EUR/USD gains at US Dollar's expense, German Merz fails to secure majority in Bundestag

- EUR/USD edges up to near 1.1360 as the US Dollar faces pressure ahead of the Fed policy decision, in which it is expected to keep interest rates steady.

- US Treasury Bessent anticipated that new economic policies could boost economic growth to 3% next year.

- The German lower house is expected to vote for Conservative Merz as the new Chancellor.

EUR/USD moves higher to near 1.1360 in Tuesday’s North American session. The major currency pair gains as the US Dollar (USD) slumps ahead of the Federal Reserve’s (Fed) interest rate decision, which will be announced on Wednesday. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, slides to near 99.40.

According to the CME FedWatch tool, traders have fully priced in that the Fed will keep interest rates steady in the range of 4.25%-4.50% in May. Therefore, the major trigger for the US Dollar will be monetary policy guidance by the Fed for the remainder of the year.

The Fed is expected to face a hard choice between holding interest rates long enough, until the central bank gets clarity on the economic outlook in the face of new economic policies announced by US President Donald Trump, and acting prematurely.

US President Trump’s tariff policies have triggered fears of an economic slowdown and elevated consumer inflation. However, US Treasury Secretary Scott Bessent stated on Monday that new economic policies will boost economic growth and lower the budget deficit. “We think we can get growth back to 3% by this time next year that will help bringing down the federal deficit by maybe 1% per year,” Bessent said in an interview with CNBC Television.

Other than Fed policy, investors will closely watch headlines pointing to the confirmation of bilateral trade deals between the US and its trading partners. US Treasury Secretary Bessent also expressed confidence that Washington “is very close to some deals on trade, maybe as early as this week on trade deals” and there could be “substantial progress on trade with China in the coming weeks”.

Daily digest market movers: EUR/USD gains as US Dollar declines, Euro struggles

- The upside in the EUR/USD pair is mainly driven by weakness in the US Dollar. The Euro (EUR) gives up significant initial gains as Conservative leader Friedrich Merz fails to gain an absolute majority in votes for Chancellor of Germany on Tuesday. Merz secured 310 votes out of 328 collectively held by the CDU/CSU bloc and the Social Democrats, falling six short of the 316 threshold required to get eligibility for swearing as Chancellor.

- Conservatives won elections in February in coalition with Social Democrats, after prior Chancellor Olaf Scholz announced a snap election in late 2024. The constitution of the German government will speed up the execution of defense spending plans and investment measures announced at the Bundestag, or the lower house of parliament, in March.

- Additionally, firm expectations that the European Central Bank (ECB) will reduce interest rates in the June meeting have also limited the Euro’s upside. The ECB is widely anticipated to reduce its Deposit Facility rate by 25 basis points (bps) to 2%.

- Traders are increasingly confident that the ECB will reduce interest rates for the eighth time in a year and seventh time in a row amid high conviction that the Eurozone inflation is on track to return to the central bank’s target of 2% by the year-end. Additionally, fears of economic shocks due to the fallout of tariffs by US President Trump in an already slowing economy pave the way for further monetary policy easing. Several ECB officials have also signaled support for further monetary policy expansion and warned of downside risks to Eurozone inflation.

- Meanwhile, the possibility of the US-EU trade deal in the near term has diminished. EU Trade Commissioner Maros Sefcovic said during European trading hours on Tuesday that the continent is more focused on strengthening ties with other trading partners, which accounts for 87% of our exports, The Straits Times reported. On the current stats of trade negotiations with the US, Sefcovic said that EU prefers to negotiate trade deal, but Washington has not shown meaningful willingness to make progress towards a fair and balanced agreement.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.30% | -0.65% | -0.80% | -0.25% | -0.09% | -0.42% | 0.13% | |

| EUR | 0.30% | -0.37% | -0.50% | 0.06% | 0.19% | -0.13% | 0.43% | |

| GBP | 0.65% | 0.37% | -0.15% | 0.41% | 0.59% | 0.24% | 0.83% | |

| JPY | 0.80% | 0.50% | 0.15% | 0.55% | 0.72% | 0.47% | 0.97% | |

| CAD | 0.25% | -0.06% | -0.41% | -0.55% | 0.16% | -0.17% | 0.41% | |

| AUD | 0.09% | -0.19% | -0.59% | -0.72% | -0.16% | -0.32% | 0.26% | |

| NZD | 0.42% | 0.13% | -0.24% | -0.47% | 0.17% | 0.32% | 0.58% | |

| CHF | -0.13% | -0.43% | -0.83% | -0.97% | -0.41% | -0.26% | -0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

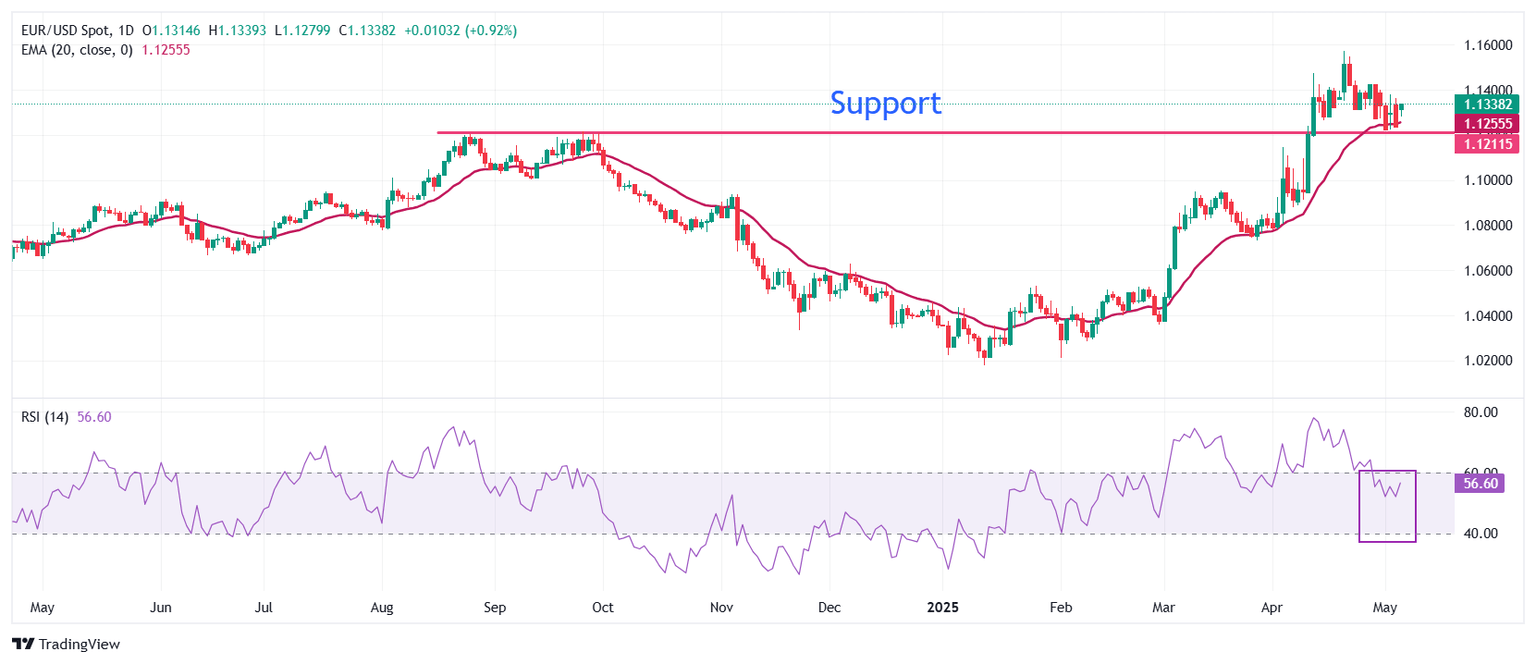

Technical Analysis: EUR/USD rises above 1.1350

EUR/USD oscillates inside Monday’s trading range above 1.1300 on Tuesday. The 20-day Exponential Moving Average (EMA) around 1.1260 continues to act as a major support for the pair.

The 14-day Relative Strength Index (RSI) falls inside the 40.00-60.00 range, indicating that the bullish momentum is concluded for now. However, the upside bias still prevails.

Looking up, the psychological level of 1.1500 will be the major resistance for the pair. Conversely, the September 25 high of 1.1214 will be a key support for the Euro bulls.

German economy FAQs

The German economy has a significant impact on the Euro due to its status as the largest economy within the Eurozone. Germany's economic performance, its GDP, employment, and inflation, can greatly influence the overall stability and confidence in the Euro. As Germany's economy strengthens, it can bolster the Euro's value, while the opposite is true if it weakens. Overall, the German economy plays a crucial role in shaping the Euro's strength and perception in global markets.

Germany is the largest economy in the Eurozone and therefore an influential actor in the region. During the Eurozone sovereign debt crisis in 2009-12, Germany was pivotal in setting up various stability funds to bail out debtor countries. It took a leadership role in the implementation of the 'Fiscal Compact' following the crisis – a set of more stringent rules to manage member states’ finances and punish ‘debt sinners’. Germany spearheaded a culture of ‘Financial Stability’ and the German economic model has been widely used as a blueprint for economic growth by fellow Eurozone members.

Bunds are bonds issued by the German government. Like all bonds they pay holders a regular interest payment, or coupon, followed by the full value of the loan, or principal, at maturity. Because Germany has the largest economy in the Eurozone, Bunds are used as a benchmark for other European government bonds. Long-term Bunds are viewed as a solid, risk-free investment as they are backed by the full faith and credit of the German nation. For this reason they are treated as a safe-haven by investors – gaining in value in times of crisis, whilst falling during periods of prosperity.

German Bund Yields measure the annual return an investor can expect from holding German government bonds, or Bunds. Like other bonds, Bunds pay holders interest at regular intervals, called the ‘coupon’, followed by the full value of the bond at maturity. Whilst the coupon is fixed, the Yield varies as it takes into account changes in the bond's price, and it is therefore considered a more accurate reflection of return. A decline in the bund's price raises the coupon as a percentage of the loan, resulting in a higher Yield and vice versa for a rise. This explains why Bund Yields move inversely to prices.

The Bundesbank is the central bank of Germany. It plays a key role in implementing monetary policy within Germany, and central banks in the region more broadly. Its goal is price stability, or keeping inflation low and predictable. It is responsible for ensuring the smooth operation of payment systems in Germany and participates in the oversight of financial institutions. The Bundesbank has a reputation for being conservative, prioritizing the fight against inflation over economic growth. It has been influential in the setup and policy of the European Central Bank (ECB).

BRANDED CONTENT

Finding the right broker for trading EUR/USD is crucial, and we've identified the top choices for this major currency pair. Read about their unique features to make an informed decision.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.