EUR/USD jumps higher in the aftermath of Eurozone/US data

- EUR/USD rises sharply as the US Dollar falls after US ADP Employment and Q3 GDP data.

- The Eurozone economy grew faster-than-expected and the German economy returns to growth.

- Trump’s victory in the US presidential election could have an adverse impact on the Eurozone growth in the longer term.

EUR/USD rises strongly on Euro's (EUR) upbeat performance after the release of the better-than-expected Eurozone flash Q3 GDP data. The report showed that the shared continent expanded at a faster-than-expected pace in the third quarter of the year. The Eurozone economy grew by 0.4%, faster than estimates and the former release of 0.2%. Compared to the same quarter of the previous year, the economy expanded 0.9% against 0.6% growth in the April-June period. Economists expected the shared continent to have grown by 0.8%.

Higher growth in the Eurozone economy came from a surprise German economic expansion, its largest nation. The German economy unexpectedly rose in the third quarter by 0.2% after contracting in the April-June period. The French economy grew by 0.4%, as expected, while the Italian growth was flat.

Meanwhile, the October preliminary Harmonized Index of Consumer Prices (HICP) data of Germany has come in hotter-than-expected. Annual HICP accelerated at a faster pace to 2.4% from the estimates of 2.1% and the prior release of 1.8%. Surprisingly positive Q3 Eurozone GDP and hot German inflation data have dampened expectations of the European Central Bank's (ECB) larger-than-usual interest rate cut of 50 basis points (bps) in December. According to market expectations, the probability of the ECB reducing interest rates by 50 bps eases to 22% from 45% after the German data release.

Recent commentaries from policymakers have indicated that they are worried about inflation remaining persistently lower due to weakening economic growth. Meanwhile, the uncertainty over the Eurozone economic outlook continues to persist ahead of the US presidential election on November 5. While national polls have indicated tight competition between former US President Donald Trump and current Vice President Kamala Harris, traders seem to be pricing in a Trump victory, which would have deep repercussions also for the Eurozone.

Trump has promised a universal 10% tariff on all imports, except those from China, which would face even bigger tariffs. The threat of tariffs could impact the Eurozone’s powerful export sector significantly. Investment banking firm Goldman Sachs projects a 1% drop in the Eurozone’s GDP if a universal 10% tariff is imposed.

Daily digest market movers: EUR/USD gains on Euro's upbeat performance

- EUR/USD climbs to near 1.0850 in Wednesday’s New York session as the US Dollar (USD) weakens after the release of the United States (US) ADP Employment Change for October and the Q3 Gross Domestic Product (GDP) data. However, the initial reaction from the US Dollar was bullish but it failed to hold the same. The US Dollar Index (DXY), which gauges Greenback’s value against six major currencies, declines near 104.40.

- The US Bureau of Economic Analysis (BEA) showed that the economy was expanded by 2.8%, slower than estimates and the former release of 3%. Meanwhile, the private employment data came in surprisingly robust. Fresh private payrolls were 233K, higher than estimates of 115K, and the former release of 159K, upwardly revised from 143K.

- A strong private job market points to improving economic growth, which would weaken the Federal Reserve's (Fed) dovish bets for the remaining year. According to an October 23-29 Reuters poll, the Fed will cut interest rates by 25 basis points (bps) in policy meetings in November and December.

- Later this week, investors will keep an eye on the Nonfarm Payrolls and the ISM Manufacturing PMI data for October, and the Personal Consumption Expenditure Price Index (PCE) data for September.

Technical Analysis: EUR/USD refreshes intraday high around 1.0850

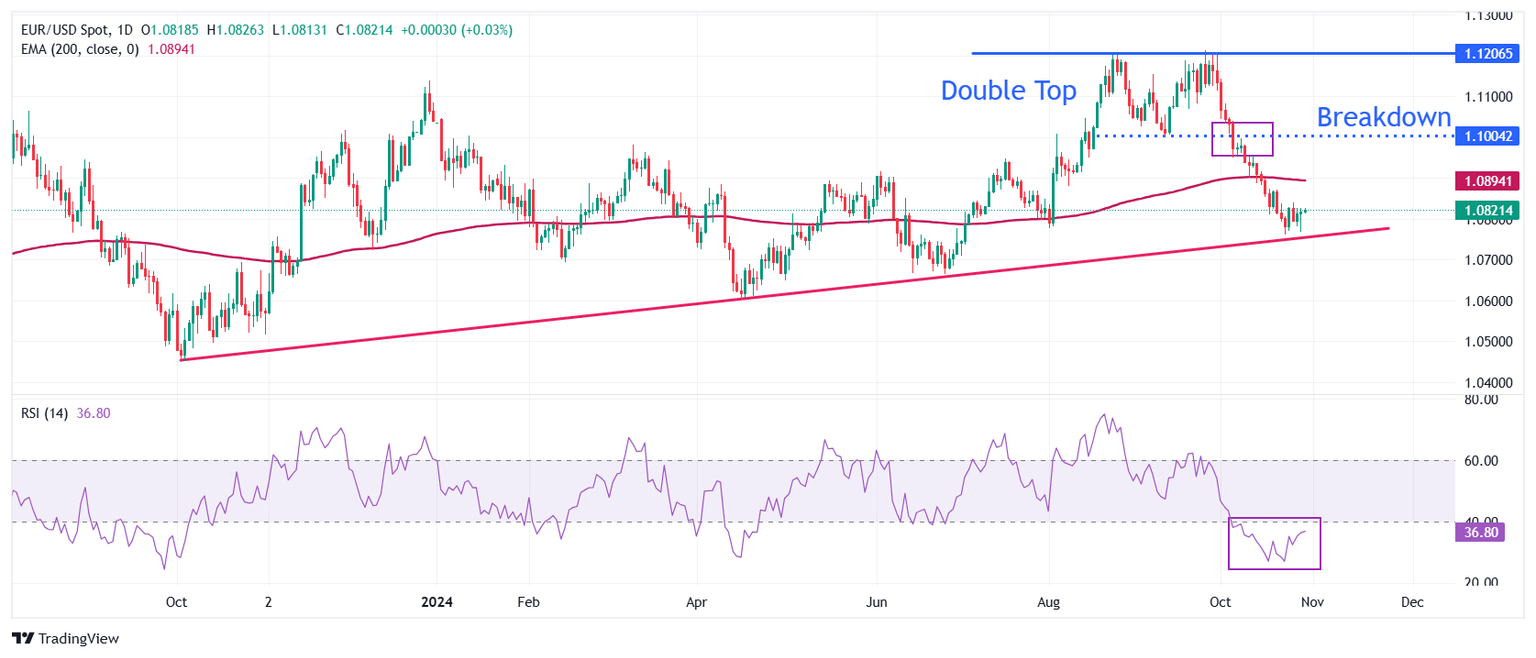

EUR/USD jumps to near 1.0850 in North American trading hours on Wednesday. The shared currency pair continues to hold above the upward-sloping trendline near 1.0750, which is plotted from the October 3, 2023, low at around 1.0450 on the daily time frame. However, the broader outlook of the major currency pair remains bearish as it stays below the 200-day Exponential Moving Average (EMA), which trades around 1.0900. However,

The downside move in the shared currency pair started after a breakdown of a Double Top formation on the daily time frame near the September 11 low at around 1.1000, which resulted in a bearish reversal.

The 14-day Relative Strength Index (RSI) remains in the 20.00-40.00 range, pointing to more downside ahead.

On the downside, the major pair could see more weakness towards the round-level support of 1.0700 if it slips below 1.0750. Meanwhile, the 200-day EMA near 1.0900, and the psychological figure of 1.1000 emerge as key resistances.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.