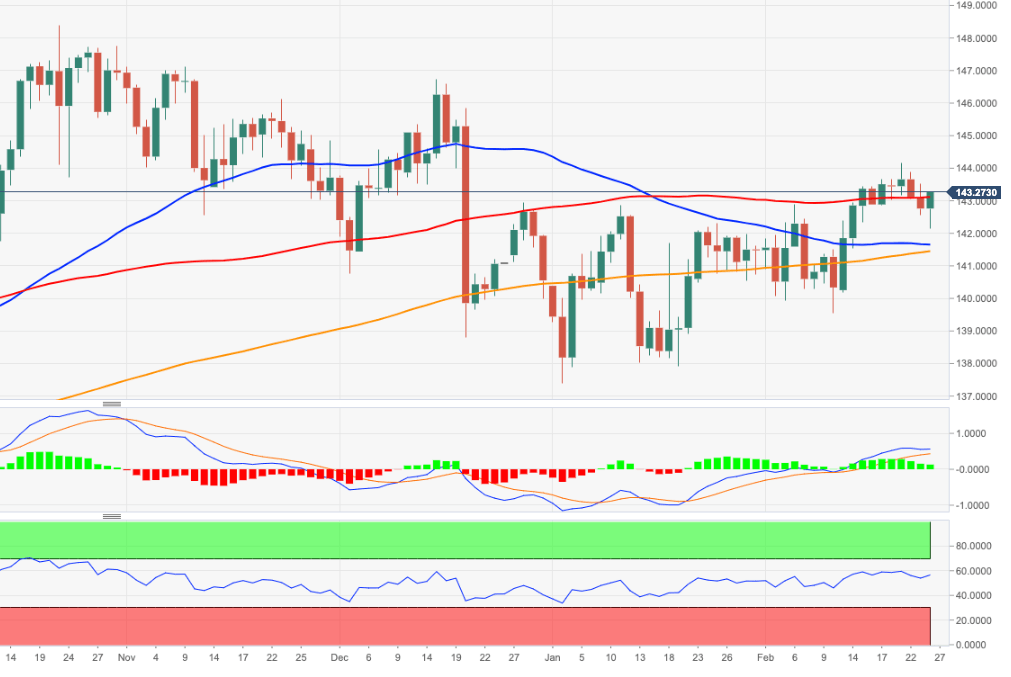

EUR/JPY Price Analysis: Interim top above 144.00?

- EUR/JPY reverses two consecutive daily pullbacks on Friday.

- Further gains seen above the 2023 high past 144.00.

EUR/JPY manages to rebound from earlier multi-session lows near 142.00 and returns to the positive territory at the end of the week.

While the cross looks somewhat side-lined for the time being, a convincing breakout of the 2023 high at 144.16 (February 21) could spark extra strength to, initially, the December 2022 peak at 146.72 (December 15).

In the meantime, while above the 200-day SMA, today at 141.41, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.