EUR/USD jumps higher as US Jobless Claims advance, focus shifts to NFP

- EUR/USD climbs above 1.0550 after weekly US Initial Jobless Claims came in higher-than-projected.

- The ECB is expected to cut its Deposit Facility Rate by 25 bps to 3% next week.

- The fallout of the French government would keep the Euro on tenterhooks.

EUR/USD advances above 1.0550 at the US Dollar’s (USD) expense. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls below the immediate support of 106.00 as the United States (US) Department of Labor showed that Initial Jobless Claims for the week ending November 29 were higher-than-estimated. The data showed that individuals claiming jobless benefits were 224K, higher than estimates and the prior release of 215K.

Weak US jobless claims data has renewed fears of deteriorating labor demand but for a clear picture of current labor market status, investors will focus on the US Nonfarm Payrolls (NFP) data for November, which will be released on Friday.

Economists expect the US economy to have added 200K fresh workers, significantly higher than the increase of 12K seen in October. The NFP report stated that payroll employment estimates in some industries were affected by the hurricanes last month. The Unemployment Rate is estimated to have increased to 4.2% from the former release of 4.1%. Investors will also pay close attention to the US Average Hourly Earnings data to get cues about the current status of wage growth.

The official employment data will influence market expectations for the Federal Reserve (Fed) interest rate path. Meanwhile, Fed Chair Jerome Powell has supported a more gradual interest rate cut pace on the back of improved labor demand, increasing economic growth, and a slight acceleration in price pressures. “The US economy is in remarkably good shape, and there is no reason it can't continue,” and " the good news is that we can afford to be a little more cautious as we try to find neutral,” Powell said at the New York Times DealBook Summit on Wednesday.

For the December meeting, there is a 77% chance that the Fed will reduce interest rates by 25 bps to 4.25%-4.50%, while the rest expect the Fed to leave them unchanged, according to the CME FedWatch tool.

Daily digest market movers: EUR/USD moves higher as investors digest French government fallout

- EUR/USD jumps above 1.0500 in North American trading hours on Thursday amid a sharp sell-off in the US Dollar. The Euro (EUR) is also performing strongly as investors attempt to move forward from the already anticipated collapse of a mere three-month-long Michel Barnier’s government after losing a no-confidence vote proposed by the Far Right and Left-wing coalition.

- The demolition of the French government has put the economy into a much deeper crisis by limiting its capacity to tame the burgeoning fiscal deficit. Far-right and left-wing lawmakers backed a no-confidence motion against Barnier after claiming the budget from his government was “flawed and harmful” to French people. The budget in question proposed €60 billion in tax increases and spending cuts aimed at addressing France’s ballooning deficit, according to Firstpost.

- Before the no-confidence vote, Barnier appealed to lawmakers, "This reality will not disappear by the magic of a motion of censure." He added the budget deficit would come back to haunt whichever government comes next.

- French political turmoil has complicated the road ahead for the already-troubled Eurozone, which is facing severe downside risks to economic growth due to weak demand and potential tariffs once the new US administration of President-elect Donald Trump takes office. Meanwhile, monthly German Factory Orders declined in October but at a slower-than-expected pace. The economic data contracted by 1.5% after rising 7.2% in September. Economists expected the Factory Orders data to have declined by 2%.

- European Central Bank (ECB) President Christine Lagarde also warned about growing risks to the trading bloc in her testimony before the Parliamentary Committee on Wednesday. “The medium-term economic outlook is uncertain, however, and dominated by downside risks," Lagarde said. "Geopolitical risks are elevated, with growing threats to international trade," she added.

- On the interest rate outlook, Lagarde sticked to her data-dependent approach. However, traders expect that the ECB will cut its Deposit Facility Rate by 25 basis points (bps) to 3% at its December 12 meeting.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.46% | -0.31% | 0.03% | -0.19% | -0.01% | -0.07% | -0.29% | |

| EUR | 0.46% | 0.16% | 0.52% | 0.32% | 0.44% | 0.39% | 0.17% | |

| GBP | 0.31% | -0.16% | 0.36% | 0.12% | 0.28% | 0.23% | 0.01% | |

| JPY | -0.03% | -0.52% | -0.36% | -0.21% | -0.04% | -0.13% | -0.32% | |

| CAD | 0.19% | -0.32% | -0.12% | 0.21% | 0.18% | 0.11% | -0.11% | |

| AUD | 0.01% | -0.44% | -0.28% | 0.04% | -0.18% | -0.06% | -0.28% | |

| NZD | 0.07% | -0.39% | -0.23% | 0.13% | -0.11% | 0.06% | -0.22% | |

| CHF | 0.29% | -0.17% | -0.01% | 0.32% | 0.11% | 0.28% | 0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

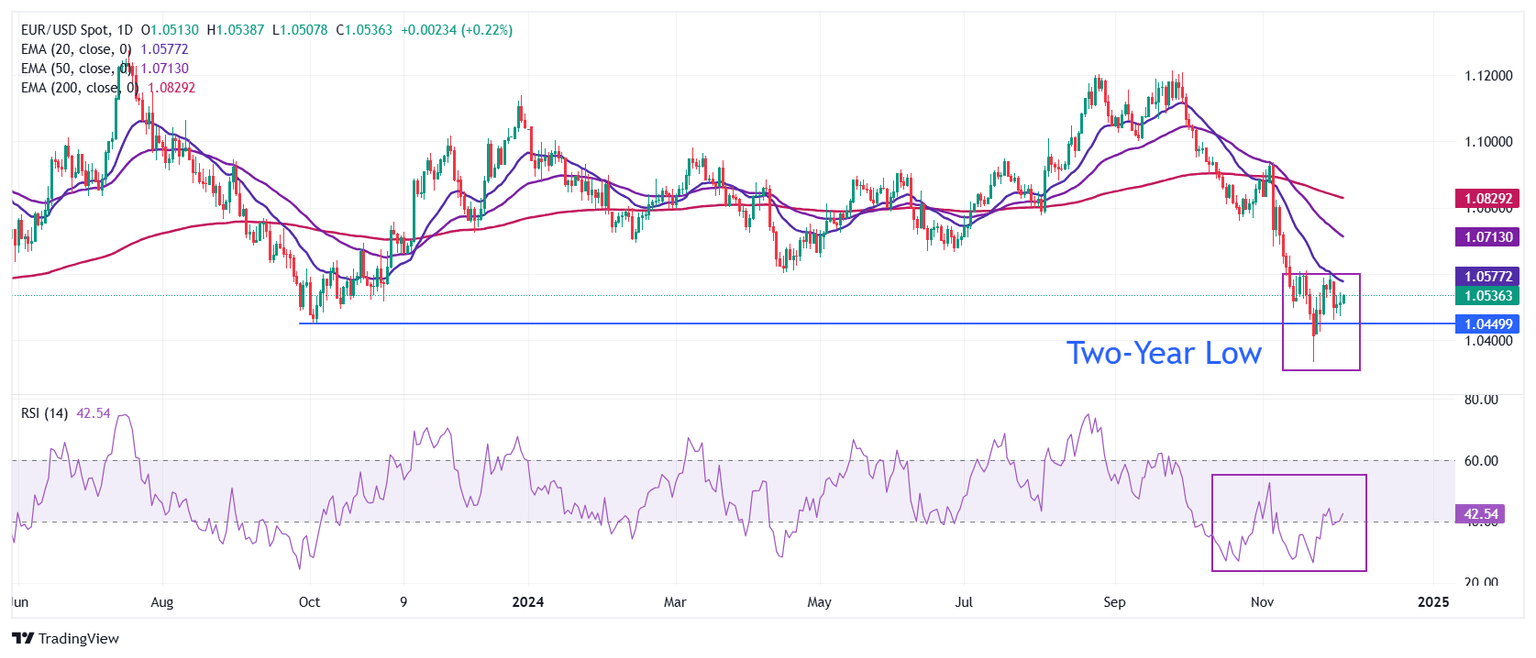

Technical Analysis: EUR/USD climbs above 1.0550

EUR/USD rebounds from the psychological figure of 1.0500 and climbs above 1.0550 in Thursday's North American session.. However, the outlook of the major currency pair remains bearish as all short-to-long-term day EMAs are declining, pointing to a downside trend.

The 14-day Relative Strength Index (RSI) rebounded after conditions turned oversold and climbed above 40.00, suggesting that the bearish momentum has faded. However, the bearish trend has not been extinguished.

Looking down, the November 22 low of 1.0330 will be a key support for Euro bulls. On the flip side, the 50-day EMA near 1.0750 will be the key barrier for the Euro bulls.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Dec 06, 2024 13:30

Frequency: Monthly

Consensus: 200K

Previous: 12K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.