EUR/USD holds on to daily gains ahead of US Nonfarm Payrolls data

- The Euro appreciates within range but is on track for a moderate weekly loss.

- Eurozone final GDP has confirmed a 0.1% growth in Q1, the yearly rate has been revised to 1.5% from 1.4%

- The US Dollar pulls back with the market bracing for a soft US NFP report later in the day.

The EUR/USD crawls higher on Friday, and extends beyond 1.1680, but remains on track for its second consecutive negative week. An upward revision of the Eurozone Gross Domestic Product has provided some additional support to the Euro, while the US Dollar remains on the defensive, ahead of the release of a crucial Nonfarm Payrolls (NFP) report later on the day.

Investors are hoping for a relatively soft NFP report later in the day to cement market expectations of a Federal Reserve (Fed) rate cut in September. US weekly Initial Jobless Claims data and the ADP report both pointed to a weakening labor market on Thursday, endorsing those views.

Comments from Federal Reserve officials have leaned to the dovish side this week. New York Fed President John Williams affirmed on Thursday that he sees "gradual rate cuts," and Chicago Fed President Austan Goolsbee reiterated that September's meeting will be "live" after warning about the deterioration of the labour market.

Bets about lower interest rates in the US have helped to ease the bond market crisis seen earlier in the week. In Europe, the German and French 30-year yields have retreated from Wednesday's lows, although they remain at relatively high levels.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.35% | -0.33% | -0.16% | -0.20% | -0.52% | -0.56% | -0.38% | |

| EUR | 0.35% | 0.03% | 0.09% | 0.15% | -0.09% | -0.20% | -0.03% | |

| GBP | 0.33% | -0.03% | 0.08% | 0.11% | -0.10% | -0.24% | -0.02% | |

| JPY | 0.16% | -0.09% | -0.08% | 0.05% | -0.26% | -0.34% | -0.02% | |

| CAD | 0.20% | -0.15% | -0.11% | -0.05% | -0.27% | -0.36% | -0.15% | |

| AUD | 0.52% | 0.09% | 0.10% | 0.26% | 0.27% | -0.13% | 0.09% | |

| NZD | 0.56% | 0.20% | 0.24% | 0.34% | 0.36% | 0.13% | 0.21% | |

| CHF | 0.38% | 0.03% | 0.02% | 0.02% | 0.15% | -0.09% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: A mild risk appetite is buoying the Euro

- The Euro is drawing support from a moderate risk-on market on Friday to regain some of the ground lost earlier in the week, although upside attempts are likely to remain contained, with investors wary of selling US Dollars ahead of the NFP report.

- Weak payrolls data boosted market expectations of a September rate cut last month, and the market consensus points to a similar performance in August. Private payrolls are seen growing by 75K following a 73K increase in July.

- US employment data released on Thursday confirmed the weak momentum of the labor market. The ADP Employment Change report showed a 54K increase in August, well below the 65K forecasted, and about half of the previous month's 106K reading.

- US weekly Initial Jobless Claims rose to 237K in the last week of August, their highest level since June, exceeding market expectations of a 230K increase from the previous week's 229K.

- Futures markets are practically fully pricing a 25-basis-point Fed rate cut after the September 16 and 17 meeting. The CME Group's FedWatch tool is showing a 99.4% chance of a quarter-point cut, and at least another one before the end of the year.

- In Europe, the final reading of the second quarter's GDP has confirmed 0.1% quarterly growth, down from the 0.6% reading seen in the previous quarter. The yearly growth has been revised up to 1-5% from the previous 1.4% estimation, equalling the economic performance of the firt three months of the year. 1.5% in the first three months of the year.

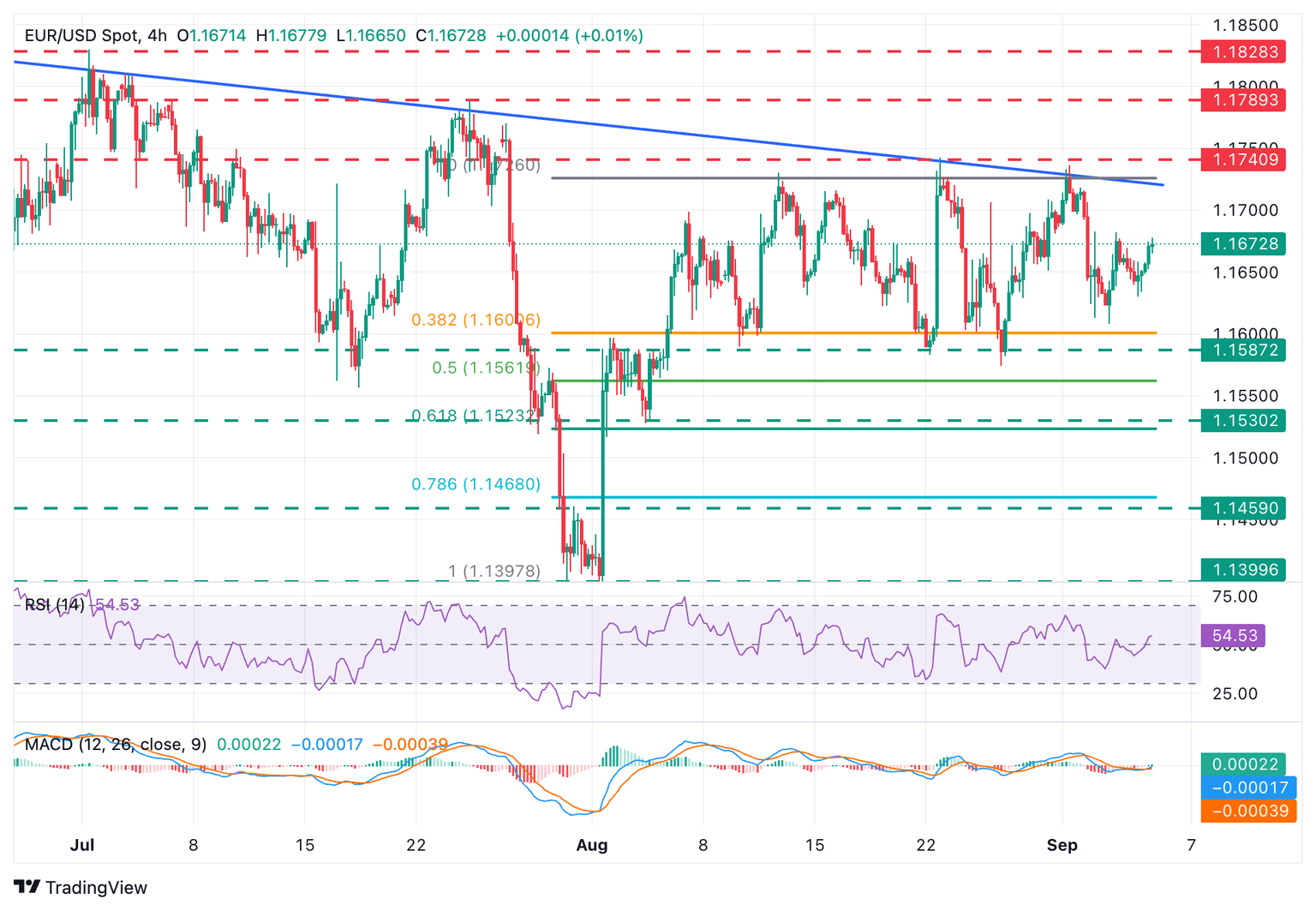

Technical Analysis: EUR/USD bulls aim for a key resistance area between 1.1720 and 1.1740

The EUR/USD is coming under increasing bullish pressure. The 4-hour Relative Strength Index RSI) has taken off from the 50 level, and the MACD shows a bullish cross, suggesting that buyers are taking control.

The confirmation above the September 3 high of 1.1682 gives bulls fresh hopes for a retest of a key resistance area between the trendline resistance, now at 1.1720, and the 1.1735 area, which capped rallies on August 13 and 22, and September 1. The pair, however, is unlikely to break these levels ahead of the release of the US Nonfarm Payrolls report

Support levels remain at Thursday's low near 1.1630 ahead of the September 3 low, right above 1.1610. Further down, the area between 1.1575 and 1.1590, which held bears on August 11, 22, and 27, and is also the floor of the last four weeks' trading range.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Sep 05, 2025 12:30

Frequency: Monthly

Consensus: 75K

Previous: 73K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Economic Indicator

Average Hourly Earnings (YoY)

The Average Hourly Earnings gauge, released by the US Bureau of Labor Statistics, is a significant indicator of labor cost inflation and of the tightness of labor markets. The Federal Reserve Board pays close attention to it when setting interest rates. A high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Fri Sep 05, 2025 12:30

Frequency: Monthly

Consensus: 3.7%

Previous: 3.9%

Source: US Bureau of Labor Statistics

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.