EUR/JPY Price Analysis: Surpasses the Tenkan-Sen, hovers around 163.00

- EUR/JPY sees a 0.19% rise, maintaining a position below the YTD high of 164.30 amid US and Japan holidays.

- For further bullish momentum, EUR/JPY needs to breach 164.00; downside risks include a potential drop towards 161.25 support.

The EUR/JPY rose a decent 0.19% yet remains well below the latest cycle and a year-to-date (YTD) high at 164.30 on Thursday. At the time of writing, the pair exchanges hands at 163.09 amid thin liquidity conditions due to holidays in the US and Japan.

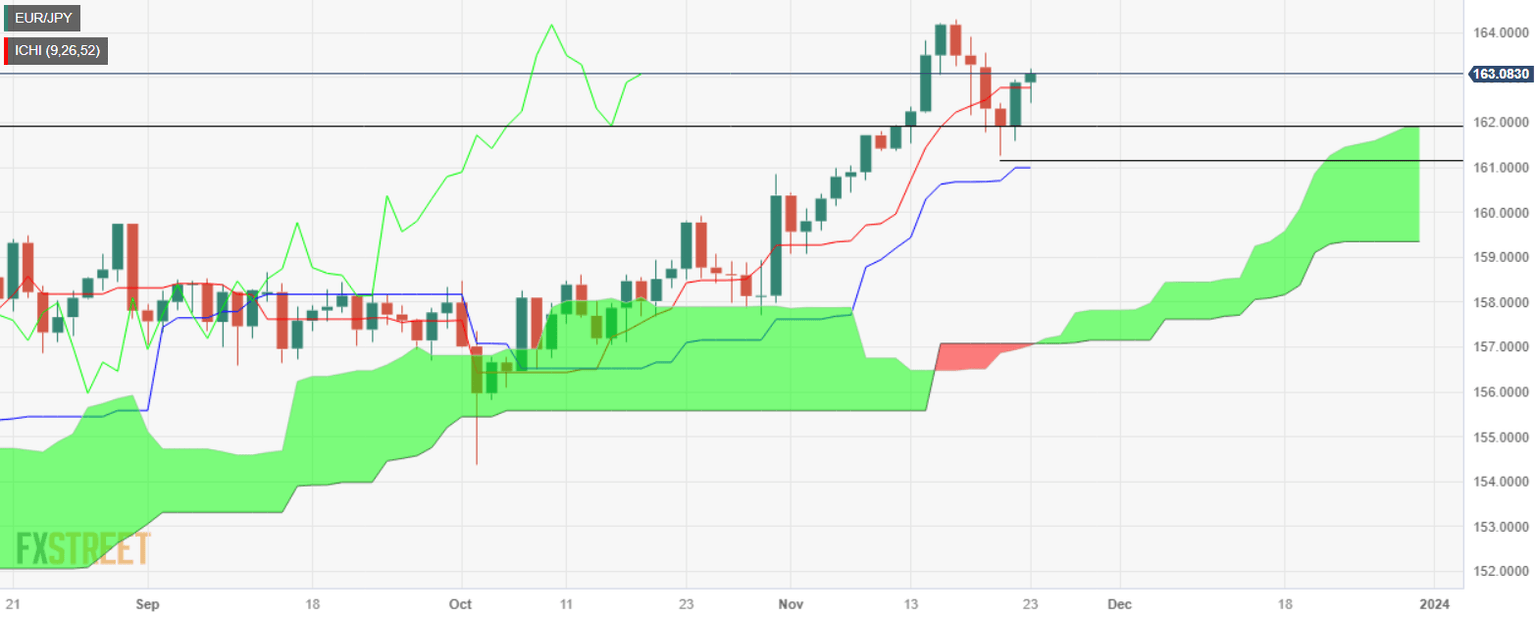

From a technical perspective, the EUR/JPY daily chart portrays the pair as neutral to upward biased, with price action remaining above the Ichimoku Cloud (Kumo) and above the Tenkan-Sen level at 162.77. Although the bias is bullish, the Tenkan and Kijun-Sen lines turned flat, suggesting consolidation lies ahead.

For a bullish continuation, the EUR/JPY needs to remain above 163.00 and test the 164.00 figure, ahead of threatening the year-to-date (YTD) high at 164.30. On the other hand, if the cross drops below the Tenkan-Sen at 162.77, that would exacerbate a drop to the Senkou Span A at 161.88. The next demand zone would be 161.25, the November 21 daily and last cycle low.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.