EUR/JPY steady as markets eye Trump-Putin talks on Ukraine

- EUR/JPY trades flat near 172.00 on Monday as geopolitical focus shifts to the Trump-Putin meeting on August 15 in Alaska.

- Traders will eye GDP data from both the Eurozone and Japan on Thursday for fresh directional cues.

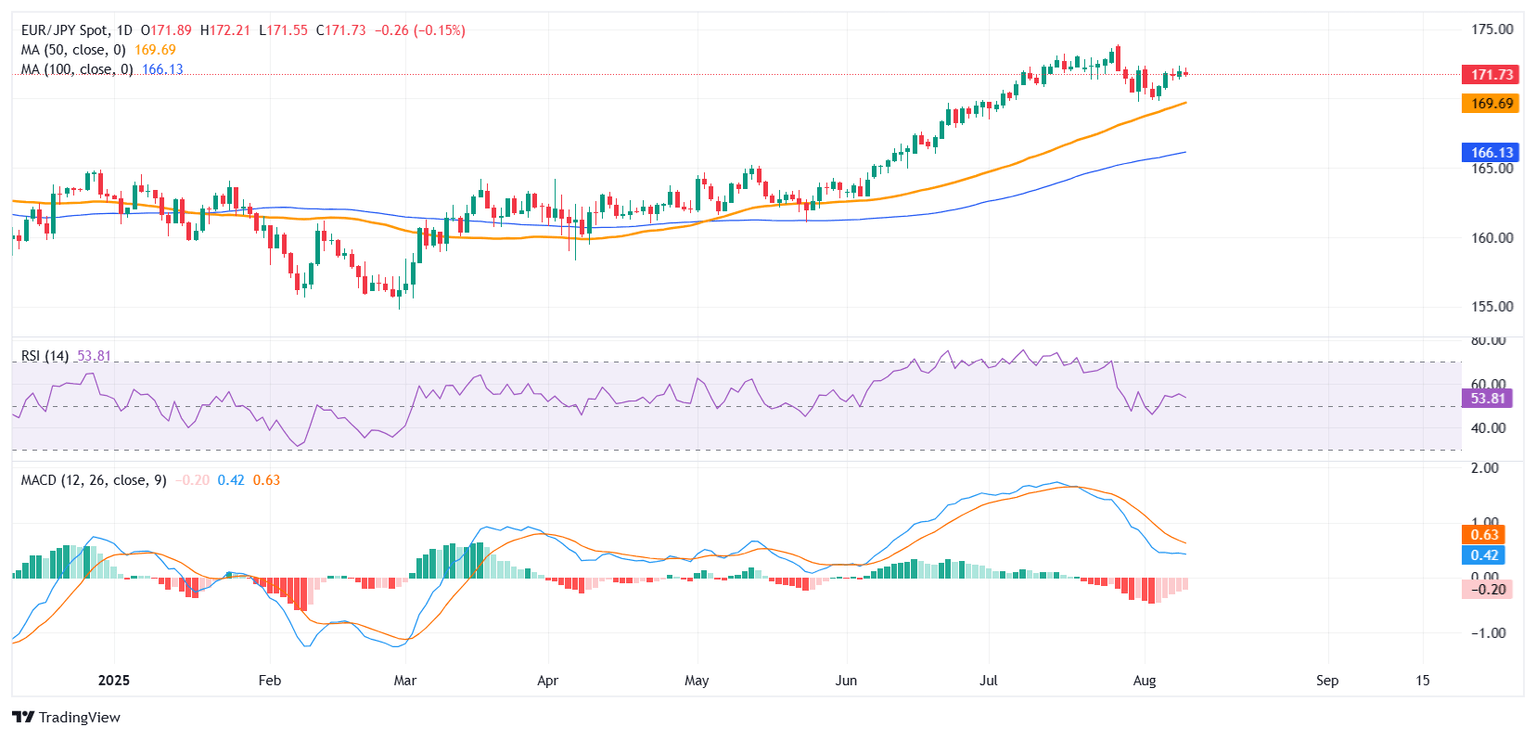

- EUR/JPY remains above the 50-day SMA at 169.70, with initial support at 171.37; a decisive break lower could pave the way toward 167.50.

The EUR/JPY pair is holding steady around 171.75 in Monday’s session, with a slightly weaker Euro (EUR) against the Japanese Yen (JPY) reflecting a cautious market mood as attention shifts to geopolitics. US President Donald Trump announced on Friday that he will meet Russian President Vladimir Putin in Alaska on August 15 to negotiate an end to the war in Ukraine, a development that could influence risk sentiment and currency flows in the coming days.

While the pair has lost some upward momentum after a two-month rally, its broader bullish structure remains intact, underpinned by a clear monetary policy gap between the European Central Bank (ECB) and the Bank of Japan (BOJ).

The ECB left its policy rates unchanged in July, keeping the deposit facility at 2.00%, the main refinancing rate at 2.15%, and the marginal lending rate at 2.40%. This decision followed eight rate cuts since December 2024 as the central bank moved to support slowing eurozone growth. However, policymakers have now adopted a more cautious stance, with some officials hinting that the easing cycle may be over. Market pricing reflects reduced expectations for further cuts this year, with some banks such as Deutsche Bank now projecting the next move could be a rate hike in 2026 if inflation stays on track.

On the other hand, the BOJ maintained its short-term policy rate at 0.50% in July, but the Summary of Opinions revealed that some members are open to another rate hike before year-end if inflationary pressures persist and tariff risks ease. The central bank raised its FY2025 inflation forecast to 2.7% from 2.2%, citing higher food prices and improving sentiment. However, political instability in Japan, including the ruling party’s loss of its parliamentary majority, has clouded the outlook for timely policy action. Analysts warn that fiscal uncertainty could delay any hawkish follow-through. Traders now await Gross Domestic Product (GDP) data from both the Eurozone and Japan on Thursday, which could offer fresh cues for EUR/JPY.

From a technical perspective, EUR/JPY maintains a medium-term bullish bias on the daily chart, with the pair trading comfortably above the 50-day Simple Moving Average (SMA) at 169.70 and the 100-day SMA at 166.13.

On the downside, immediate support is seen at 171.37 (Friday’s low), followed by the 50-day SMA at 169.70; a break below this level could open the door for a deeper pullback toward 167.50.

Momentum indicators are neutral, with the Relative Strength Index (RSI) steady around 54 after easing from overbought territory, suggesting there is still room for upside without immediate risk of exhaustion. The Moving Average Convergence Divergence (MACD) histogram is showing signs of easing bearish momentum, hinting that a sustained break above 172.50 could trigger a fresh leg higher toward July’s peak at 173.90.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.