EUR/USD firmer above 1.0800 post-PMIs

- EUR/USD regains the 1.0800 mark and above on Tuesday.

- Flash Manufacturing PMIs in core Euroland came in mixed.

- Dollar stays weak post-Fed extra easing measures.

The single currency is prolonging the upbeat mood on Tuesday and is helping EUR/USD to break above the key 1.0800 barrier to print fresh 3-day highs near 1.0870.

EUR/USD gains ground on USD-weakness

EUR/USD is advancing for the third consecutive session on Tuesday, extending the optimism seen at the beginning of the week and managing well to surpass and keep business above the key barrier at 1.0800 the figure.

The pair is deriving support pari passu with the corrective downside in the greenback, all after the Federal Reserve announced an open-ended programme of purchases of Treasuries and MBS on Monday, adding to the other stimulus measures released in previous days.

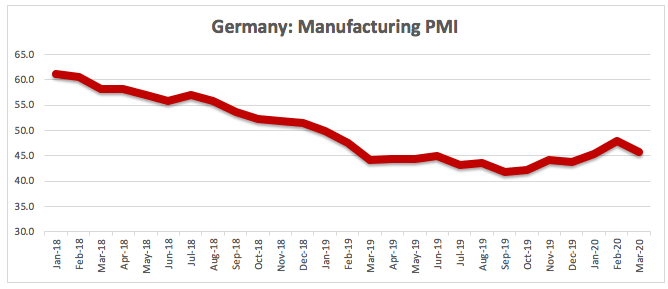

In addition, better-than-expected preliminary manufacturing PMIs in Germany and the broader Euroland for the current month have been also lending legs to the ongoing recovery in the shared currency.

Later in the day and across the pond, February’s New Home Sales are due seconded by the Richmond Fed manufacturing gauge and the advanced Markit’s Manufacturing/Services PMIs for the current month.

What to look for around EUR

EUR/USD remains in recovery-mode at the beginning of the week, always following USD-dynamics, developments from the coronavirus and the response from central banks. On the latter, the recently announced extra measures from the Fed has been collaborating further with the rebound in the pair from recent YTD lows. On the macro view, better-than-forecasted PMIs in both Germany and the broader Euroland opened the door to some respite in the prevailing downtrend of fundamentals in the region, although the underlying stance still remains well on the negative side.

EUR/USD levels to watch

At the moment, the pair is gaining 0.98% at 1.0832 and a breakout of 1.0866 (weekly high Mar.24) would target 1.0992 (monthly low Jan.29) en route to 1.1015 (55-day SMA). On the other hand, immediate contention emerges at 1.0635 (2020 low Mar.23) seconded by 1.0569 (monthly low Apr.10 2017) and finally 1.0494 (monthly low Mar.2 2017).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.