EUR/USD recovers as US Dollar retreats despite de-escalation in US-China trade war

- EUR/USD attracts some bids near 1.1300 as the US Dollar faces downward pressure after a two-day recovery.

- Washington has shown openness to reach a trade deal with China.

- ECB Nagel warns that the German economy could enter a mild recession.

EUR/USD finds cushion around 1.1300 and rebounds to near 1.1385 during North American trading hours on Thursday. The major currency pair recovers as the US Dollar (USD) falls back after a two-day recovery. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls back to near 99.25 after facing pressure around the immediate high of 100.00.

Despite Thursday’s retracement, financial market participants seem to be pricing in a further recovery in the US Dollar in the near term amid increasing hopes of a de-escalation in the trade war between the United States (US) and China. Washington has shown a willingness to get to the table with Beijing, but these can’t proceed without a reduction in critically higher tariff rates.

Currently, the US has imposed additional 145% tariffs on Chinese products, inclusive of a 20% fentanyl levy, and Beijing has increased duties by 125% on imports from the US. "Neither side believes that these are sustainable levels,” US Treasury Secretary Scott Bessent said on Wednesday. The Wall Street Journal (WSJ) reported on Wednesday that the administration could reduce additional tariffs on China to between roughly 50% and 65%.

On Tuesday, US President Donald Trump also signaled that “discussions with Beijing are going well” and added that he thinks “they will reach a deal”. Trump further added that tariffs on China would not be as high as “145%, but they wouldn’t be zero”.

However, in the longer term, investors still doubt the strength of the US Dollar as domestic business activity has been hit hard by fears of a potential economic slowdown. The flash S&P Global Purchasing Managers’ Index (PMI) report showed on Wednesday that tariffs are causing companies to “hike their selling prices at a pace not seen for over a year”. The agency warned that these higher prices will “inevitably feed through to higher consumer inflation, potentially limiting the scope for the Federal Reserve (Fed) to reduce interest rates at a time when a slowing economy looks in need of a boost”.

On the economic front, US Durable Goods Orders data for March has come in stronger than expected. The cost for fresh orders of durable goods rose at a robust pace of 9.2% comapred to estimates of 2% and the prior release of 0.9%. This indicates that factory owners are paying higher prices for producing goods domestically than importing from their trading partners across the globe.

Daily digest market movers: EUR/USD gains as Euro rises

- The recovery move in the EUR/USD pair is also driven by Euro's (EUR) outperformance. The single currency gains, even though traders have become increasingly confident that the European Central Bank (ECB) will cut interest rates in the June policy meeting. The reason behind accelerating ECB dovish bets is officials’ confidence that inflation will return to the central bank’s target of 2% this year.

- On Wednesday, ECB policymaker and Bundesbank President Joachim Nagel reiterated that he expects “Eurozone inflation to return to 2% over the course of this year”, even when the “level of uncertainty is extraordinarily high”, Reuters reports. Nagel warned that the German economy could see a mild “recession” for the third year in a row in the face of tariffs announced by United States (US) President Donald Trump.

- During European trading hours on Thursday, ECB policymaker and Finnish central bank governor Olli Rehn said that the central bank should not rule out a "larger interest rate cut".

- Apart from ECB monetary policy expectations, the major trigger for the Euro is negotiations between the European Union (EU) and Washington. Though both nations have shown openness to have a deal and maintain healthy trade relations, there has not been much progress since April 7, when EU trade commissioner Maros Sefcovic stated that the administration has offered the US “zero-for-zero tariffs” for cars and all industrial goods.

- Also, German Finance Minister (FM) Joerg Kukies indicated that he is hopeful of having a trade agreement with the US while interviewed by Deutschlandfunk broadcaster on Wednesday. Kukies answered diplomatically and drew scenarios. "The position is very simple: Plan A is that we want an agreement and the tariffs should go down instead of going up, and Plan B is if this doesn’t work, we will use countermeasures.”, he said.

- On the economic front, German IFO Business Climate, Current Assessment, and Expectations have come in better than expected. Business Climate, an early indicator of current conditions and business expectations, has come in higher at 86.9 than estimates of 85.2 and the prior release of 86.7. Current Assessment and Expectations are seen at 86.4 and 87.4, respectively.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.59% | -0.40% | -0.77% | -0.17% | -0.38% | -0.54% | -0.65% | |

| EUR | 0.59% | 0.19% | -0.19% | 0.42% | 0.19% | 0.05% | -0.06% | |

| GBP | 0.40% | -0.19% | -0.38% | 0.23% | 0.01% | -0.14% | -0.26% | |

| JPY | 0.77% | 0.19% | 0.38% | 0.60% | 0.40% | 0.20% | 0.16% | |

| CAD | 0.17% | -0.42% | -0.23% | -0.60% | -0.18% | -0.35% | -0.48% | |

| AUD | 0.38% | -0.19% | -0.01% | -0.40% | 0.18% | -0.16% | -0.27% | |

| NZD | 0.54% | -0.05% | 0.14% | -0.20% | 0.35% | 0.16% | -0.11% | |

| CHF | 0.65% | 0.06% | 0.26% | -0.16% | 0.48% | 0.27% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Technical Analysis: EUR/USD bounces back to near 1.1380

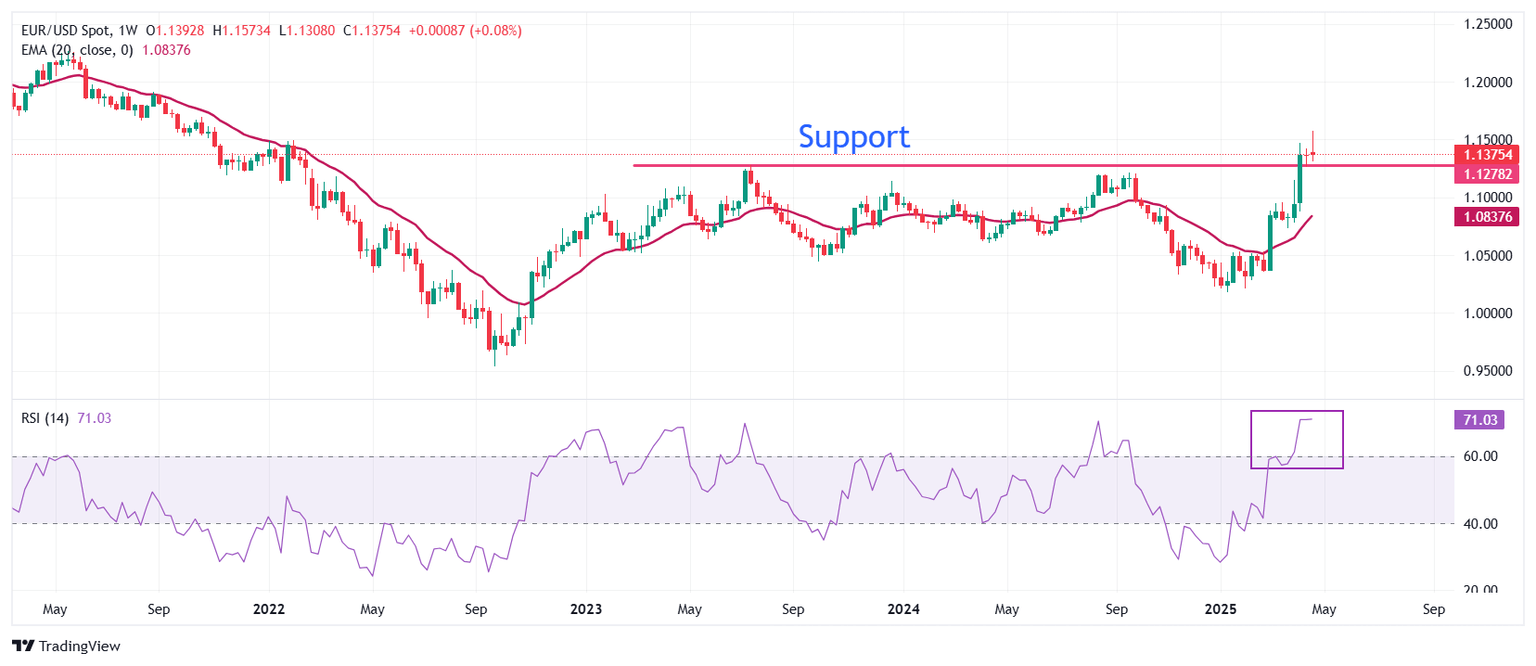

EUR/USD gains ground after a two-day correction to near 1.1300 on Thursday. The major currency pair had shown a strong rally in the last few weeks after a breakout above the September 25 high of 1.1215. Advancing 20-week Exponential Moving Average (EMA) near 1.0850 suggests a strong upside trend.

The 14-week Relative Strength Index (RSI) climbs near overbought levels above 70.00, which indicates a strong bullish momentum, but chances of some correction cannot be ruled out.

Looking up, the round-level figure of 1.1600 will be the major resistance for the pair. Conversely, the July 2023 high of 1.1276 will be a key support for the Euro bulls.

BRANDED CONTENT

Finding the right broker for trading EUR/USD is crucial, and we've identified the top choices for this major currency pair. Read about their unique features to make an informed decision.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.