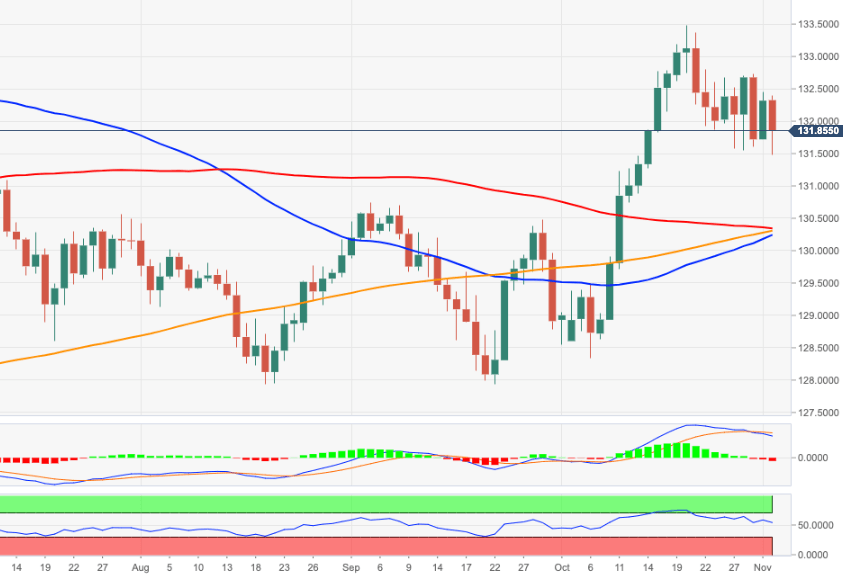

EUR/JPY Price Analysis: Solid contention remains around 131.50

- EUR/JPY leaves behind Monday’s gains and retests 131.50.

- Further losses await on a breach of the mid-131.00s.

Sellers returned to the market and dragged EUR/JPY back to the negative territory on turnaround Tuesday.

The cross fades Monday’s constructive price action and refocuses instead once again on the 131.50 area, which still emerges as quite a strong support area. This zone is also reinforced by a Fibo level (of the October’s rally) at 131.51. The loss of this area is expected to meet the next level at another Fibo at 130.97.

In the broader scenario, while above the 200-day SMA at 130.26, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.