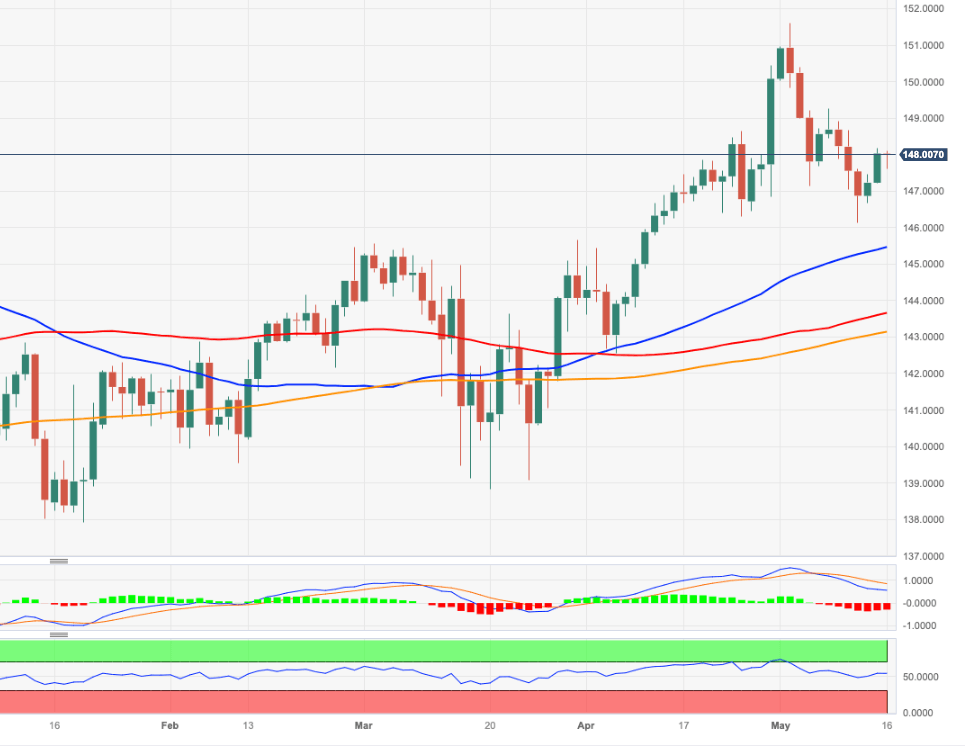

EUR/JPY Price Analysis: Initial resistance comes around 148.00

- EUR/JPY’s recovery appears to have met initial hurdle near 148.00.

- The continuation of the rebound targets the weekly high near 149.30.

The ongoing upside momentum in EUR/JPY struggles to surpass the 148.00 region with conviction on Tuesday.

Once the 148.00 area is surpassed, the cross should be able to challenge the weekly peak at 149.26 (May 8). The surpass of this level could pave the way for a potential test of the YTD high at 151.61 (May 2).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 143.11.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.