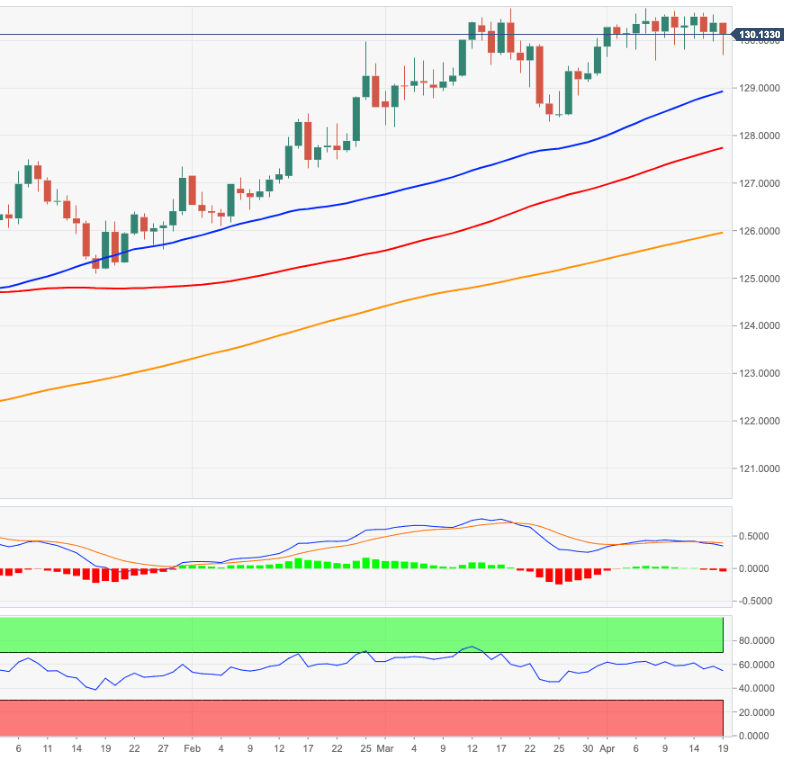

EUR/JPY Price Analysis: Interim support emerges at 129.13

- EUR/JPY starts the week on a soft note, drops to 129.70.

- There is an interim support at the 50-day SMA.

EUR/JPY manages to reverse an initial drop to the 129.70 region, although it keeps the bearish note so far on Monday.

The continuation of the current consolidative theme looks the most likely scenario in the very near-term at least. However, further gains in the Japanese currency carries the potential to force the cross to creep lower and face the next minor support at the 50-day SMA, today at 129.13.

The resumption of the upside, on the other hand, is expected to meet the next hurdle at the 2021 high near 130.70 (April 7) ahead of the 131.00 mark.

While above the 5-month support line near 128.70, extra gains remain on the table, with the longer term target at the 2018 high at 131.98 (July 17).

In the meantime, while above the 200-day SMA at 125.88 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.