EUR/JPY Price Analysis: Reclaims 162.00 as buyers target 163.00 before reaching overbought levels

- EUR/JPY climbs 0.18%, buoyed despite optimism for ECB rate cuts in a disinflationary environment.

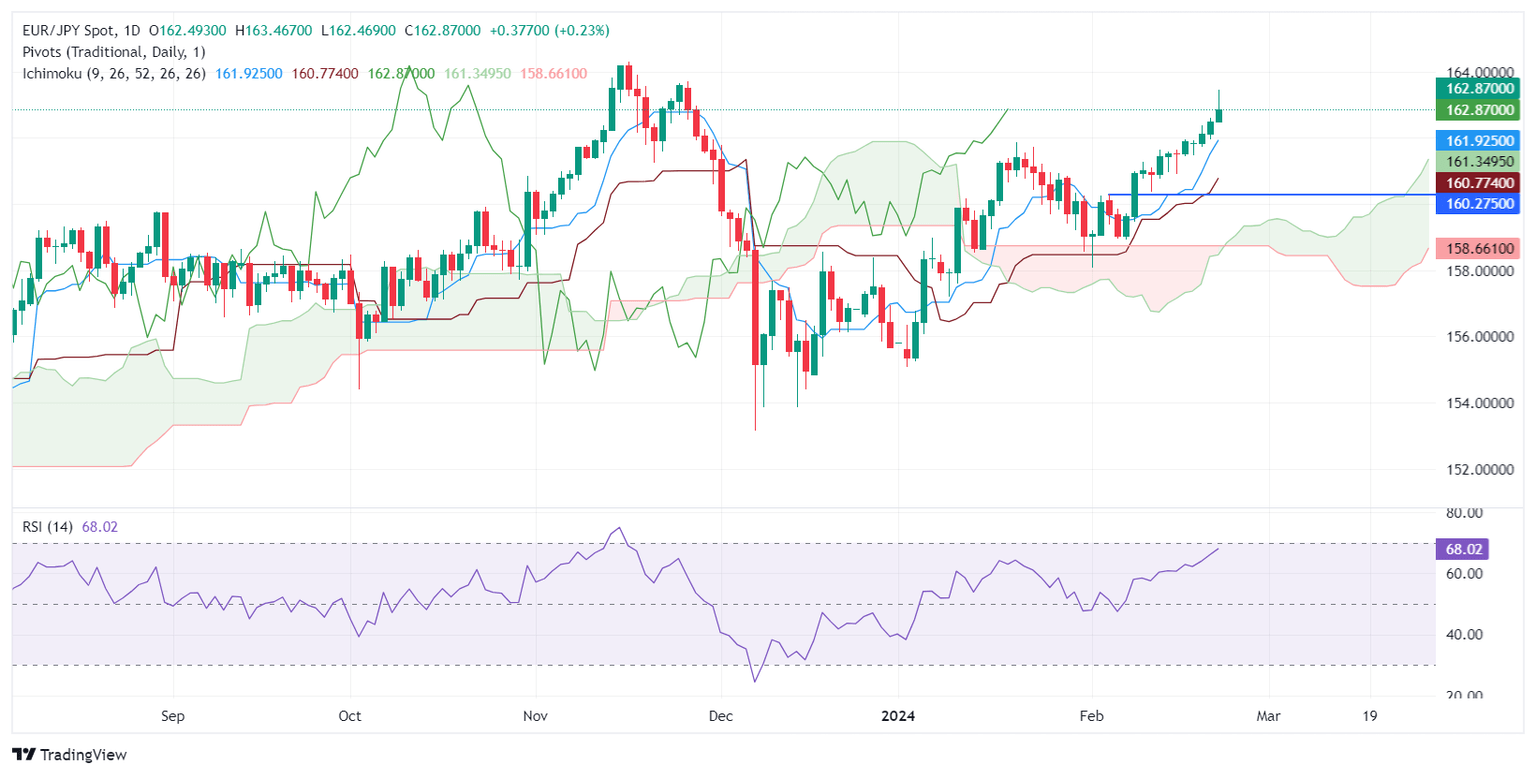

- Crossing Tenkan-Sen, targets 163.00 resistance, aiming for November's peak at 164.31 in ongoing uptrend.

- Potential pullback to find support at Tenkan-Sen (161.92), with subsequent supports at 161.34 and 160.77.

The Euro clings to decent gains versus the Japanese Yen late during the North American session, amid a mixed market mood. Eurozone (EU) economic data showed the disinflation process amongst countries in the bloc continued and has opened the door to discussions that the European Central Bank (ECB) might cut rates sooner rather than later. At the time of writing, the EUR/JPY exchanges hands at 162.91, up 0.18%.

The cross-pair has extended its gains past the Tenkan-Sen level and the 162.00 figure, as the Relative Strength Index (RSI) is close to entering overbought levels. However, as the uptrend remains strong, the RSI might get to the 80 level before the EUR/JPY tumbles. Therefore, the pair’s next resistance level sits at 163.00, followed by the November 16 high at 164.31.

On the flip side, if EUR/JPY retreats below the 162.00 mark, sellers could challenge the Tenkan-Sen at 161.92. Once cleared, the next support would be the Senkou Span A at 161.34 before challenging the Kijun-Sen level at 160.77.

EUR/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.