EUR/JPY Price Forecast: Bounces back and aims to reclaim yearly high above 173.00

- EUR/JPY rebounds to near 172.60 as the Japanese Yen resumes its downside journey.

- Japan’s ruling coalition party lost control in upper house.

- The ECB is expected to leave interest rates steady in the policy meeting on Thursday.

The EUR/JPY pair claws back a majority of its initial losses and rises to near 172.60 during the late Asian session on Monday after a weak opening around 172.00 earlier in the day. The cross attracts bids as the Japanese Yen (JPY) struggles to hold initial gains due to political uncertainty in Japan.

On Sunday, Japan’s ruling party coalition-led by Prime Minister Shigeru Ishiba lost control in upper house, which prompted fears of a political change in the economy. A scenario that often weighs on the domestic currency.

The political uncertainty in Japan has come at a time when the nation is struggling to finalize a trade agreement with the United States (US) before the August 1 deadline.

Meanwhile, the Euro (EUR) is expected to trade cautiously as the European Central Bank (ECB) is scheduled to announce the monetary policy on Thursday. According to analysts at Erste Group, the ECB is expected to leave its key borrowing rates steady.

On the global front, trade tensions between the European Union (EU) and the US have increased as the latter has demanded more concessions before finalizing a deal. According to a report from the Financial Times (FT), Washington is eyeing at least a minimum tariff of 15% to 20% in a deal with the Eurozone.

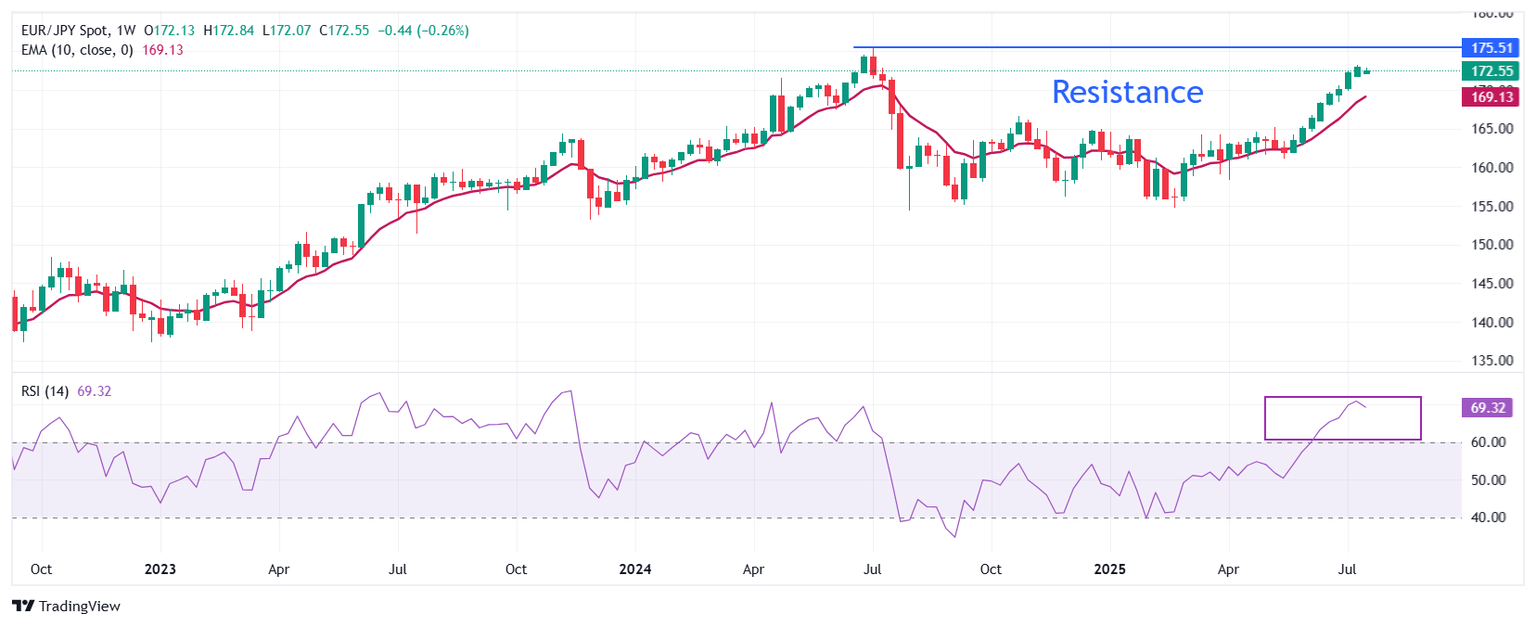

EUR/JPY strives to extends its winning streak for the ninth week. Upward-sloping 10-week Exponential Moving Average (EMA) near 169.10 suggests that the overall trend is bullish.

The 14-day Relative Strength Index (RSI) trades near 70.00, suggesting that a bullish momentum is intact.

Going forward, the pair would witness more upside towards the July 2024 high of 175.43 if it breaks above the last week high of 173.25.

On the flip side, a downside move by the pair below the July 16 low of 171.84 could result in a further decline towards the July 11 low of 170.81, followed by the round-level support of 170.00.

EUR/JPY weekly chart

Economic Indicator

ECB Rate On Deposit Facility

One of the European Central Bank's three key interest rates, the rate on the deposit facility, is the rate at which banks earn interest when they deposit funds with the ECB. It is announced by the European Central Bank at each of its eight scheduled annual meetings.

Read more.Next release: Thu Jul 24, 2025 12:15

Frequency: Irregular

Consensus: 2%

Previous: 2%

Source: European Central Bank

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.