EUR/USD treads water near highs ahead of the German CPI data

- The Euro stands tall, as hopes of trade normalisation keep the safe-haven US Dollar near lows.

- German CPI is expected to have ticked up following disappointing Retail Sales data earlier today

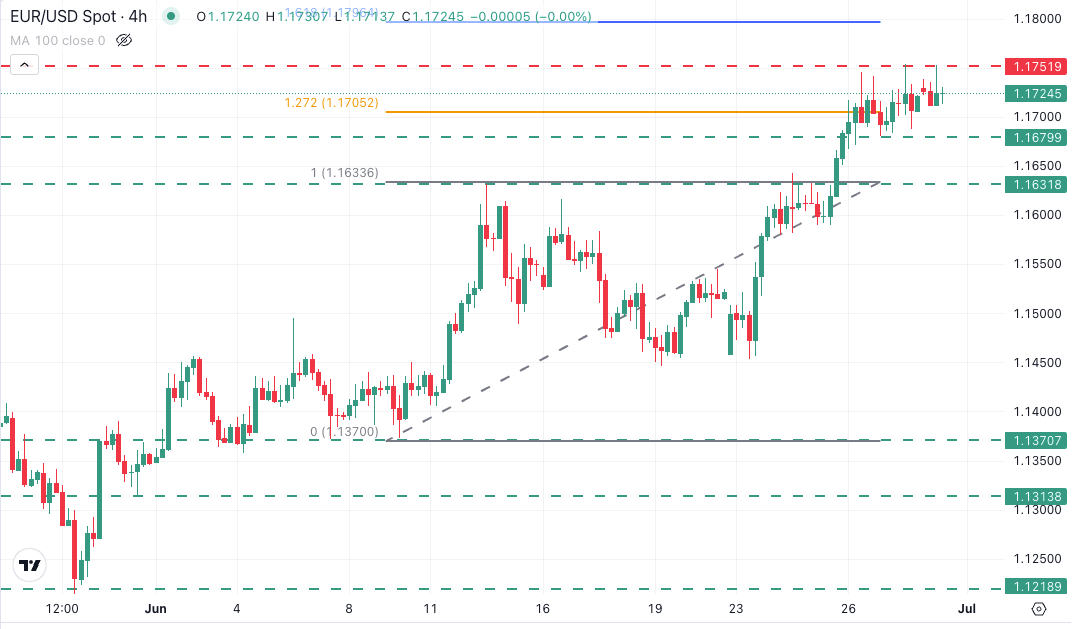

- EUR/USD maintains its positive trend intact with 1.1750 on the bulls' focus.

The EUR/USD pair is trading sideways on Monday, consolidating near the multi-year highs, at 1.1750 reached last week. News of progress in US trade talks with several partners is increasing hopes that major trade agreements are possible, feeding a mild appetite for risk and keeping the safe-haven US Dollar (USD) on the defensive.

Data from the Eurozone seen earlier today revealed that Germany's May Retail Sales decline unexpectedly in May, adding to the evidence of the soft economic momentum in the region's major economy. The focus now is on the June's German Consumer Prices Index (CPI) and ECB Lagarde's speech, due later today.

On Friday, US Treasury Secretary Scott Bessent affirmed that the US and China reached a deal on imports of rare earths, which concludes the agreement signed a few weeks ago and normalizes the relationship between the world's two major economies.

Apart from that, Canada announced that it rescinded the digital services tax, which caused the termination of the trade talks with the US last Friday, paving the way for the negotiations to resume.

Japanese authorities confirmed that their top negotiator, Ryosei Akazawa, will remain in the US to advance negotiations, and US Treasury Secretary Scott Bessent suggested during the weekend that tariff talks might extend until the US Labour day, on September 1, providing further leeway to reach significant agreements and boosting investors' confidence about some normalisation of the global trade scenario.

In the US, a sweeping tax bill, which is expected to add up more than $3 trillion to the US debt stockpile over the next 10 years, is making its way through the Senate. Investors' concerns about a debt crisis in the US are posing an additional weight to the US Dollar.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.11% | -0.07% | -0.10% | 0.18% | -0.11% | -0.15% | |

| EUR | -0.09% | -0.02% | -0.15% | -0.20% | 0.05% | -0.20% | -0.25% | |

| GBP | -0.11% | 0.02% | -0.34% | -0.19% | 0.07% | -0.20% | -0.23% | |

| JPY | 0.07% | 0.15% | 0.34% | -0.03% | 0.30% | -0.00% | -0.03% | |

| CAD | 0.10% | 0.20% | 0.19% | 0.03% | 0.23% | -0.02% | -0.05% | |

| AUD | -0.18% | -0.05% | -0.07% | -0.30% | -0.23% | -0.27% | -0.31% | |

| NZD | 0.11% | 0.20% | 0.20% | 0.00% | 0.02% | 0.27% | -0.03% | |

| CHF | 0.15% | 0.25% | 0.23% | 0.03% | 0.05% | 0.31% | 0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Trade optimism keeps the US Dollar on its back foot

- The US Dollar (USD) remains depressed against most currencies, with the US Dollar Index (DXY) steady at levels not seen since 2022. A trade agreement with China resolving the key rare earth issue has raised hopes that the negotiations with Canada may resume. Added to this, the extension of the July 9 deadline into September has boosted investors' optimism, favouring risk-sensitive currencies to the detriment of the safe-haven USD.

- In Europe, the unexpected decline of the German Retail Sales monthly figures, which dropped 1.6% in May against market expectations of a 0.5% increase, has weighed on the Euro (EUR) rally. The common currency, however, maintains its broader positive tone intact following an almost 2% rally last week.

- Italy's Consumer Prices Index (CPI) accelerated by 0.2% in June, from the 0.1% contraction seen over the previous month, but still below the 0.3% forecasted by market analysts. Yearly inflation remained steady at 1.7% against expectations of a slight pick up to 1.8%.

- Later today, Germany's preliminary consumer prices figures for June are expected to show a slightly hotter increase, to a 0.2% monthly advance and a 2.2% year-on-year rate, from 0.1% and 2.1% respectively in the previous month.

- The US Calendar is light on Monday with only Fed Bostic and Goldsbee's speeches to mention. The market is increasingly pricing an interest rate cut in September, and their comments will be closely watched to confirm this view.

- On Friday, the US Personal Consumption Expenditures (PCE) Price Index revealed higher-than-expected price pressures in May. The headline index accelerated by a 0.1% monthly rate and to a 2.3% Y-o-Y as expected, but the core inflation rose by 0.2% and 2.7% respectively, beyond the 0.1% and 2.6% readings forecasted by market analysts.

- These data failed to dampen hopes that the Federal Reserve (Fed) will cut rates over the coming months. The CME Group's Fed Watch Tool shows only a 20% chance of a rate cut in July, but chances of an at least 25 basis points (bps) rate cut in September have risen beyond 90% from just above 60% two weeks ago.

EUR/USD resistance at 1.1750 is a key level for bulls

EUR/USD maintains its bullish trend intact after a sharp rally last week. The pair keeps consolidating gains as the 4-hour Relative Strength Index pulls back from overbought levels and price action is constrained within a 70-pip range, right below a nearly four-year high at 1.1750.

Immediate resistance is at the June 26 and 27 high, at 1.1745. Beyond here, the next upside target might be at the 161.8% Fibonacci extension level of the June 10-12 rally at 1.1795.

On the downside, the pair is finding support at the June 27 low at 1.1680. A bearish move below here would face support at the previous resistance area between 1.1630 and 1.1640 (June 12, 24, and 25 highs).

Economic Indicator

ECB's President Lagarde speech

The European Central Bank's President Christine Lagarde, born in 1956 in France, has formerly served as Managing Director of the International Monetary Fund, and minister of finance in France. She began her eight-year term at the helm of the ECB in November 2019. As part of her job in the Governing Council, Lagarde holds press conferences in detailing how the ECB observes the current and future state of the European economy. Her comments may positively or negatively the Euro's trend in the short term. Usually, a hawkish outlook boosts the Euro (bullish), while a dovish one weighs on the common currency (bearish).

Read more.Next release: Mon Jun 30, 2025 17:30

Frequency: Irregular

Consensus: -

Previous: -

Source: European Central Bank

Economic Indicator

Consumer Price Index (MoM)

The Consumer Price Index (CPI), released by the German statistics office Destatis on a monthly basis, measures the average price change for all goods and services purchased by households for consumption purposes. The CPI is the main indicator to measure inflation and changes in purchasing trends. The MoM figure compares the prices of goods in the reference month to the previous month. A high reading is bullish for the Euro (EUR), while a low reading is bearish.

Read more.Next release: Mon Jun 30, 2025 12:00 (Prel)

Frequency: Monthly

Consensus: 0.2%

Previous: 0.1%

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.