EUR/USD rises as US Dollar drops ahead of Trump’s tariff announcement

- EUR/USD moves higher to near 1.0820 ahead of US President Trump's announcement of reciprocal tariffs.

- Anxiety over Trump's tariffs has dampened the confidence of US businesses and households.

- Soft Eurozone HICP data paves the way for more ECB interest rate cuts.

EUR/USD rises to near 1.0820 during North American trading hours on Wednesday. The major currency pair gains as the US Dollar (USD) declines before the announcement of reciprocal tariffs by United States (US) President Trump at 20:00 GMT. The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, falls to near 104.00.

Investors expect Trump's tariffs will also be unfavorable to the US economy, considering consumer and business confidence deterioration. The ISM Manufacturing Purchasing Managers Index (PMI) also showed on Tuesday that the business activity contracted in March after expanding for two straight months. "Demand and production retreated, and destaffing continued, as panellists’ companies responded to demand confusion," ISM Manufacturing Chair Timothy Fiore said.

US President Trump's fresh suite of tariffs is expected to become effective immediately after the announcement. Such a scenario will upend the global trading system, making products of countries that will attract higher tariffs less competitive. Higher import duties will also result in a slowdown in global business investment as firms would struggle to ascertain the demand outlook of their products.

The comments from US Treasury Secretary Scott Bessent on Tuesday also indicated that the President will impose the highest level of levies on his trading partners and stated that targeted countries could pass them by meeting US demands, specifically by diminishing rates on imports from the US.

Meanwhile, the ADP Employment Change data for March has come in better than expected. US private employers added 155K workers, significantly higher than estimates of 105K and the prior release of 84K, revised higher from 77K.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.58% | -0.35% | -0.01% | 0.01% | -0.46% | -0.77% | -0.18% | |

| EUR | 0.58% | 0.25% | 0.55% | 0.59% | 0.14% | -0.21% | 0.41% | |

| GBP | 0.35% | -0.25% | 0.35% | 0.36% | -0.11% | -0.43% | 0.16% | |

| JPY | 0.01% | -0.55% | -0.35% | -0.01% | -0.48% | -0.80% | -0.20% | |

| CAD | -0.01% | -0.59% | -0.36% | 0.01% | -0.47% | -0.77% | -0.19% | |

| AUD | 0.46% | -0.14% | 0.11% | 0.48% | 0.47% | -0.32% | 0.27% | |

| NZD | 0.77% | 0.21% | 0.43% | 0.80% | 0.77% | 0.32% | 0.60% | |

| CHF | 0.18% | -0.41% | -0.16% | 0.20% | 0.19% | -0.27% | -0.60% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily digest market movers: EUR/USD rises amid weakness in US Dollar

- EUR/USD moves higher despite investors expecting the European Union (EU) to be one of the leading trading partners of the US that will attract the highest tariffs. US President Donald Trump has alleged the EU several times for unfair trade practices with the US. Trump has blamed the Eurozone for not buying enough American goods.

- Trump's sweeping hefty tariffs on the Eurozone will significantly impact the region’s economic outlook. Last week, ECB President Christine Lagarde said that the trade war could subtract 0.5% from the bloc’s economic growth. Lower economic growth and easing inflationary pressures in the Eurozone would boost expectations that the European Central Bank (ECB) will cut interest rates in the policy meeting this month.

- On Tuesday, the Eurostat reported that the core Harmonized Index of Consumer Prices (HICP) – which excludes volatile items such as food, energy, alcohol, and tobacco – rose at a slower pace of 2.4% in 12 months to March, compared to estimates of 2.5% and the prior release of 2.6%. During European trading hours on Wednesday, Christine Lagarde also sounded confident in her interview on the Irish radio station Newstalk that the battle against inflation will be over soon. "There is still a bit of work to do on inflation, but it is very close to target," Lagarde said.

- The outlook of the Eurozone could be worsened if the EU Commission shoots retaliatory measures against Trump’s tariff. European Commission President Ursula von der Leyen warned on Tuesday, “We do not necessarily want to retaliate, but if it is necessary, we have a strong plan to do so, and we will use it.” Von der Leyen added that all instruments for countermeasures are “on the table” and that we have the power to “push back against US tariffs”.

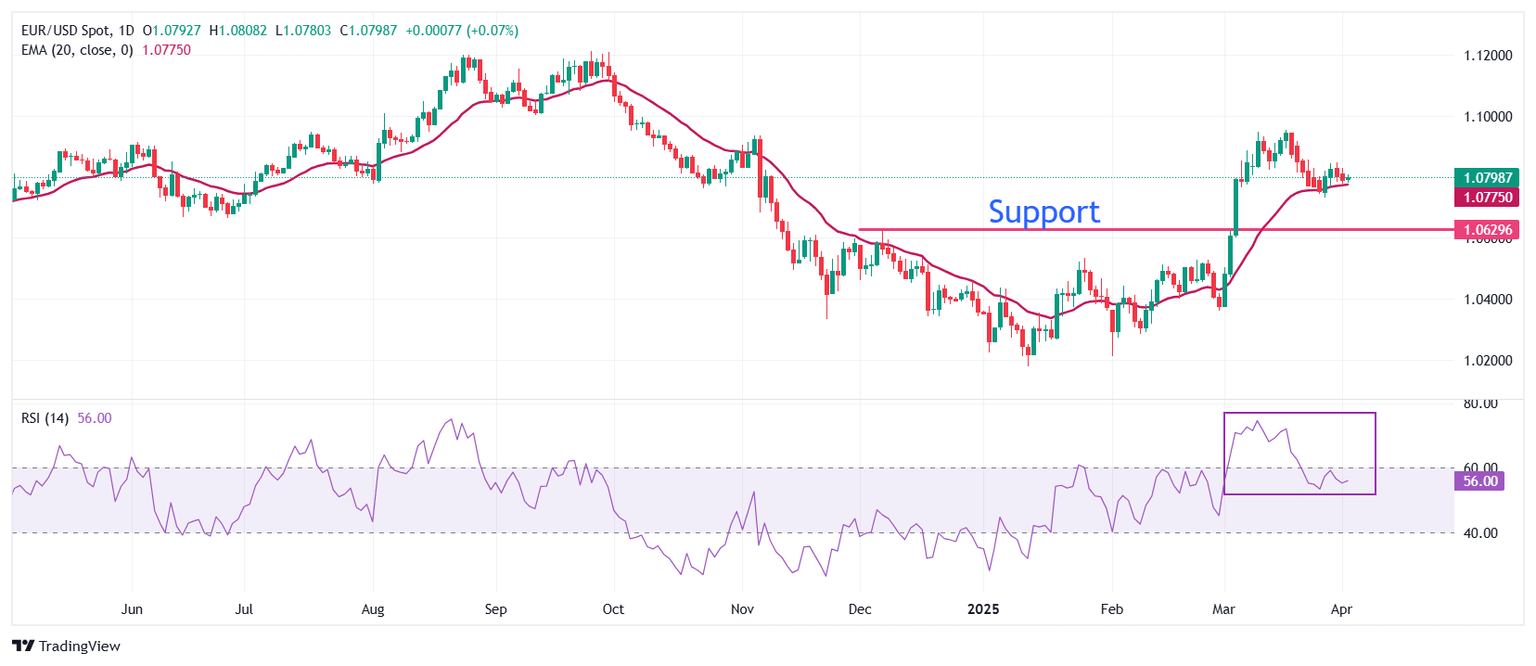

Technical Analysis: EUR/USD holds key level of 1.0800

EUR/USD ticks higher but stays inside Tuesday’s range, trading around 1.0800 at the time of writing on Wednesday. The 20-day Exponential Moving Average (EMA) continues to provide support to the pair around 1.0778.

The 14-day Relative Strength Index (RSI) cools down below 60.00, suggesting that the bullish momentum is over, but the upside bias is intact.

Looking down, the December 6 high of 1.0630 will act as the major support zone for the pair. Conversely, the psychological level of 1.1000 will be the key barrier for the Euro bulls.

Economic Indicator

US Liberation Day Tariff Announcements

US President Donald Trump is set to announce wide-ranging tariffs in an event he named "Liberation Day." The moves could significantly affect global trade and financial assets.

Read more.Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.