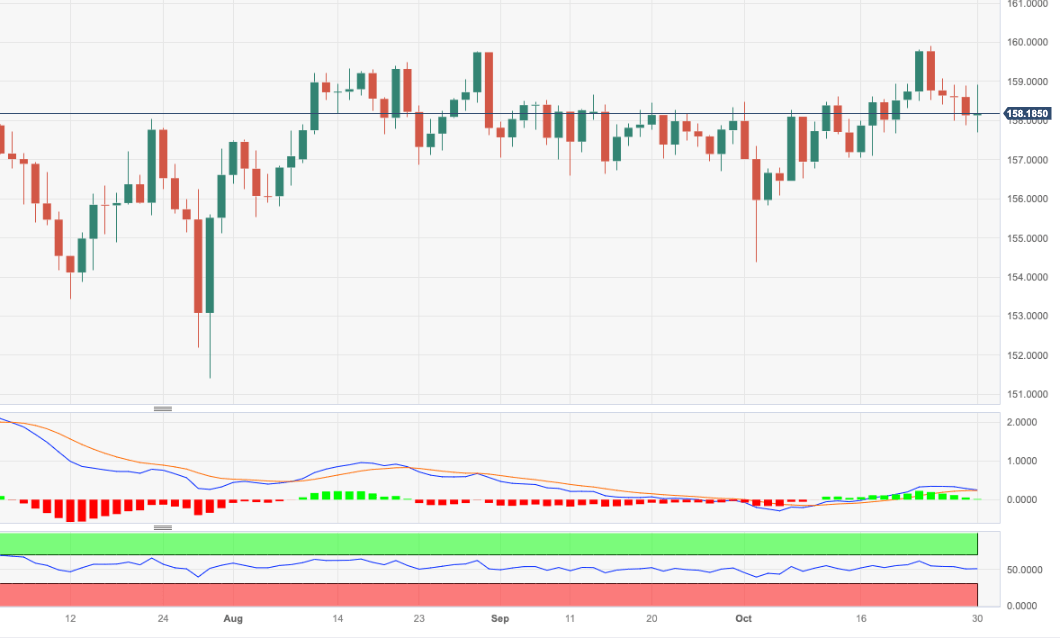

EUR/JPY Price Analysis: Upside capped by 160.00

- EUR/JPY picks up some upside pace and flirts with 159.00.

- Bullish attempts should meet a tough barrier near 160.00.

EUR/JPY reverses Friday’s marked pullback and clings to daily gains just above the 158.00 yardstick.

Further consolidation appears to be the name of the game for the cross for the time being. Against that, the breakout of this theme could encourage the index to challenge the 2023 top at 159.91 (October 24) closely followed by the round level at 160.00.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 151.26.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.