EUR/JPY Price Analysis: Rising bets for extra upside

- EUR/JPY advances well past the 131.00 mark on Thursday.

- Extra gains now seen testing 132.00 and beyond.

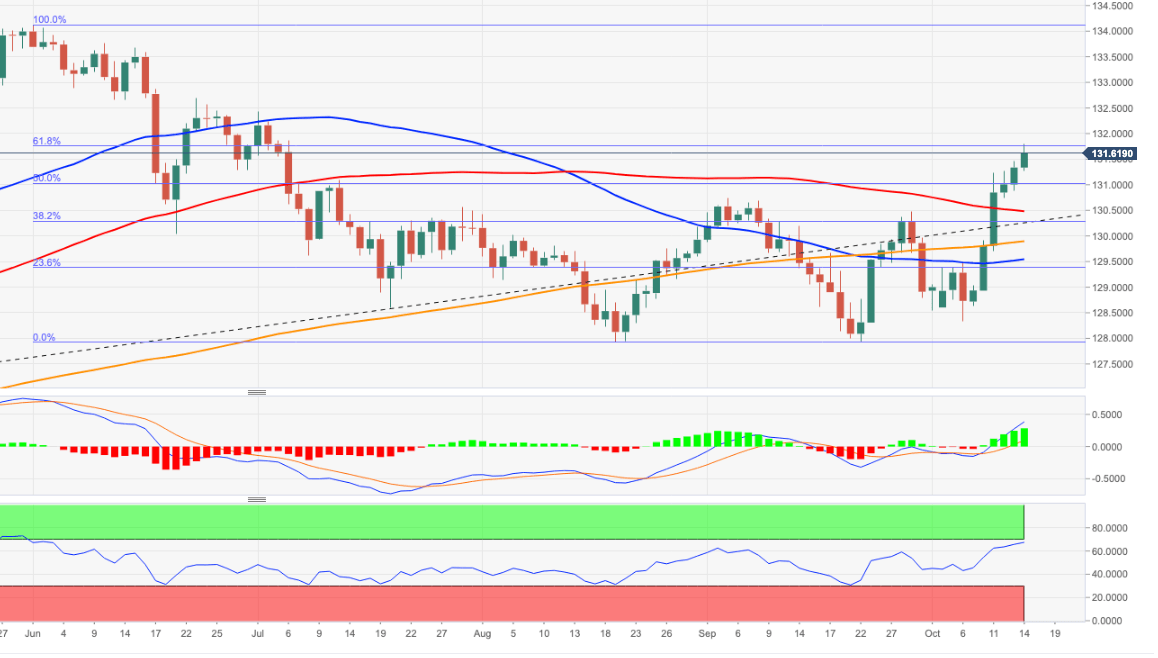

EUR/JPY extends the sharp recovery for yet another session and this time further north of the 131.00 hurdle.

The intense move higher in the cross has been exacerbated following the recent breakout of the key 200-day SMA and now targets the round level at 132.00 ahead of minor obstacles at the July 1 high at 132.43 and the June 23 high at 132.69, all prior to another Fibo level at 132.79.

In the broader scenario, while above the 200-day SMA at 129.85, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.