EUR/USD leaps to new monthly peaks near 1.2100

- EUR/USD accelerates gains and approaches the 1.21 level.

- The sell-off in the dollar picks up further pace ahead of key data.

- ECB’s Lagarde will speak later, US Nonfarm Payrolls takes centre stage.

The buying pressure around the single currency gather extra steam and pushes EUR/USD back to the vicinity of the 1.21000 neighbourhood, or new weekly/monthly tops.

EUR/USD up on USD-selling, looks to NFP

EUR/USD adds to Thursday’s gains well past the 1.2000 mark and looks poised to challenge the next barrier at 1.2100 the figure amidst the increasing selling bias surrounding the dollar.

Supporting the momentum in the European currency appears the improvement in yields of the German 10-year Bund, which trade in fresh peaks around -0.21% along with a mild upside in the US 10-year benchmark.

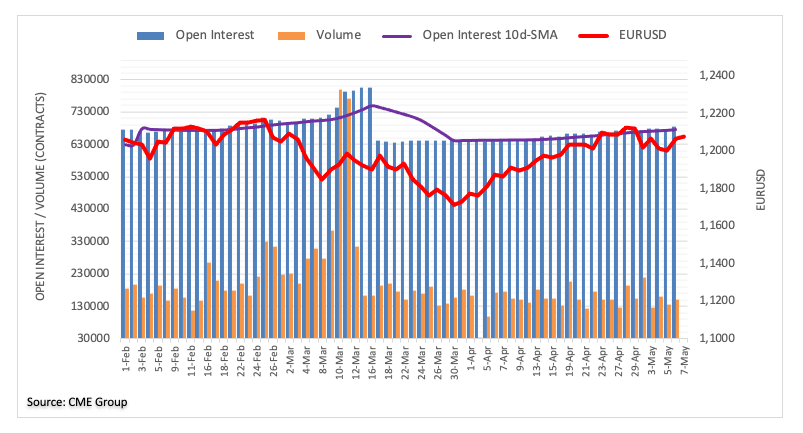

The positive mood in EUR also appears propped up by the recent activity in the futures markets on Thursday, as the daily upside was in tandem with rising open interest and volume.

In the meantime, the better mood in the risk complex collaborates with the upside in the pair ahead of the key publication of the US Nonfarm Payrolls for the month of April. Consensus expects the economy to have created 978K jobs during last month and the Unemployment Rate to have eased to 5.8%.

Earlier in the euro docket, the German Industrial Production expanded 2.5% MoM in March, while the trade surplus shrunk to €14.3 billion during the same period. Later, ECB’s C.Lagarde will speak on the global economy.

What to look for around EUR

EUR/USD extends the bounce off the 1.1985/80 band and looks to reclaim the key 1.2100 area at the end of the week. The rebound in the sentiment around the single currency stays constructive on the back of the investors’ shift to the improved growth outlook in the Old Continent now that the vaccine campaign appears to have gained some serious pace and solid results from key fundamentals pari passu with the surging morale in the bloc.

Key events in the euro area this week: ECB’s Lagarde speech (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections.

EUR/USD levels to watch

So far, spot is gaining 0.10% at 1.2077 and faces the next up barrier at 1.2150 (monthly high Apr.29) followed by 1.2243 (monthly high Feb.25) and finally 1.2349 (2021 high Jan.6). On the other hand, a breach of 1.1985 (monthly low May 5) would target 1.1944 (200-day SMA) en route to 1.1887 (61.8% Fibo of the November-January rally).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.