EUR/USD bull flag could be deceptive vs. fundamentals

- EUR/USD bulls days could be numbered and the bull flag nullified.

- Bears stay in charge in a slow grind to the downside of the bearish channel.

In an earlier article from the US session, posted around the US president, Joe Biden's, announcement of sanctions on Russia, EUR/USD was posing as a bull flag pattern that has so far yet to materialise into a meaningful breakout.

EUR/USD bulls move in to clean up on the risk-off stops, bull flag taking shape

In fact, the price continues to deteriorate, slowly but surely into a deeper test of the bullish hourly impulse. More on that below.

Meanwhile, risk sentiment is leaning negative following an important pivot in the diplomatic resolution to the Ukraine crisis.

On Tuesday, the US removed one of those in an announcement from US Secretary Antony Blinken, saying that Russia's invasion is beginning, and that ''it doesn't make sense for me to meet with Russia's Lavrov anymore.''

He says he sent a letter the same day to him to inform him of that.

Key notes

- Blinken says Putin's 'disturbing' speech yesterday and statements today showed to the world that he views Ukraine as a 'subordinate' of Russia

- Blinken says now we know now that Putin's plan all along has been to invade Ukraine

- Blinken says Putin is blatantly breaking the laws and principles that have kept peace across Europe and in the world.

- Says the US will not allow Russia to claim the pretence of diplomacy.

- Says US and partners are always open to diplomacy but Moscow needs to demonstrate that it is serious about diplomacy.

- Says if Moscow's approach changes, US remains prepared to engage.

- Blinken says on the sanctions: we started high and we will stay high.

EUR/USD technical analysis

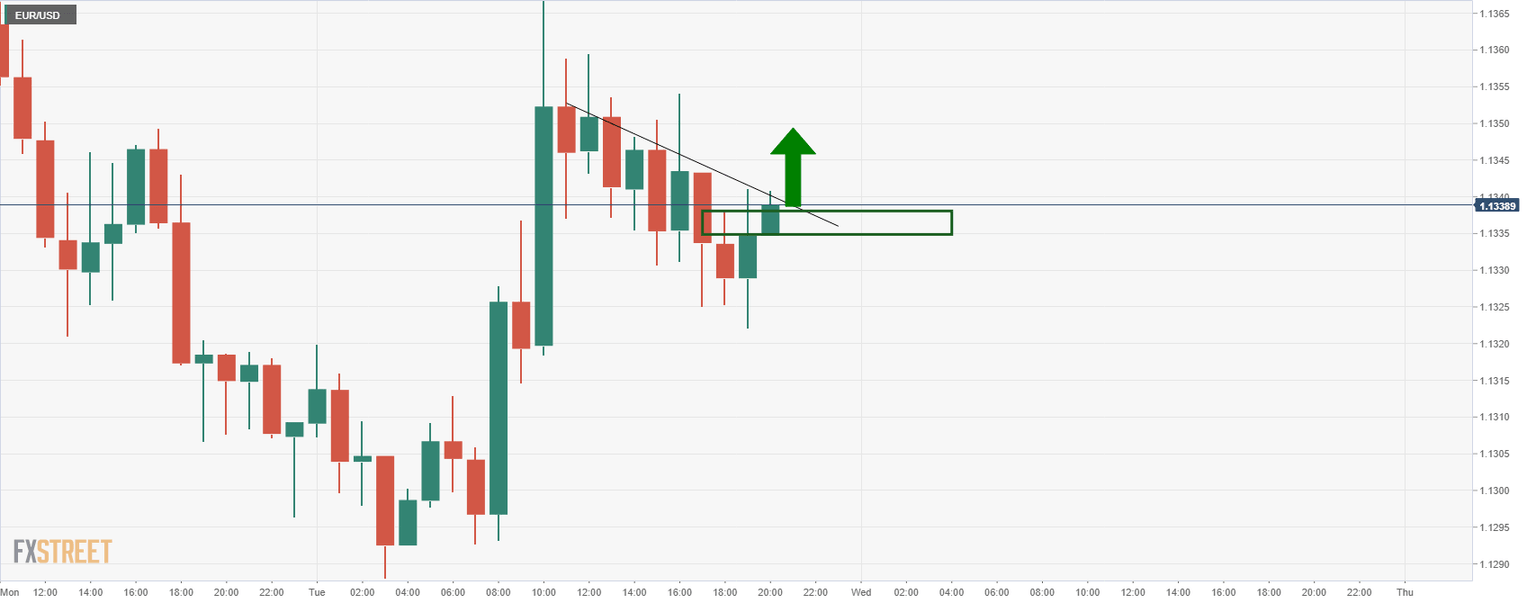

H1 chart prior analysis

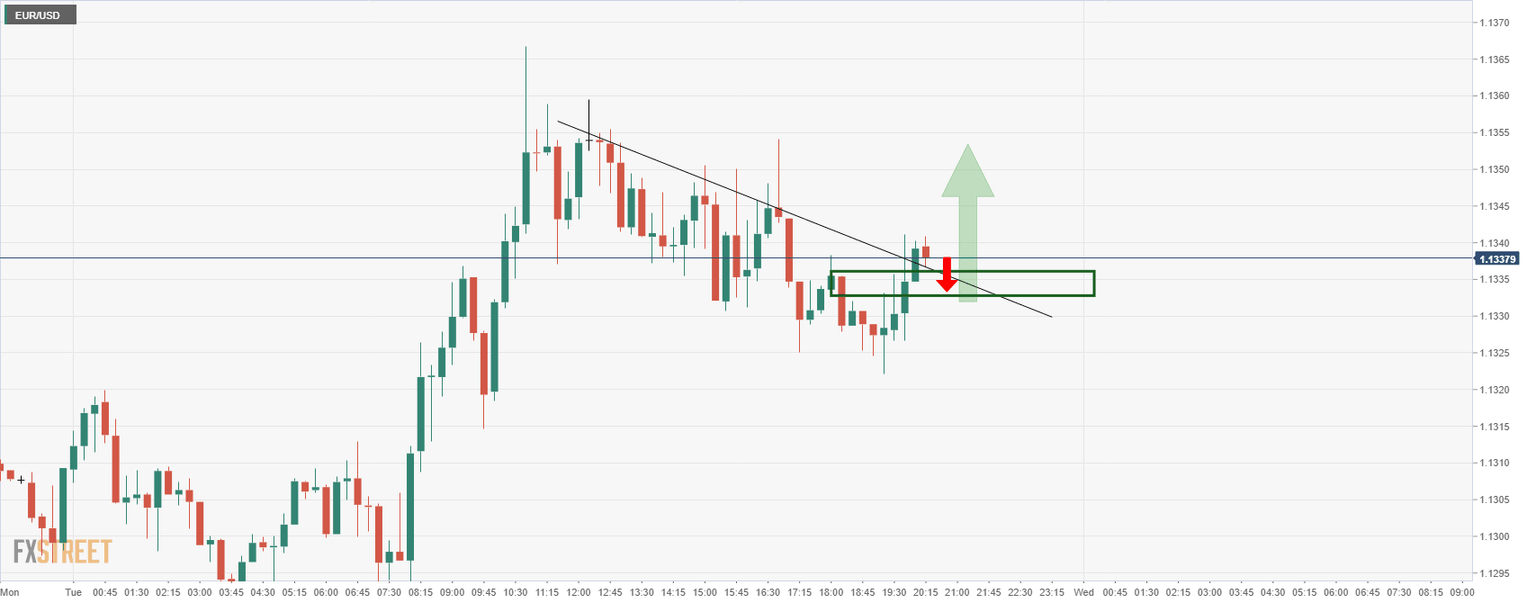

EUR/USD M15 chart, prior analysis

EUR/USD live market, M15 chart

As illustrated, while the price did turn south into what was the old counter-trendline, it kept sinking and has resulted in a sideways drift, printing a lower low in Asia. There is from to go until the prior structure is met in the region of 1.1315 where support would be expected to attract buyers. This could lead to an eventual rally and break of the overextended bull flags resistance in the coming sessions.

With that being said, if risk-off fundamental sentiment steps up, the bull's days will be numbered and the flag will be nullified by significant continuation to the downside:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.