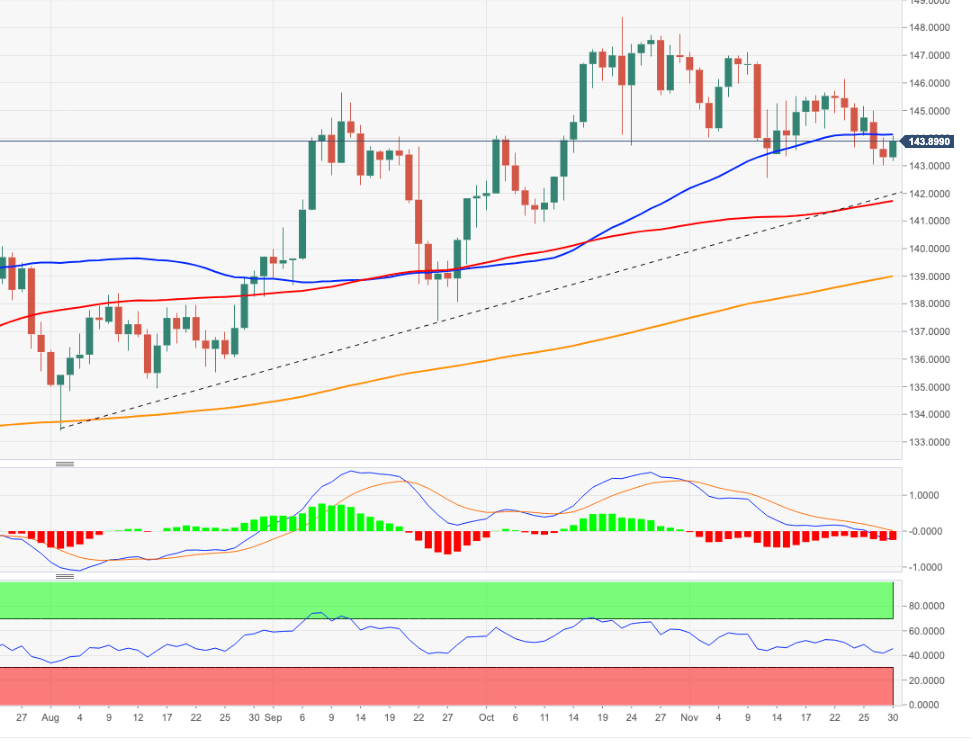

EUR/JPY Price Analysis: Further gains likely above 142.00

- EUR/JPY rebounds from recent tops and trespasses 144.00.

- Extra upside remains on the cards above the 4-month support line.

EUR/JPY manages to leave behind two daily declines in a row and briefly breaks above the 144.00 barrier on Wednesday.

In case bulls push harder, the door could open to a potential test of the weekly high at 146.13 (November 23) in the short-term horizon. While above the 4-month support line near 142.00, the near-term outlook for the cross is expected to remain positive.

In the longer run, the cross should keep the bullish view unaltered above the 200-day SMA, today at 138.96.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.