EUR/USD hits two-week high as Fed dovish bets surge on Bessent remarks

- a EUR/USD climbs to 1.1730, trades near 1.1700, up 0.20% on the day.

- US Treasury Secretary Scott Bessent urges a 50 bps September cut, says rates should be 150–175 bps lower.

- Markets price in 98% odds of a Fed 25 bps cut, 2% for 50 bps.

- Geopolitical optimism over a possible Ukraine–Russia resolution adds EUR/USD upside bias.

EUR/USD surges on Wednesday, hitting a two-week high at around 1.1730 as the US Dollar (USD) gets battered, sponsored by traders speculating that the Federal Reserve (Fed) might turn dovish following remarks by US Treasury Secretary Scott Bessent. At the time of writing, the pair trades at 1.1699, up by more than 0.20%.

Earlier, US Treasury Secretary Scott Bessent commented that the Fed should reduce borrowing costs by 50 basis points at the September meeting due to weakness in the labor market. He added in an interview with Bloomberg that rates should be “150, 175 basis points lower.”

Monet market players rushed to almost entirely price in a quarter of a percentage point. Prime Market Terminal data shows odds at 94%, with a slim 6% chance for a 50-bps rate cut at the September 16-17 meeting.

Tuesday’s US inflation report showed that the headline Consumer Price Index (CPI) in July was unchanged at 2.7% YoY from June, below forecasts of 2.8%. Core CPI jumped above estimates of 3%, coming at 3.1%, up from 2.9% in the previous month.

In Europe, Germany reported that inflation in July hit the European Central Bank (ECB) and the Bundesbank 2% goal, as expected. Contrarily, in Spain, the CPI was 2.7% YoY for the same period. Nevertheless, ECB guidance had shown that the Governing Council turned more neutral regarding monetary policy after cutting rates at the last meeting.

Expectations that the interest rate differential between the Fed and the ECB may reduce substantially are a tailwind for EUR/USD. This, alongside hopes of a solution to the Ukraine-Russia conflict, could propel the pair higher in the near term.

Ahead this week, the EU’s economic docket will feature the release of jobs data, Industrial Production, and the Gross Domestic Product (GDP) for the bloc. In the US, the Producer Price Index (PPI) is awaited, along with Initial Jobless Claims and Fed speeches.

Daily digest market movers: EUR/USD climbs as traders fully priced in Fed rate cut

- Now that inflation figures on the consumer side are in the rearview mirror, traders' focus shifts to Thursday’s Producer Price Index (PPI). Economists project a rise in core PPI from 2.6% to 2.9% YoY in July.

- Chicago Fed President Austan Goolsbee stressed that economists agreed on the importance of the Federal Reserve’s independence from political influence, warning that such autonomy is essential to prevent inflation from returning. He described tariffs as a “stagflationary shock” and expressed concern that they could act as a one-time event triggering transitory inflation.

- Looking ahead, Goolsbee said upcoming Fed meetings will be “live,” indicating that most policymakers will avoid pre-committing to interest rate decisions, keeping options open based on incoming data.

- The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of its peers, is down 0.26% at 97.80, a tailwind for the EUR/USD pair.

- On the European Central Bank (ECB) front, the easing cycle seems to be on pause for the September meeting, with 94% odds for the ECB to keep rates unchanged, and a slim 9% chance of a 25 basis points (bps) rate cut.

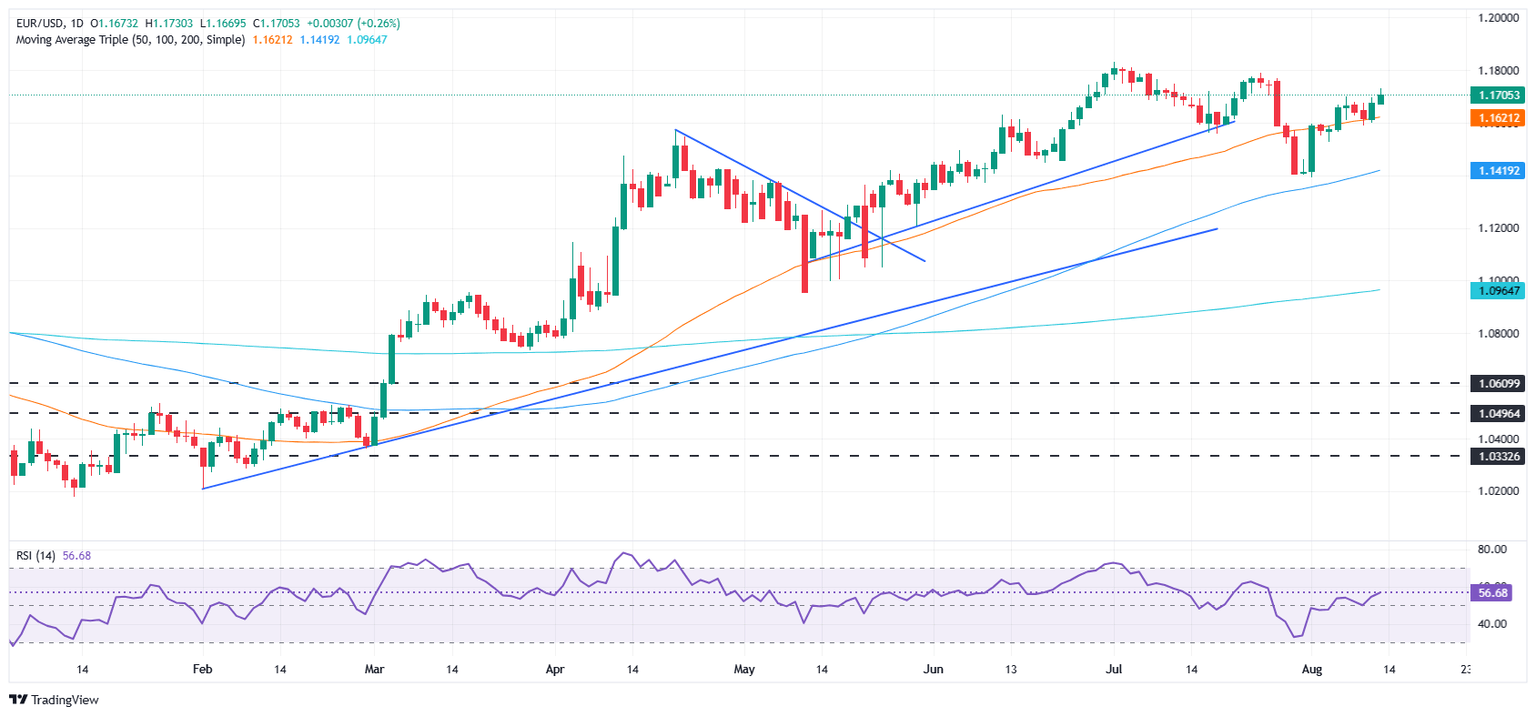

Technical outlook: EUR/USD hovers near 1.1700 as bulls’ target 1.1800

The uptrend continued, with EUR/USD trading near the 1.1700 figure. A daily close above the latter could pave the way for testing the current week’s high of 1.1730, ahead of 1.1750. A breach of the latter will expose 1.1800, and the YTD high at 1.1829.

Conversely, if EUR/USD ends the session below 1.1700, sellers would remain hopeful to test the 1.1650 mark in the near term. Resting below that level is the confluence of the 20- and 50-day Simple Moving Averages (SMAs) at around 1.1627/20, before 1.1600.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.