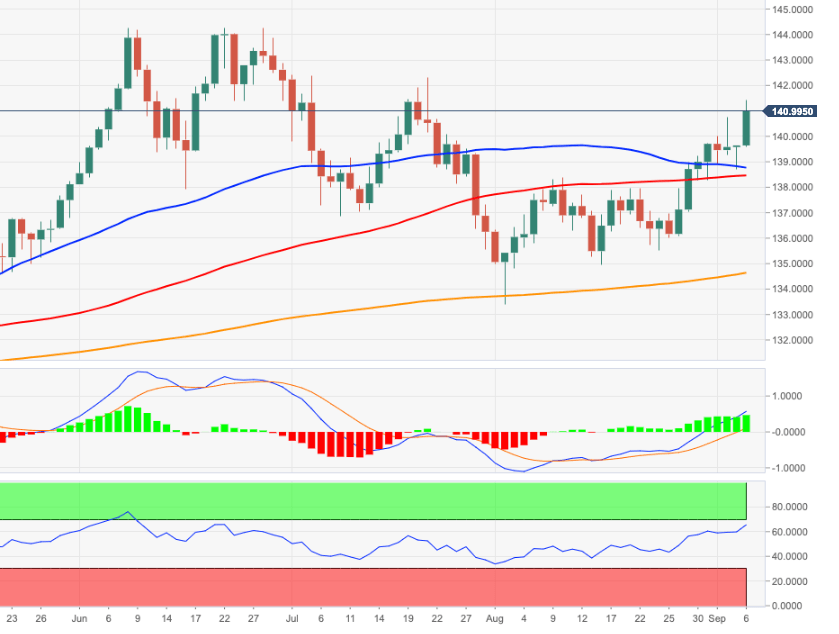

EUR/JPY Price Analysis: Increasing bets for a move to 142.00 and above

- EUR/JPY extends the rebound past the 141.00 mark on Tuesday.

- Immediately to the upside comes the 142.30 zone.

EUR/JPY accelerates gains and trespasses the 141.00 barrier, or multi-week highs, on Tuesday.

Extra gains in the cross remains favoured for the time being, with the next target now emerging at the weekly top at 142.32 (July 21) ahead of the 2022 peak at 144.27 (June 28).

While above the 200-day SMA at 134.60, the prospects for the pair should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.