EUR/USD rebounds as Fed Powell acknowledges progress in disinflation

- EUR/USD rebounds from 1.0700 after Fed Powell acknowledged that disinflation has resumed.

- Eurozone headline HICP softened expectedly in June, while core reading grew steadily.

- ECB Lagarde said inflation is heading in the right direction.

EUR/USD bounces back strongly from the intraday low near the round-level support of 1.0700 in Tuesday's American session. The major currency pair recovers after discussions between ECB President Christine Lagarde and Federal Reserve (Fed) Chair Jerome Powell at the ECB Forum on Central Banking in Sintra, Portugal. In conversation, ECB Lagarde acknowledged that inflation in the Eurozone economy is moving in the right direction and the central bank is very advanced in the disinflation path. She added, "We don't need to have services inflation at 2%."

Earlier, the Euro remained under pressure due to an expected decline in the preliminary Eurozone Harmonized Index of Consumer Prices (HICP) data for June. Annual HICP decelerated to 2.5%, as expected, year-on-year from May’s reading of 2.6%. In the same period, the core HICP, which excludes volatile components like food, energy, alcohol, and tobacco, grew steadily by 2.9%. Investors expected the underlying inflation to have declined to 2.8%. Core inflation measure rose at a steady pace due to sticky service inflation. Price pressures in the service sector rose in line with the pace of 4.1% as registered in May. Current inflation readings are unlikely to provide cues about where price pressures are heading.

On Monday, the preliminary German HICP report for June showed that price pressures softened more than expected, opening the door for the ECB to make back-to-back rate cuts. However, policymakers have refrained from providing a specific rate-cut path as they worry that an aggressive policy-easing campaign could revamp price pressures again.

On Monday, ECB Lagarde said, "It will take time for us to gather sufficient data to be certain that the risks of above-target inflation have passed." Lagarde added, "The strong labor market means that we can take time to gather new information," Reuters reported.

Meanwhile, uncertainty ahead of France’s second-round runoffs scheduled on July 7 will also keep the Euro on its toes. As per the exit polls for the first round of France's parliamentary elections, Marine Le Pen's far-right National Rally (RN) is in a comfortable position but with a smaller margin than projected.

Daily digest market movers: EUR/USD recovers as US Dollar gives away its entire intraday gains

- EUR/USD rebounds as the US Dollar (USD) retreats after Fed Powell said at the ECB Forum on Central Banking that progress in the disinflation process has resumed. However, they want to see more good inflation data before reducing interest rates. Powell added that the service inflation remains stickier and wage growth is above where they want to see. The comments were broadly similar to one delivered in the June's monetary policy meeting.

- On the economic front, the United States (US) ISM Manufacturing Purchasing Managers’ Index (PMI) report showed that factory activities unexpectedly declined in June. Data also indicated that inflationary pressures in the manufacturing sector, measured by the ISM Manufacturing Prices Paid Index, grew at a significantly slower pace than expected.

- The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, edges lower to near 105.80 after failing to sustain above the crucial resistance of 106.00. Meanwhile, investors look for more cues about when the Federal Reserve (Fed) will start reducing interest rates this year. For that, investors will focus on the US Nonfarm Payrolls (NFP) report for June, which will be published on Friday.

- Currently, financial markets expect the Fed to start reducing interest rates from the September meeting. Two rate cuts this year, against only one cut projected by Fed policymakers in their latest dot plot, are expected.

- In the New York session, the US Bureau of Labor Statistics (BLS) reported stronger-than-expected JOLTS Job Openings data for May. New job vacancies came in at 8.14 million. Economists expected a slight decline to 7.9 million from April’s reading of 8.06 million.

Technical Analysis: EUR/USD holds key support of 1.0700

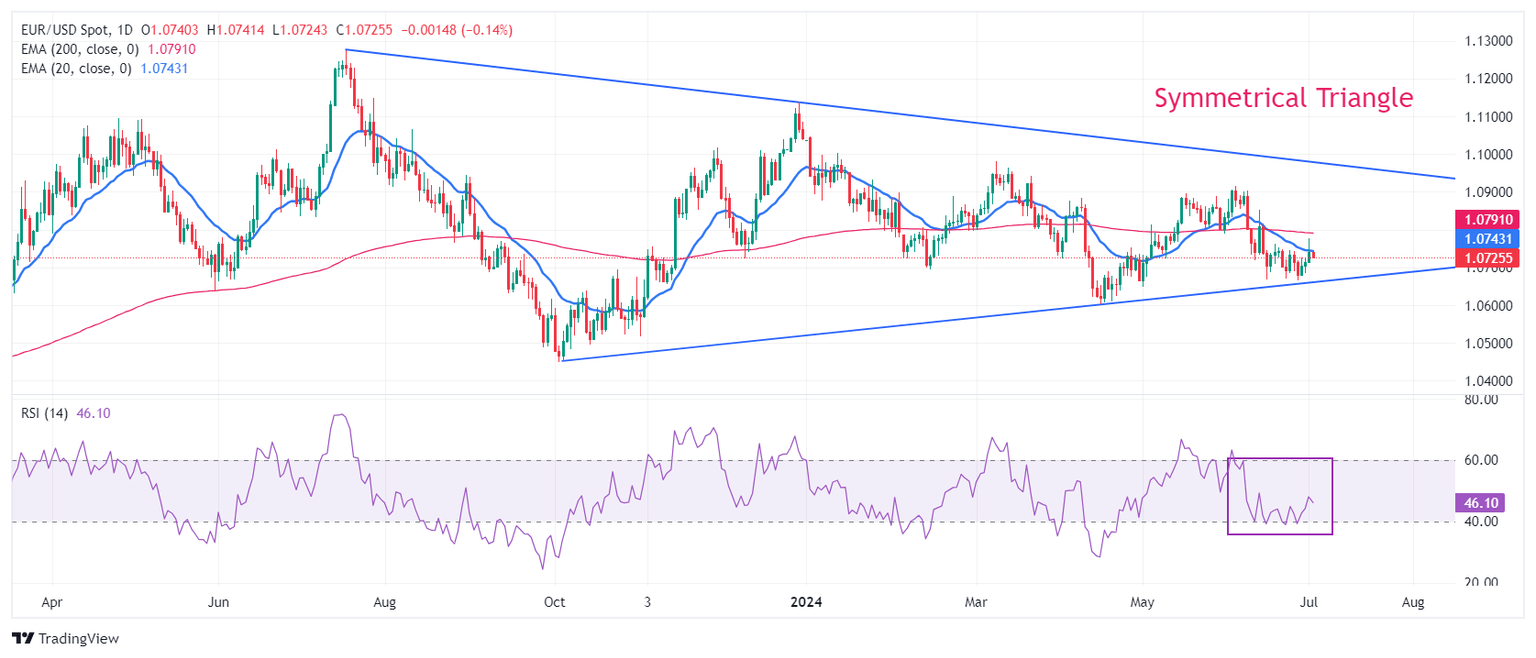

EUR/USD drops to near 1.0720 after failing to hold above the 20-day Exponential Moving Average (EMA), which trades around 1.0740. The major currency pair rebounded last week after discovering strong buying interest near the upward-sloping border of the Symmetrical Triangle formation on a daily timeframe near 1.0666, which is marked from 3 October 2023 low at 1.0448. The downward-sloping border of the above-mentioned chart pattern is plotted from 18 July 2023 high at 1.1276. The Symmetrical Triangle formation exhibits a sharp volatility contraction, which indicates low volume and narrow ticks.

The major currency pair remains below the 200-day Exponential Moving Average (EMA) near 1.0790, suggesting that the overall trend is bearish.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting indecisiveness among market participants.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Jul 05, 2024 12:30

Frequency: Monthly

Consensus: 190K

Previous: 272K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.