EUR/USD fluctuates within recent ranges as investors brace for US consumer inflation data

- The Euro bounces up on hopes of an EU-US trade deal and upbeat Eurozone economic data.

- Investors remain wary of placing large US Dollar bets ahead of the US CPI release.

- EUR/USD is likely to find significant resistance at the 1.1700 area.

The EUR/USD pair is trading higher on Tuesday, following better-than-expected Eurozone Industrial Production and German economic sentiment figures, and investors are wary of holding large US longs, awaiting the release of June's US inflation numbers.

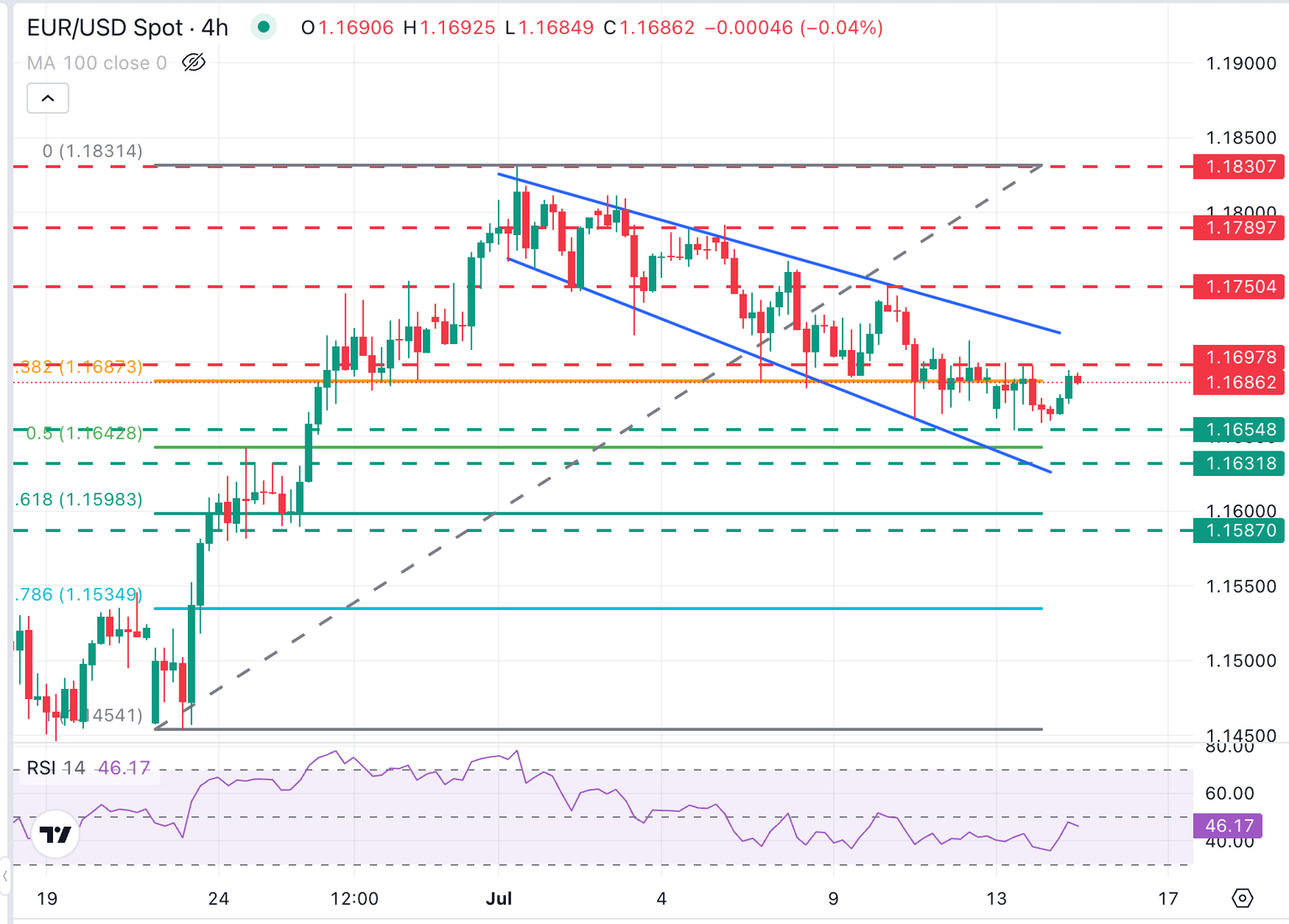

The Euro (EUR) appreciates from the three-week lows at 1.1655 hit on Monday, yet with upside attempts limited below 1.1700. Looking at the broader trend, the pair continues trapped within a downtrend channel, retreating from a nearly four-year high of 1.1830 set on July 1.

Market sentiment improves somewhat on Tuesday as the negotiations with the US continue, and President Trump announced the visit of EU officials to the US before reiterating his willingness to talk in an interview with journalists at the White House on Monday.

The US Dollar (USD), on the other hand, is showing a somewhat softer tone, with investors wary of holding large Dollar long positions ahead of the US consumer inflation report. Investors will analyze June's CPI to assess the impact of tariffs and anticipate the Federal Reserve's (Fed) next monetary policy steps. Any deviation from the market consensus might have a significant impact on US Dollar crosses.

Meanwhile, US President Trump has continued pressuring the Fed Chairman Jerome Powell, calling for lower interest rates. Trump's unprecedented harassment is very likely to intensify if the Fed's higher inflation expectations do not materialise, putting the central bank's independence into question. In previous occasions, these dynamics have increased negative pressure on the US Dollar.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.16% | -0.19% | -0.03% | -0.12% | -0.30% | -0.36% | -0.39% | |

| EUR | 0.16% | -0.09% | 0.12% | 0.02% | -0.17% | -0.26% | -0.22% | |

| GBP | 0.19% | 0.09% | 0.18% | 0.11% | -0.11% | -0.19% | 0.02% | |

| JPY | 0.03% | -0.12% | -0.18% | -0.12% | -0.26% | -0.38% | -0.28% | |

| CAD | 0.12% | -0.02% | -0.11% | 0.12% | -0.16% | -0.30% | -0.09% | |

| AUD | 0.30% | 0.17% | 0.11% | 0.26% | 0.16% | -0.10% | 0.07% | |

| NZD | 0.36% | 0.26% | 0.19% | 0.38% | 0.30% | 0.10% | 0.22% | |

| CHF | 0.39% | 0.22% | -0.02% | 0.28% | 0.09% | -0.07% | -0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: US Dollar loses steam with CPI numbers on focus

- US consumer prices are expected to have accelerated to a 2.7% year-on-year pace in June, from 2.4% in May. The core CPI, which strips off the influence of seasonal prices of food and energy, is seen accelerating to 3% in the last twelve months to June from 2.8% in the previous month.

- On Monday, President Trump called Chairman Powell a "knucklehead, Stupid guy" on Monday and said that inflation is not a serious concern for the economy, affirming that interest rates should be brought down to 1% from the current 4.25%-4.50% range. These attacks are highly likely to intensify if consumer inflation data comes below the market expectations.

- In the Eurozone, the German ZEW Economic Sentiment Index indicated a stronger-than-expected improvement in investors' economic confidence, rising to 52.7 from 47.5 in May, surpassing expectations of a 50.0 reading. The sentiment about the current economic situation also improved beyond expectations, to a -59.5 reading, from -72.0 in the previous month.

- Likewise, Eurozone Industrial Production accelerated beyond expectations in May, showing a 1.7% monthly increase, beating expectations of a 0.6% advance, while April's reading was revised higher, to a 2.2% contraction from the 2.4% decline previously estimated.

- Earlier on the day, data from China revealed the economy grew at a 5.2% pace in the second quarter, improving market expectations of a 5.1% reading and reflecting an unexpected resilience to US tariffs. These figures have contributed to improving market sentiment, adding weight to the safe-haven US Dollar.

EUR/USD bounces up from lows, with 1.1700 capping rallies for now

EUR/USD keeps trading within a descending channel from the July 1 highs. The pair is bouncing up from lows, but upside attempts are highly likely to remain limited until the outlook of the trade relationship between the EU and the US clarifies. Technical indicators in the 4-hour chart remain within bearish territory, with the Relative Strength Index (RSI) still below the 50 midline.

Bears failed to confirm below the 1.1660 support area (July 10 and 12 lows), but upside attempts remain limited below 1.1700 so far. A bearish continuation below the mentioned 1.1660 might find support at the 50% Fibonacci retracement of the late June bullish run, at 1.1640, ahead of the bottom of the bearish channel from July 1 highs, at 1.1630.

On the upside, the 1.1700 and the channel top, now around 1.1710, are likely to pose significant resistance. If that area is breached, the next target will be the July 10 high, at 1.1750.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Jun 11, 2025 12:30

Frequency: Monthly

Actual: 2.4%

Consensus: 2.5%

Previous: 2.3%

Source: US Bureau of Labor Statistics

The US Federal Reserve (Fed) has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Jun 11, 2025 12:30

Frequency: Monthly

Actual: 2.8%

Consensus: 2.9%

Previous: 2.8%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.