EUR/USD falls below 1.17 as profit-taking lifts US Dollar

- EUR/USD retreats nearly 1% as US Dollar recovery follows profit-taking after Powell’s dovish Jackson Hole speech.

- Markets still price an 86% chance of a September Fed cut, though inflation and jobs reports remain decisive.

- German IFO Business Climate rose to 89, signaling a fragile recovery, while US housing data softened after June’s revision.

EUR/USD erases some of last Friday’s gains and drops 0.93% as the Greenback stages a recovery, following dovish remarks by Federal Reserve (Fed) Chair Jerome Powell. Expectations that the Fed will cut rates in September triggered the Euro’s (EUR) advance. The pair trades back below 1.1700 at around 1.1610 at the time of writing.

The US Dollar’s recovery seems to have been triggered by traders taking profits, as market participants continued to digest Powell’s words. Although he opened the door to resume the Fed’s easing cycle, he needs data confirmation.

According to the FedWatch Tool, the odds for a Fed rate cut at the September meeting are 86%. If the Fed pulls the trigger, the EUR/USD pair could extend its rally and pave the way for a test of the year-to-date (YTD) high of 1.1829.

The outcome of the Federal Reserve’s September meeting is yet to be certain. Before the monetary policy decision, two inflation reports await—the Core Personal Consumption Expenditures (PCE) Price Index for July, and August’s Consumer Price Index (CPI)— and August’s Nonfarm Payrolls.

Two red-hot inflation reports and strong employment data could prevent the Fed from cutting rates, pushing that decision towards the last quarter of 2025.

Data-wise, the US economic docket featured housing data, which fell following an upward revision to June’s print. In the European Union (EU), Germany reported the IFO Business Climate, which hit its highest level since May 2024, at 89, above expectations and July’s 88.6. The IFO President Clemens Fuest said, “The recovery of the German economy remains weak.”

Daily digest market movers: EUR/USD falls amid broad US Dollar strength

- The Euro’s drop is attributed to broad US Dollar strength. The US Dollar Index (DXY), which tracks the performance of the US Dollar against a basket of six currencies, rises by over 0.69% to 98.40.

- Fed Chair Powell said at Jackson Hole that, “The baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” He added that “the stability of the unemployment rate and other labor market measures allows us to proceed carefully.”

- St. Louis Fed President Alberto Musalem said that he needs more data before deciding to support a rate cut at the September meeting, given that inflation remains above the Fed’s 2% goal. “It is real that inflation is running closer to 3% than to 2%. That's real, and there is a possibility, not the base case, that there could be some persistence,” he said, adding that monetary policy “is in the right place.”

- US New Home Sales fell -0.6% in July from 1.656 million to 1.652 million.

- EUR/USD is set to extend its gains due to central bank monetary policy divergence. The European Central Bank (ECB) is projected to hold rates unchanged at the next meeting, while the Fed, although the chances have trimmed, is expected to resume its easing cycle.

- Expectations that the Fed will reduce rates at the September meeting continued to trend higher. Across the pond, the ECB is expected to hold rates with odds standing at 94%, and a slim 6% chance of a 25-basis-point (bps) rate cut.

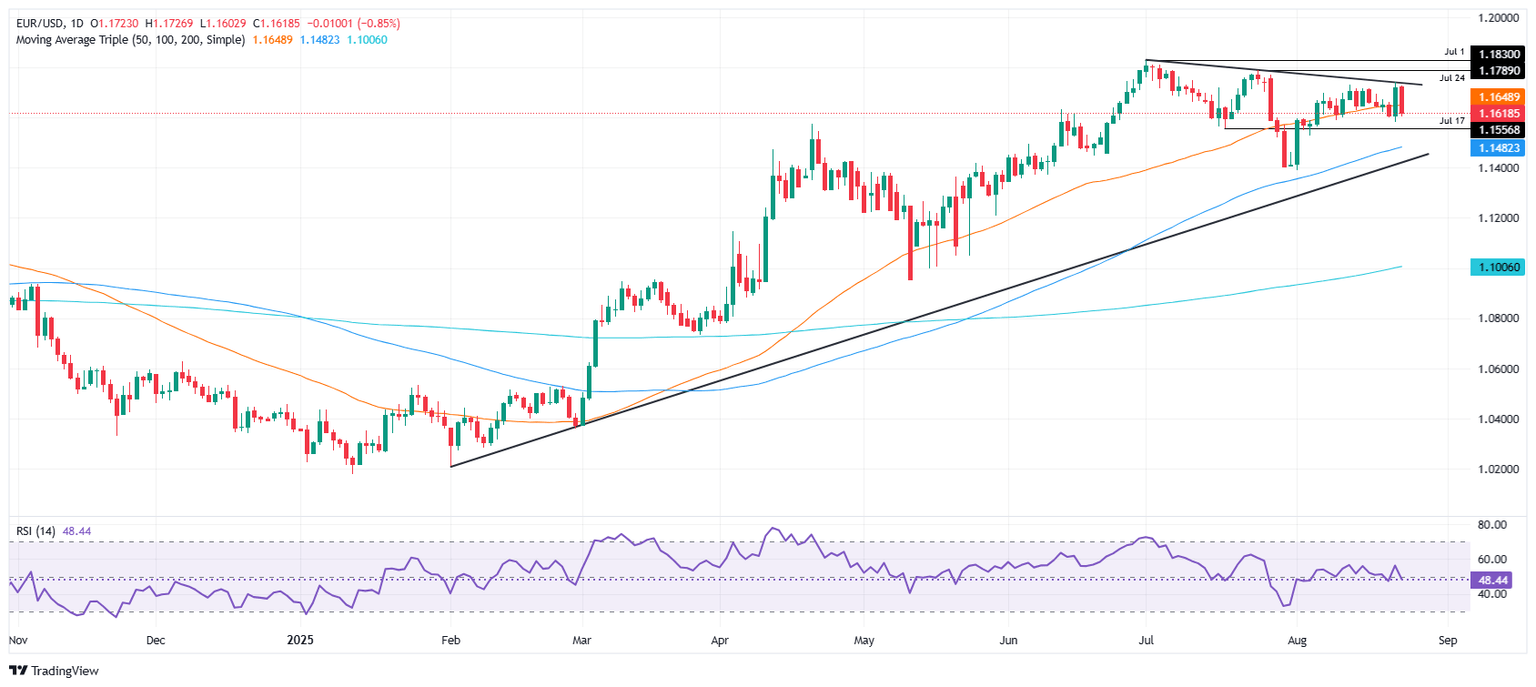

Technical outlook: EUR/USD tumbles below 1.17 as bears eye 1.16

EUR/USD uptrend remains intact, but the ongoing pullback towards the 20-day Simple Moving Average (SMA) of 1.1615 and the Relative Strength Index (RSI) turning bearish suggests that the pullback might extend lower, before the pair continues to climb higher.

If EUR/USD drops below 1.1600, this clears the way to challenge the 1.1500, followed by the 100-day SMA at 1.1488. Conversely, if bulls push prices above 1.1650, expect another re-test of 1.1700, with the next area of interest being 1.1742, the August 22 high.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.