EUR/JPY Price Forecast: Bullish outlook seems vulnerable around the 100-day EMA near 161.00

- EUR/JPY softens to near 161.05 in Thursday’s early European session.

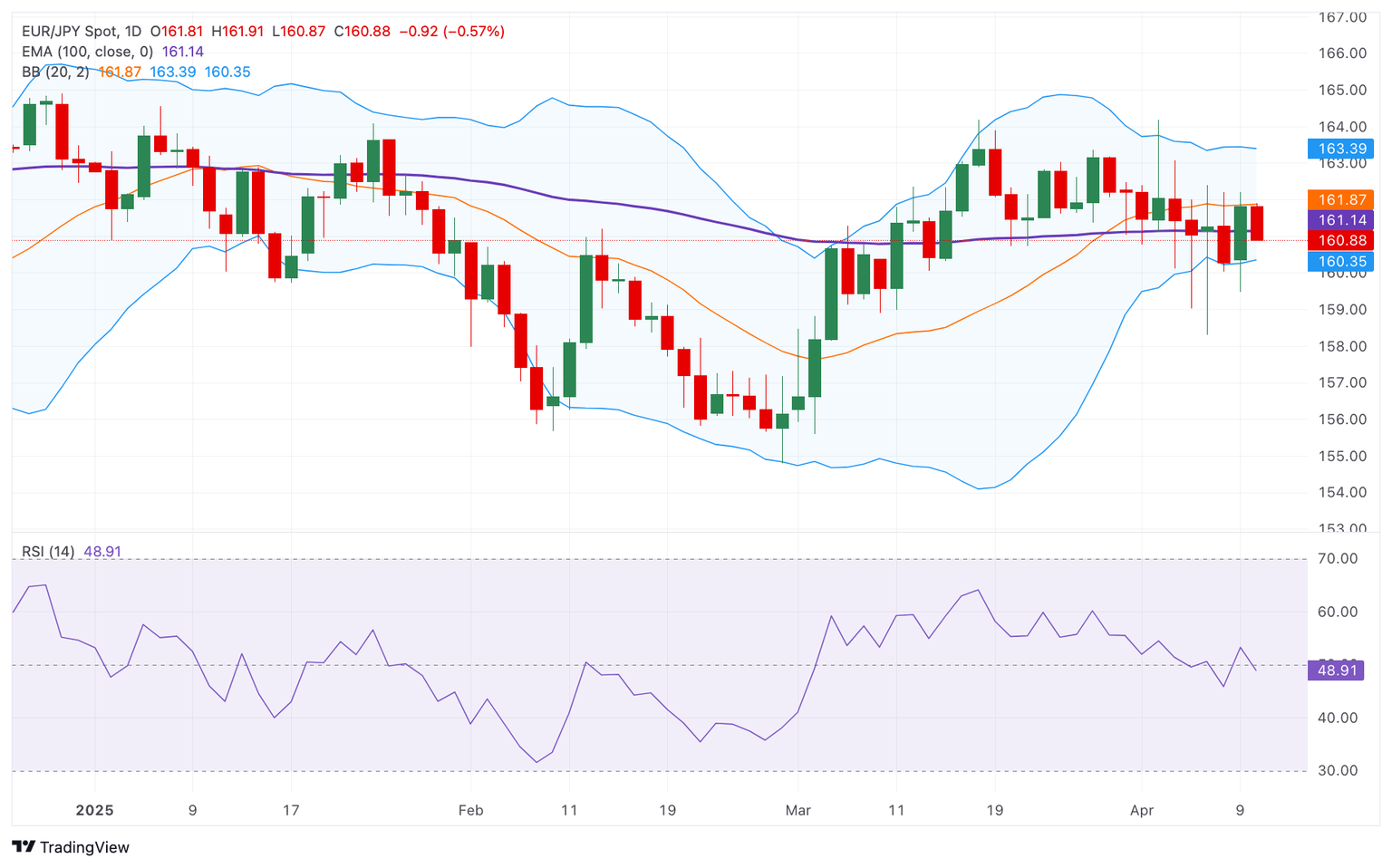

- Further consolidation for the cross cannot be ruled out with the neutral RSI indicator.

- The initial support level is located at 160.35; the first upside barrier emerges at 162.20.

The EUR/JPY cross weakens to around 161.05 during the early European session on Thursday. The Japanese Yen (JPY) drifts higher against the Euro (EUR) as the stronger-than-expected Japanese Producer Price Index (PPI) keeps the door open for further rate hikes by the Bank of Japan (BoJ).

Technically, the constructive outlook of EUR/JPY seems vulnerable as the cross hovers around the key 100-day Exponential Moving Average (EMA) on the daily chart. The cross could resume its downside if it closes below the key 100-day Exponential Moving Average (EMA) on the daily chart. Further consolidation looks favorable, with the 14-day Relative Strength Index (RSI) standing around the midline, displaying neutral momentum in the near term.

The first downside target for EUR/JPY is located at 160.35, the lower limit of the Bollinger Band. Sustained trading below the mentioned level could see a drop to the 160.00 psychological level. The additional downside filter to watch is 159.12, the low of March 6.

On the other hand, the immediate resistance level for the cross emerges at 162.20, the high of April 9. Extended gains could see a rally to 163.40, the upper boundary of the Bollinger Band. The next hurdle is seen at 164.84, the high of December 27, 2024.

EUR/JPY daily chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

BRANDED CONTENT

Finding the right broker for your trading strategy is essential, especially when specific features make all the difference. Explore our selection of top brokers, each offering unique advantages to match your needs.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.