EUR/USD dips as Fed rate cut bets fade and tariff deadline nears

- EUR/USD falls on hawkish Fed expectations and rising yields.

- The US Dollar rebounds as the safe-haven demand for the greenback increases ahead of the Wednesday tariff deadline.

- EUR/USD tests support as bullish momentum fades.

The Euro (EUR) is falling against the US Dollar (USD) at the start of the American session, with EUR/USD testing 1.7360 at the time of writing.

Euro pressured as US Dollar firms on hawkish Fed expectations and rising yields

The Euro's weakness on Monday is primarily driven by renewed strength in the US Dollar and a market repricing of interest rate expectations. According to the CME FedWatch tool, markets are pricing a 4.7% probability of a 25-basis-point rate cut in July, down from 20.7% last week. The probability of a rate cut in September is at 64.5%, down from 75.4% last week. This follows Thursday's better-than-expected US Nonfarm Payrolls (NFP) report last week.

As a key objective of US monetary policy, the strong figures have diminished the prospects that the Federal Reserve (Fed) will cut interest rates in the near term.

The yield differential between Europe and the US continues to favor the Dollar, further undermining the Euro’s upside potential.

Safe-haven demand for the US Dollar rises ahead of Wednesday’s tariff deadline

On the trade front, the US Treasury Secretary told CNBC on Monday that the Trump administration is expecting to announce additional trade deals before Wednesday.

Speaking at Morristown Airport on Sunday, US President Trump stated, "I think we will have most countries done by July 9, either a letter or a deal,” referring to new tariffs that will be imposed on 12–15 countries.

With letters outlining the charges due Monday and reciprocal tariffs expected to take effect by August 1, markets are bracing for heightened trade tensions, supporting the safe-haven demand for the US Dollar.

EUR/USD tests support as bullish momentum fades

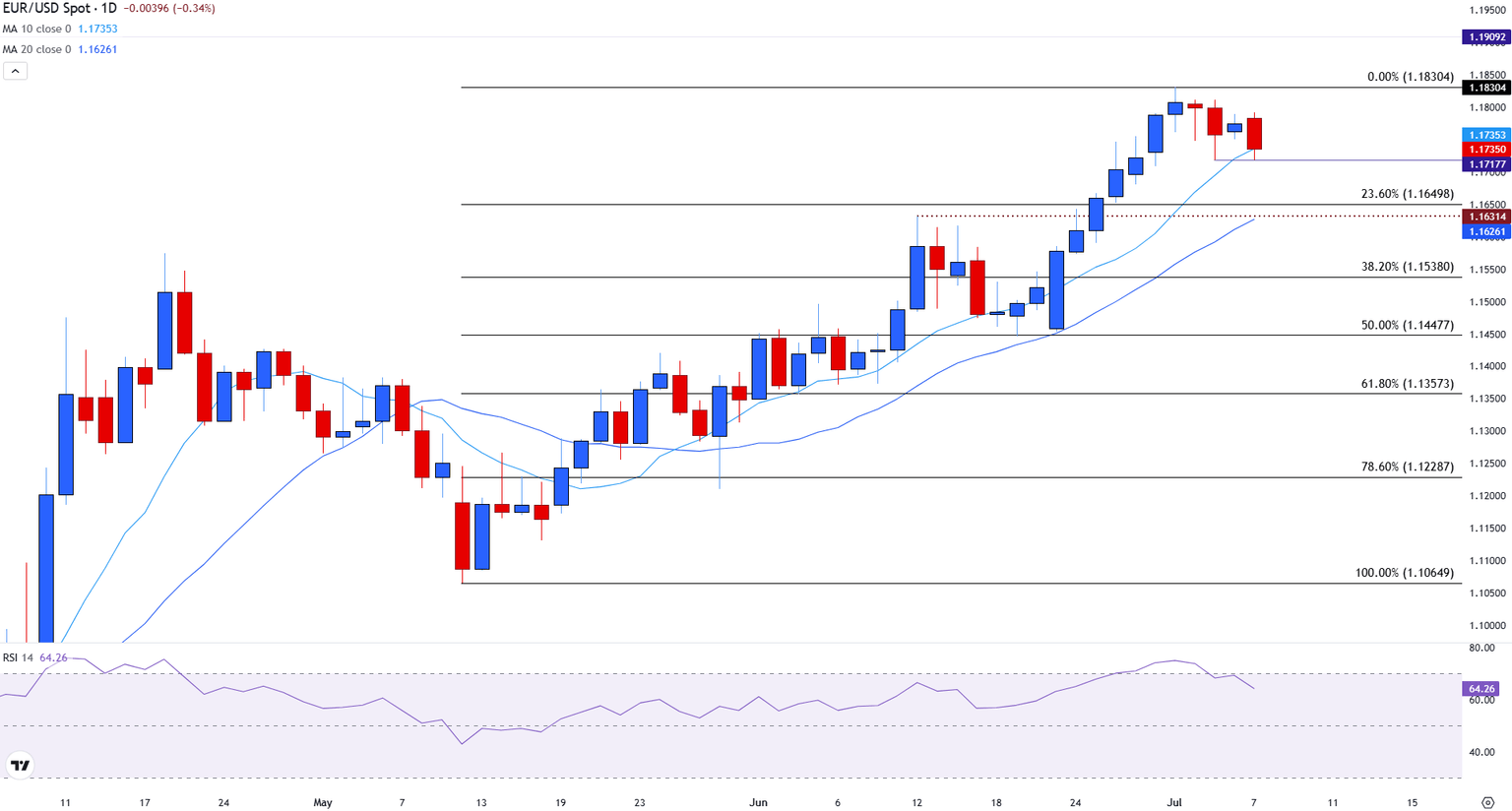

EUR/USD price action has pulled back near the 10-day Simple Moving Average (SMA) at 1.1736, with psychological support seen near the 1.1700 level. A break below the nearby 23.6% Fibonacci retracement of the May-July rally at 1.1647 could deepen the correction toward the 20-day SMA at 1.1626. Despite the recent decline, the Relative Strength Index (RSI) remains elevated at 64, indicating that the broader uptrend remains intact, for now, despite fading bullish momentum.

EUR/USD daily chart

A EUR/USD recovery above 1.1800 would likely re-ignite bullish interest, setting the stage for a test of the recent cycle high above 1.1830. A sustained break above this resistance could open the door to the psychological 1.1900 level.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.