EUR/USD looks offered in new cycle lows in sub-0.9900 levels

- EUR/USD drops below 0.9900 to clinch new cycle lows.

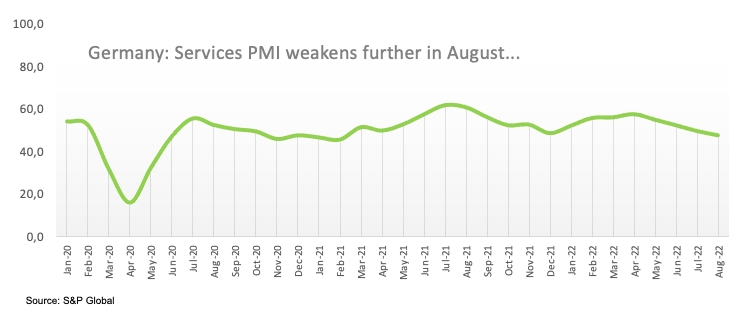

- Germany final Services PMI came at 47.7 in August.

- US markets will remain closed due to the Labor Day holiday.

Sellers returned to the European currency and drags EUR/USD to fresh lows in the 0.9880/75 band for the first time since December 2002 on Monday.

EUR/USD weaker on USD-strength, prudent ahead of ECB

EUR/USD manages to leave behind the initial pessimism and rebounds from nearly 2-decade lows in the sub-0.9900 area at the beginning of the week, always against the backdrop of fresh buying interest in the dollar.

Indeed, the US Dollar Index (DXY) rose to more than 20-year highs north of the 110.00 hurdle before the opening bell in the old continent on Monday, as investors continue to adjust to the prospects for extra rate hikes by the Fed in the next months.

However, and before the Fed’s event, the ECB will meet later this week and expectations among investors appear to still favour a 75 bps rate hike, all amidst the unabated elevated inflation and with the spectre of the energy crush still hovering around the region.

In the docket, final figures saw the Services PMI in Germany at 47.7 in August and 49.8 in the broader Euroland. Later in the session, Retail Sales in the euro area will close the daily calendar.

What to look for around EUR

EUR/USD remains well under pressure and breaches the 0.9900 mark to flirt with levels last seen nearly 20 years ago.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence. The latter, in the meantime, keeps closely following the prevailing debate around the size of the next interest rate hikes by both the ECB and the Federal Reserve.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany, EMU Final Services PMI, EMU Retail Sales, EMU Sentix Index (Monday) – Germany Construction PMI (Tuesday) – Flash EMU Q2 GDP Growth Rate (Wednesday) – ECB Interest Rate Decision, Fed Powell (Thursday) – Eurogroup Meeting, Emergency Energy Meeting (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is losing 0.39% at 0.9912 and the breach of 0.9877 (2022 low September 5) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low). On the other hand, there is an initial up barrier at 1.0090 (weekly high August 26) ahead of 1.0192 (55-day SMA) and then 1.0202 (August 17 high).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.