EUR/JPY Price Analysis: Probable correction lower

- EUR/JPY records new 2021 tops beyond the 132.00 mark.

- Overbought conditions could spark a knee-jerk.

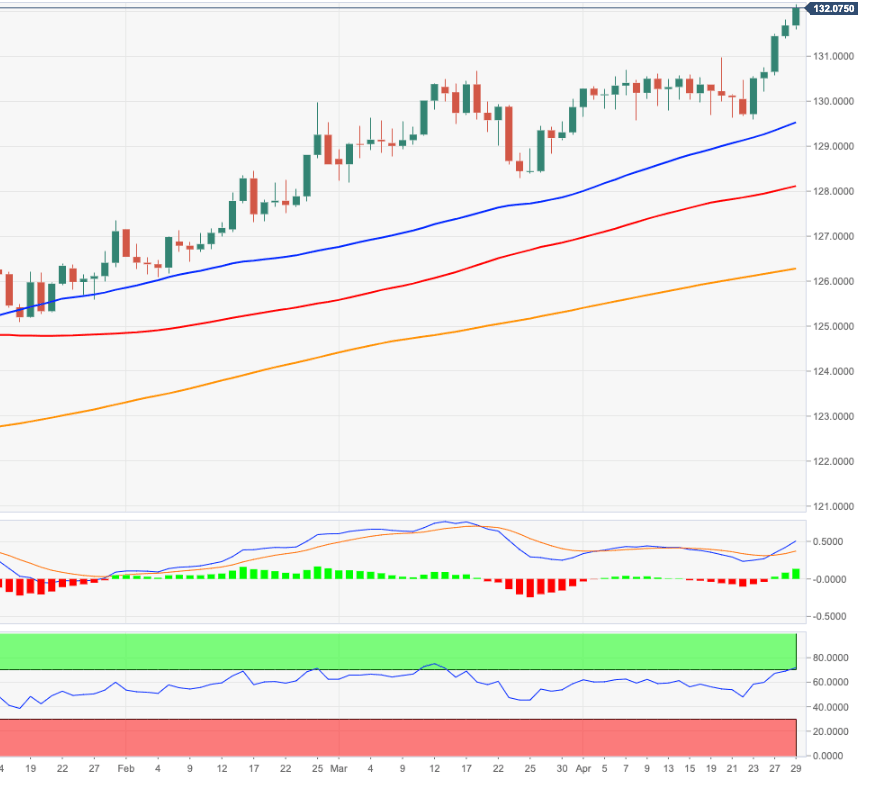

EUR/JPY’s rally remains unabated and trades in fresh 2021 highs beyond 132.00 the figure on Thursday.

The cross accelerates the recent breakout of the April’s consolidative range and surpasses the 132.00 yardstick for the first time since October 2018.

In the meantime, the upside bias remains unchanged while above the immediate support line around 129.80. This area of support is reinforced by the 50-day SMA near 129.70. However, there is the tangible chance of a temporary move lower in response to the current overbought conditions.

Next on the upside, there are no relevant resistance levels until the September 2018 high at 133.13.

Looking at the broader picture, the positive stance in EUR/JPY is seen unchanged while above the 200-day SMA, today at 126.22.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.