EUR/USD appears cautious near 1.0800 ahead of Fed event

- EUR/USD alternates gains with losses in the sub-1.0800 region.

- The Fed is likely to skip a rate hike at its meeting later on Wednesday.

- Latest US inflation figures support the largely anticipated Fed pause.

In line with the broad-based consolidation theme in the FX universe, EUR/USD trades within a narrow range in the vicinity of the 1.0800 region ahead of the key FOMC event due later on Wednesday.

EUR/USD remains focused on the Fed gathering

EUR/USD has so far interrupted its weekly recovery and hovered around the 1.0800 zone on Wednesday in response to the generalized directionless mood in the global markets as investors await the interest rate decision by the Federal Reserve, which is expected later in the European evening.

While a pause in the Fed’s hiking cycle is largely telegraphed, another 25 bps rate raise by the ECB is also anticipated on Thursday. The Fed’s decision to reach an impasse in its tightening programme was further propped up by another decline in US inflation figures last month.

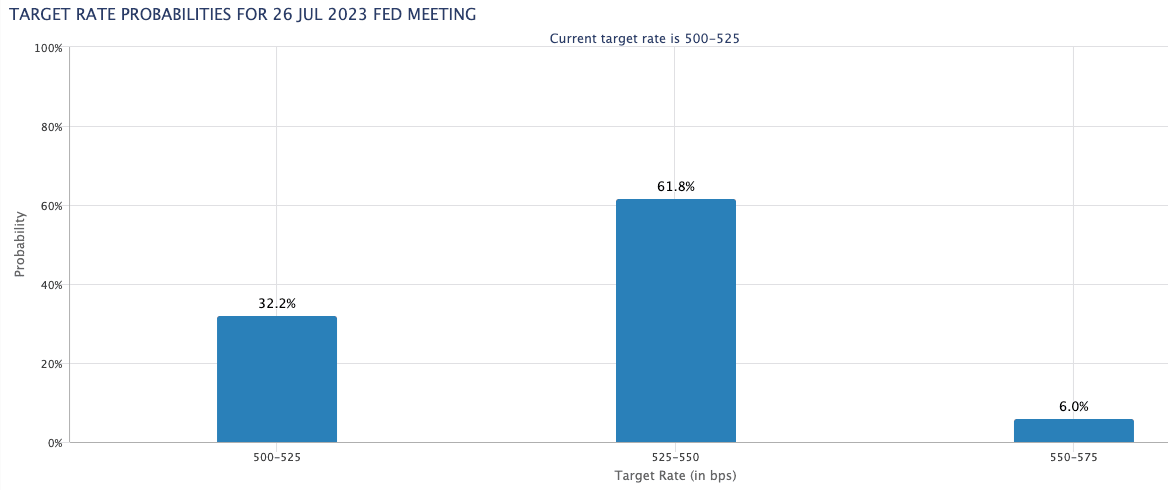

However, fast forwarding to July, both central banks are expected to hike interest rates by a quarter-point. In fact, according to the FedWatch Tool by CME Group, the probability of that scenario approaches 62% so far.

Data-wise, in the euro area, Industrial Production will be the sole release, while weekly Mortgage Applications are due across the pond.

What to look for around EUR

EUR/USD trades close to the 1.0800 region in response to the consolidative mood in the rest of the global assets in the pre-FOMC trade.

In the meantime, the pair’s price action is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB speak continues to favour further rate hikes, although this view appears to be in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: EMU Industrial Production (Wednesday) – Eurogroup Meeting, EMU Balance of Trade, ECB Interest Rate Decision, ECB Lagarde (Thursday) – ECOFIN Meeting, Final EMU Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle in June and July (and September?). Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.06% at 1.0786 and faces the next support at 1.0635 (monthly low May 31) seconded by 1.0516 (low March 15) and finally 1.0481 (2023 low January 6). On the other hand, the surpass of 1.0823 (monthly high June 13) would target 1.0877 (55-day SMA) en route to 1.0904 (weekly high May 16).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.