EUR/USD recovers strongly as US Dollar corrects, US-China trade talks in focus

- EUR/USD recovers to near 1.1300 as the US Dollar retreats from almost a month's high..

- Investors focus on the US-China trade talks on Saturday, with US Lutnick saying he is confident of a de-escalation in the Sino-US trade war.

- ECB Rehn says that the Eurozone’s disinflation trend is intact and the economic outlook is grim.

EUR/USD rebounds to near 1.1300 during North American trading hours on Friday from over a three-week low around 1.1200 earlier in the day. The major currency pair bounces back as the US Dollar (USD) retraces amid caution ahead of the trade talks between the United States (US) and China due on Saturday.

The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, corrects to near 100.40 from almost a month high of 100.85 posted earlier in the day.

Investors will pay close attention to the US-China trade discussions in Switzerland on Saturday. China is the second largest market of US imports after Mexico, according to the US COMTRADE database on international trade. Additionally, the trade war between Washington and Beijing is the key trigger behind downward revisions in global economic growth, given the labor cost competitive advantage of China.

The White House has expressed confidence that the tariff war between the US and China will de-escalate after the meeting. “De-escalation and bringing rates down are the goal for China,” US Commerce Secretary Howard Lutnick said in an interview with CNBC on Thursday. Lutnick also demonstrated confidence that Washington will “roll out more deals over the next month”. His comments came after the announcement of the US-United Kingdom (UK) trade deal.

Meanwhile, US President Donald Trump has indicated that tariffs on China could be lowered to 80% through a post on Truth.Social. "80% Tariff on China seems right! It's up to Scott Bessent," Trump said.

Daily digest market movers: EUR/USD gains at US Dollar's expense

- The recovery move in the EUR/USD pair is also driven by the Euro’s (EUR) outperformance against its peers on Friday. The Euro advances despite European Central Bank (ECB) officials showing confidence that inflation is on track to return to the central bank’s target of 2%, and concerns over the economic outlook.

- “Disinflation is on track and the growth outlook is weakening, in case this is going to be confirmed in our June forecast, then in my view in order to achieve our 2% symmetric inflation target over the medium term, the right reaction in monetary policy is to cut rates,” ECB policymaker and Finnish central bank governor Olli Rehn said during European trading hours, Bloomberg reported. Generally, the Euro underperforms when ECB officials favor monetary policy expansion.

- Meanwhile, investors await the response from the US regarding the tariff countermeasures announced by the European Union (EU) Commission on Thursday. During European trading hours, ECB Governing Council member Gediminas Šimkus said that “Eurozone inflation depends on EU retaliation to the US.”

- On Thursday, the European Commission launched a public consultation paper that contains possible countermeasures in response to US tariffs. The paper showed countermeasures on up to €95 billion of US imports if trade talks fail to deliver a satisfactory result for the bloc, which is a little short of €100 billion reported by Bloomberg on Tuesday.

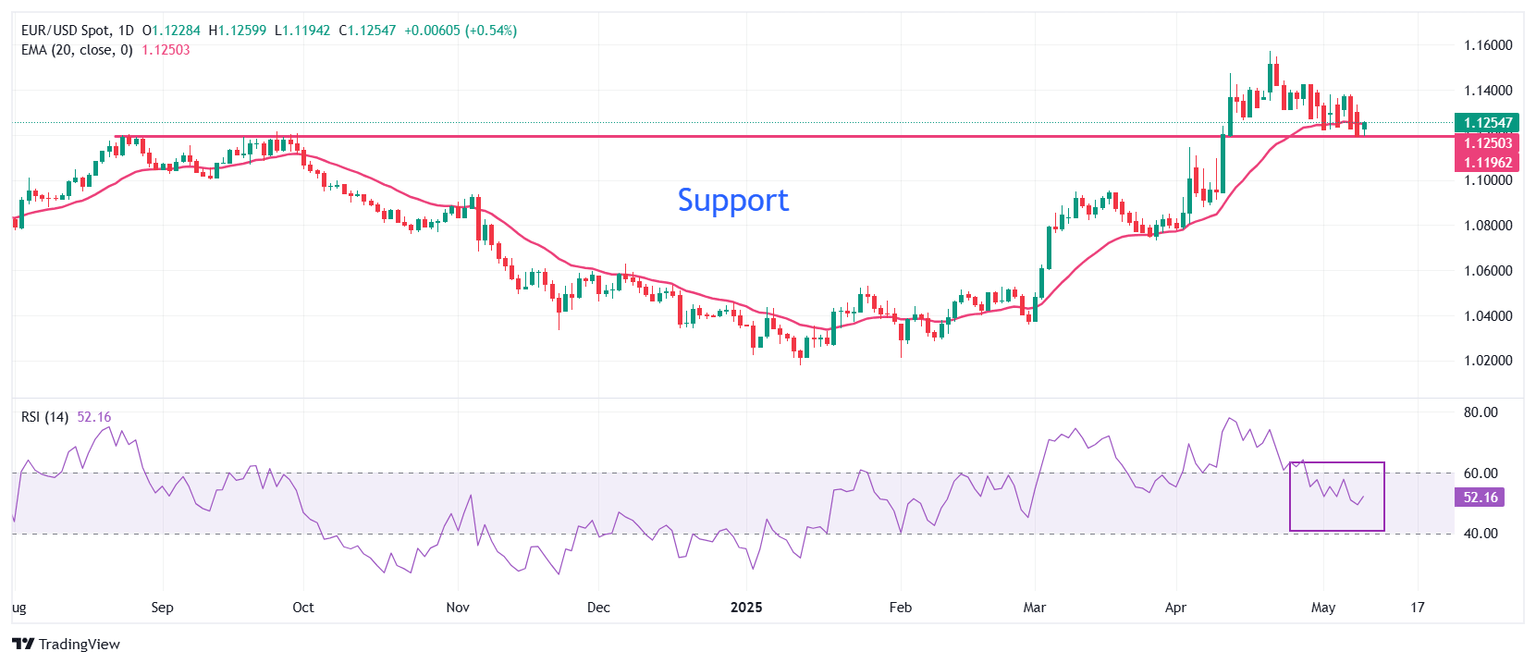

Technical Analysis: EUR/USD bounces back strongly from 20-day EMA

EUR/USD continues to find bids near the 20-day Exponential Moving Average (EMA) around 1.1250.

The 14-day Relative Strength Index (RSI) remains inside the 40.00-60.00 range, indicating that the bullish momentum is concluded for now. However, the upside bias still prevails.

Looking up, the psychological level of 1.1500 will be the major resistance for the pair. Conversely, the April 3 high of 1.1145 will be a key support for the Euro bulls.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Last release: Wed May 07, 2025 18:00

Frequency: Irregular

Actual: 4.5%

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.