EUR/USD bears shift into gear on hawkish Fed Powell

- EUR/USD is under pressure as the Fed chair's hawkish comments send Wall Street lower and USD higher.

- Fed's chair, has stated in the presser that they could move faster and sooner than they did the last time.

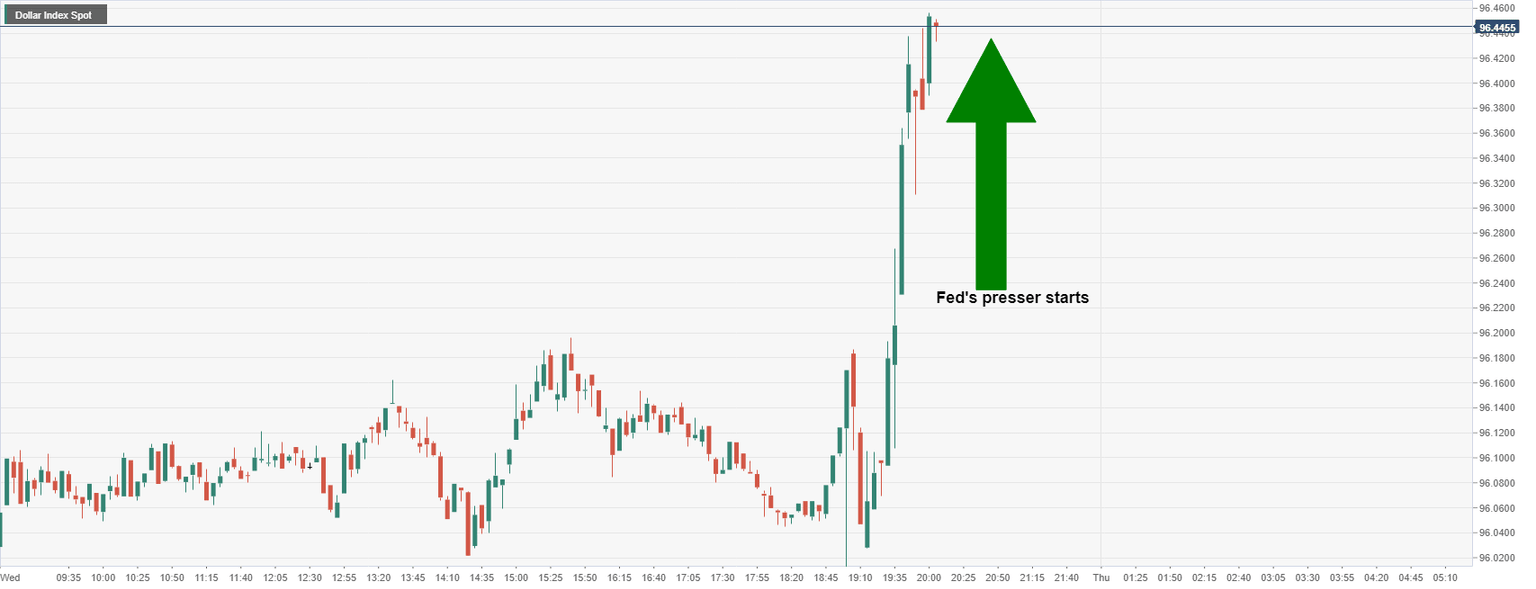

EUR/USD is down 0.5% on the day following a sell-off on the back of a hawkish turn of events during the Federal Reserve event today, Despite a relatively dovish statement, as per the more hawkish of market expectations, the US dollar and yields have soared on the back of a pivot during the Federal Reserve's chairman's press conference.

Jerome Powell, the Fed's chair, has stated in the presser that they could move faster and sooner than they did the last time which has helped the US dollar to extend on pre-presser gains:

Additionally, the Fed's chair stated that they could hike rates at every meeting and that they are of the mind to raise rates in March.

Fed's Powell's key comments, so far

- We are of the mind to raise rates at the March meeting.

- The current economy means we can move sooner, perhaps faster than we did last time.

- The next meeting will be coming to more of the details on the Balance Sheet.

- Other forces this year should also bring down inflation.

- Quite a bit of room to raise rates without dampening employment.

- No decision made on policy path, path to be led by incoming data.

EUR/USD technical analysis

As a consequence, US equities are down and EUR/USD has dropped below a key technical level on the charts, losing the 1.13 area and printing a fresh low of 1.1240:

On the wider time frames, such as the H4 chart, the price is seen testing the next critical level of support:

Bulls will need to get back above 1.1310 to be in the clear at this juncture.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.