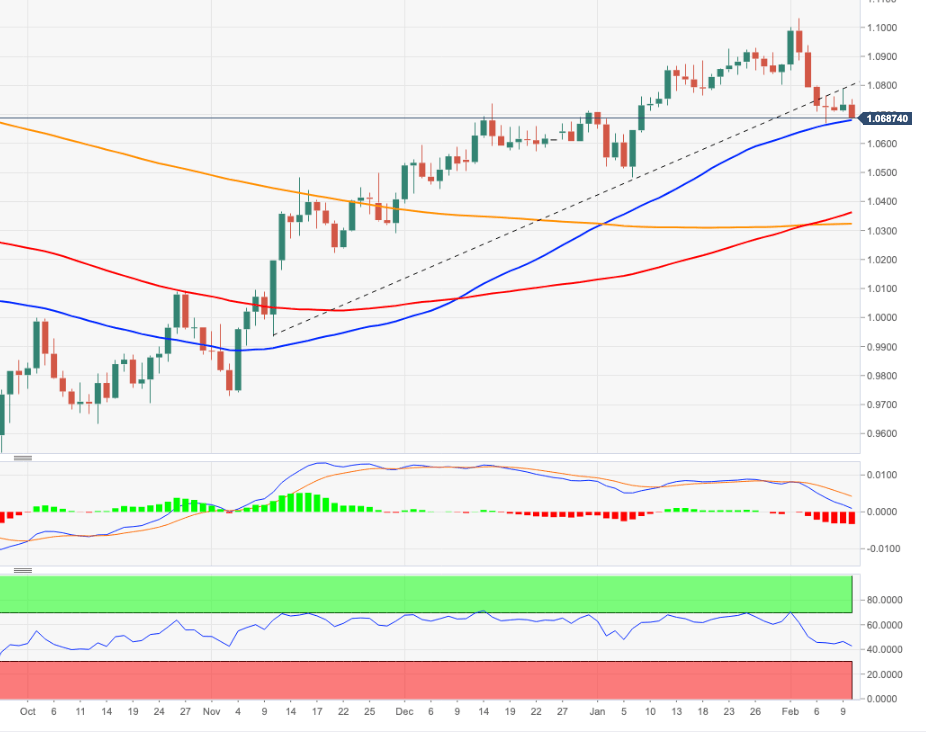

EUR/USD Price Analysis: Another drop to the February low is not ruled out

- EUR/USD resumes the downside following Thursday’s decent uptick.

- A deeper decline could see the monthly low near 1.0670 retested.

EUR/USD keeps the weekly range bound theme unchanged and now breaks below the key 1.0700 support on Friday.

In case losses gather extra impulse, then the pair could rapidly challenge the so far February low at 1.0669 (February 7). The loss of the latter could pave the way for further retracement to the 2023 low at 1.0481 (January 6).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0321.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.