EUR/USD faces some downside pressure near 1.0750 post-Payrolls

- EUR/USD now reverses initial gains and revisits 1.0980.

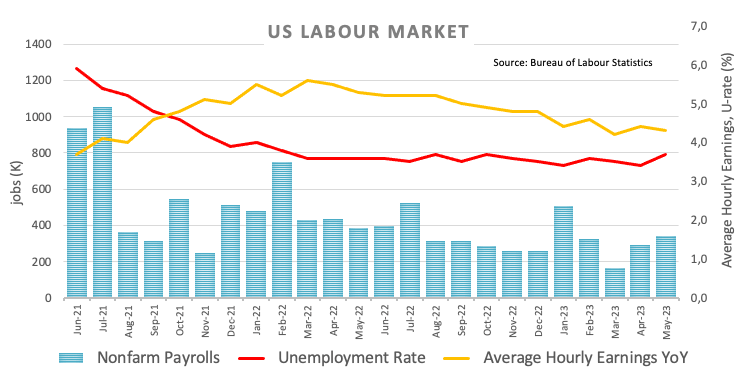

- US Non-farm Payrolls surprised to the upside in May.

- The unemployment rate edged higher to 3.7%.

EUR/USD now returns to the negative territory on the back of the post-Payrolls bout of strength in the greenback on Friday.

EUR/USD: Daily upside capped near 1.0780

EUR/USD picks up extra selling pressure after the release of the Nonfarm Payrolls showed the US economy added 339K jobs during May, surpassing initial expectations for a gain of 190K jobs. In addition, the April reading was revised up to 294K (from 253K).

Further data saw the Unemployment Rate ticking higher to 3.7% and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.3% MoM and 4.3% from a year earlier. Additionally, the Participation Rate held steady at 62.6%.

What to look for around EUR

EUR/USD attempts to consolidate the recent breakout of the 1.0700 barrier following the resumption of the selling pressure in the greenback.

In the meantime, the pair’s price action is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB speak continues to favour further rate hikes, although this view appears to be in contrast to some loss of momentum in economic fundamentals in the region.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle in June and July (and September?). Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.03% at 1.0758 and faces initial contention at 1.0635 (monthly low May 31) seconded by 1.0516 (low March 15) and finally 1.0481 (2023 low January 6). On the upside, the break above 1.0779 (weekly high June 2) would target 1.0812 (100-day SMA) en route to 1.0886 (55-day SMA).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.