EUR/USD drifts closer to weekly lows on cautious markets, ahead of the FOMC Minutes

- The Euro remains capped below 1.1730 with investors still wary of risk.

- The lack of progress in the Eurozone-US negotiations poses headwinds to a significant Euro recovery.

- The market focus shifts to the FOMC minutes, looking for further guidance for USD crosses.

The EUR/USD pair is posting moderate losses on Wednesday, nearing the bottom of the weekly range, as investors remain wary of risk after US President Donald Trump announced new tariffs on copper and pointed to significant restrictions on pharmaceuticals.

The Euro (EUR) is accelerating its decline ahead of Wednesday's US session opening. Failure to extend above 1.1730 earlier on the day has given fresh hopes to bears, who are pushing the pair back close to Tuesday's lows at 1.1680 at the time of writing. day, but upside attempts have been capped below 1.1730. All in all, the broader negative trend remains intact, with price action showing a bearish correction from multi-year highs at 1.1830.

Trump took his trade war to the next stage after announcing 50% tariffs on imports of copper products and threatening a 200% levy on drugs if pharmaceutical firms do not relocate their production to the US within the next 12 months.

These measures come less than 24 hours after the US imposed 25% tariffs on Japan and Korea, the country's second and third major Asian partners. The deadline for their application was delayed to August 1, and US Government officials left a door open to adjustments if trading partners send their proposals, which contributed to easing the risk-averse reaction to the new tariffs.

In a more domestic scope, the trade negotiations between the Eurozone and the US do not seem to be at their best moment. Eurozone sources continue to express hopes of reaching a deal that will spare them from the 10% baseline levy, but Trump affirmed that he will send a tariff letter to the European Union this week. Not the best news for the Euro.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.29% | 0.12% | 0.10% | 0.32% | 0.15% | 0.24% | 0.08% | |

| EUR | -0.29% | -0.15% | -0.19% | 0.03% | -0.09% | -0.06% | -0.09% | |

| GBP | -0.12% | 0.15% | 0.02% | 0.19% | -0.02% | 0.04% | -0.04% | |

| JPY | -0.10% | 0.19% | -0.02% | 0.18% | 0.05% | 0.12% | -0.01% | |

| CAD | -0.32% | -0.03% | -0.19% | -0.18% | -0.11% | -0.08% | -0.12% | |

| AUD | -0.15% | 0.09% | 0.02% | -0.05% | 0.11% | 0.04% | 0.00% | |

| NZD | -0.24% | 0.06% | -0.04% | -0.12% | 0.08% | -0.04% | -0.07% | |

| CHF | -0.08% | 0.09% | 0.04% | 0.01% | 0.12% | -0.01% | 0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The Euro loses ground with US tariffs in the air

- EUR/USD maintains a broader bearish tone this week. The US Dollar (USD) picks up, buoyed by its safe-haven status amid risk-averse markets and a 5-day rally in US Treasury yields. Investors, on the other hand, remain reluctant to place large Euro bets until the trade relationship between the Eurozone and the US clarifies.

- The fate of the Eurozone-US trade negotiation remains uncertain. Comments from the meeting have been mixed, with Trump saying that the EU was "very nice to us" but also "much worse than China". From the European side, the Swedish finance minister considered the US proposal "very bad". EU representatives are still hopeful of reaching a deal, but the US president announced that a tariff letter will be sent to the Eurozone in the next couple of days. The Euro is likely to remain on its back foot in the meantime.

- The Eurozone economic calendar is thin on Wednesday, with only European Central Bank speakers worth mentioning. They are likely to reiterate that the central bank is in a good place to wait for developments in the international trade scenario and their impact on growth and inflation.

- In the US, the highlight is the release of the FOMC Minutes, due later in the day at 18:00 GMT. Federal Reserve Chair Jerome Powell delivered a hawkish message that has been endorsed by the strong US employment figures seen in June. The risk for the US Dollar is on the upside.

- Data from Germany released on Tuesday revealed that the trade surplus increased by EUR 18.4 billion in May, from EUR 15.8 billion in April, against expectations of a slight decline to EUR 15.5 billion. The main reason behind the higher surplus, however, has been a larger-than-expected decline in imports, which points to slower domestic demand.

- In France, the trade deficit widened to EUR 7.76 billion in May from EUR 7.68 billion in April, slightly above the EUR 7.7 billion anticipated by market forecasts.

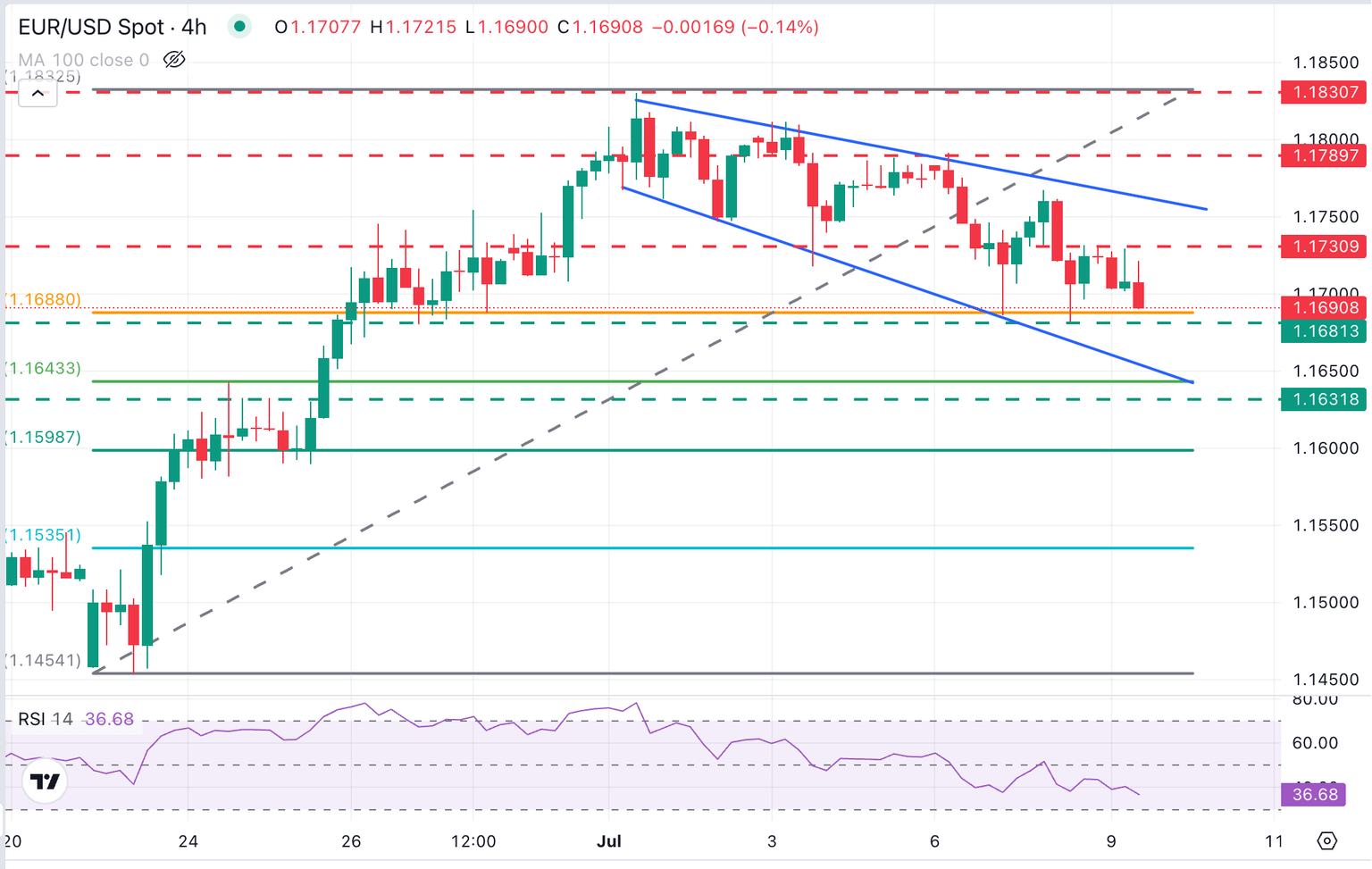

EUR/USD keeps trading within a corrective channel

EUR/USD recovery attempt was limited right below the descending trendline resistance from July 1 highs, at the 1.1770 area, which keeps the price action within a broadening wedge pattern. This figure reveals an emotional market, often appearing at major tops.

Technical indicators are on bearish territory, with the Relative Strength Index (RSI) wavering below the 50 level on the 4-hour chart, although the support area above 1.1680, where the 38.2% Fibonacci retracement level of the June 24 - July 1 rally meets the July 7 and 8 lows, seems a strong support level.

Below here, the pair might find support at 1.1630 - 1.1645, where previous highs meet the 50% Fibonacci retracement level of the mentioned late June rally.

On the upside, immediate resistance is the intraday high, at 1.1730, ahead of the mentioned trendline and the July 8 high at the 1.1765-1.1770 area.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Next release: Wed Jul 09, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.