EUR/USD clings to daily gains above 1.0300 on data, looks at FOMC

- EUR/USD fades part of the earlier advance to the 1.0350 region.

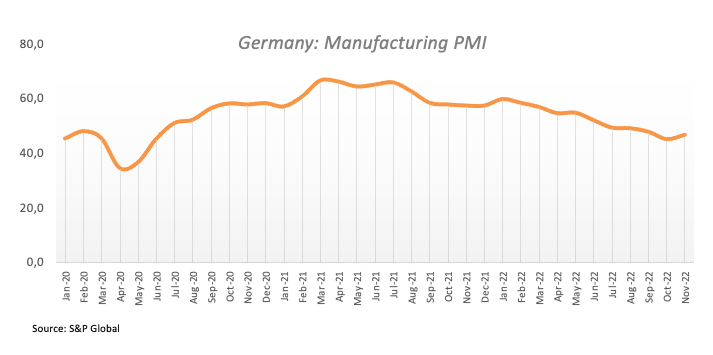

- Germany flash Manufacturing PMI seen rebounding a tad in November.

- Markets’ attention will be on the release of the FOMC Minutes later in the day.

The European currency extends the recent optimism and lifts EUR/USD to the 1.0350 zone on Wednesday, where it appears to be encountering some initial resistance.

EUR/USD focuses on the Fed, data

EUR/USD advances for the second session in a row so far against the backdrop of renewed selling pressure in the Greenback, which also appears weighed down by the lack of traction in US yields.

In the German debt market, the key 10-year bund yield remains flat-lined just below the 2.0% yardstick.

There is no meaningful reaction in the pair to the mixed results from the advanced PMIs in both Germany and the broader Euroland for the month of November. Indeed, the Manufacturing PMI came out at 46.7 (from 45.1) in Germany and 47.3 (from 46.4) in the euro bloc, while the Services gauge is seen at 46.4 (from 46.5) and 48.6 (from 48.6), respectively.

Later on the US docket, all the attention is expected to gyrate around the publication of the FOMC Minutes, seconded by Initial Claims, Durable Goods Orders, flash PMIs, New Home Sales and the final Consumer Sentiment.

What to look for around EUR

EUR/USD trades on a firm note and reaches the mid-1.0300s, as cautiousness keeps the US Dollar under the microscope ahead of the release of the FOMC Minues.

In the meantime, the European currency is expected to closely follow Dollar dynamics, geopolitical concerns and the Fed-ECB divergence. In addition, markets repricing of a potential pivot in the Fed’s policy remains the exclusive driver of the pair’s price action for the time being.

Back to the euro area, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – emerges as an important domestic headwind facing the Euro on the short-term horizon.

Key events in the euro area this week: EMU, Germany Advanced PMIs (Wednesday) – Germany IFO Business Climate, ECB Accounts (Thursday) – Germany Final Q3 GDP Growth Rate, GfK Consumer Confidence (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.09% at 1.0312 and faces the next up barrier at 1.0395 (200-day Simple Moving Average (SMA)) ahead of 1.0481 (monthly high November 15) and finally 1.0500 (round level). On the flip side, a breach of 1.0222 (weekly low November 21) would target 1.0023 (100-day SMA) en route to 0.9935 (low November 10).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.