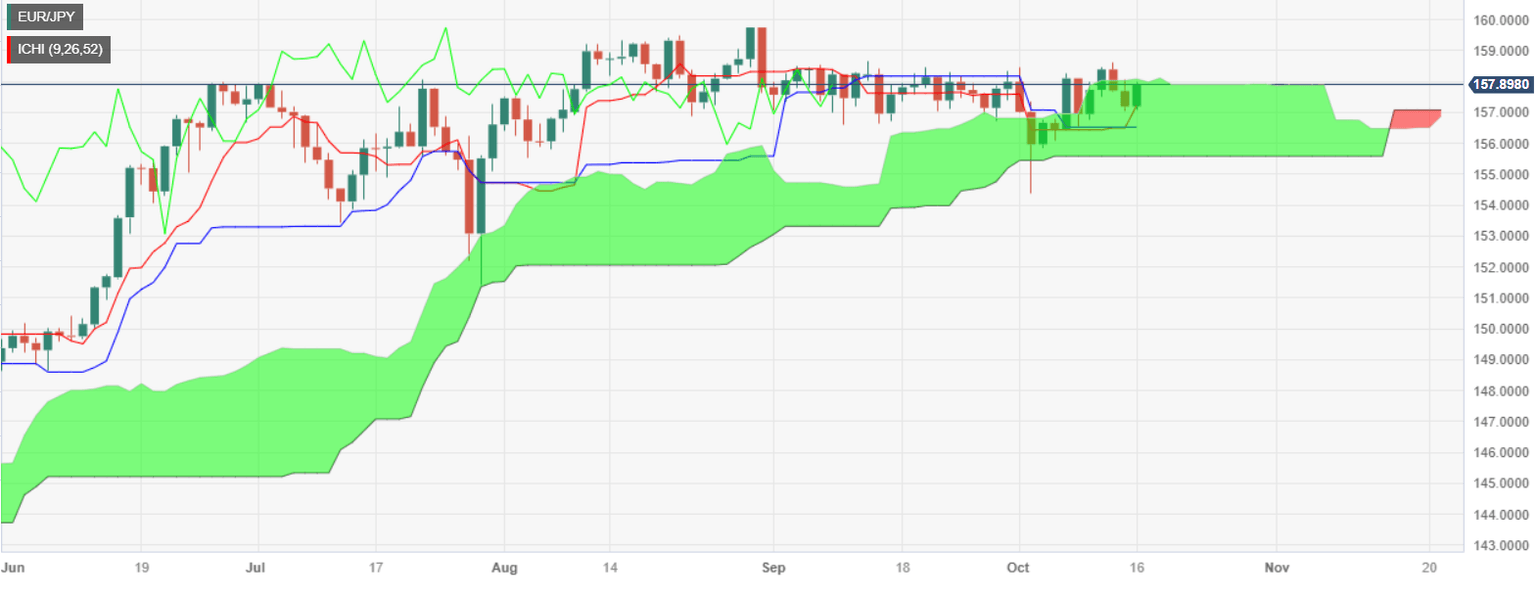

EUR/JPY Price Analysis: Eyes top of Ichimoku cloud on risk-appetite, buyers target 158.00

- EUR/JPY trades with a 0.47% gain, bouncing from daily lows of 156.98.

- Technical indicators suggest potential upward movement, targeting the October 12 high.

- A successful breach of the Kumo top could pave the way to the YTD high of 159.76.

The EUR/JPY pair tests the top of the Ichimoku Cloud (Kumo), at around 157.80, amid risk sentiment improvement, as a bullish-engulfing chart pattern looms. At the time of writing, the cross-pair prints gains of 0.47%, after bouncing off daily lows of 156.98.

From a technical standpoint, the EUR/JPY remains in consolidation, threatening to crack the top of the Kumo, which would expose the October 12 high of 158.61. A breach of that area would open the door to challenge the year-to-date (YTD) high of 159.76.

Conversely, if EUR/JPY sellers moved in, the first support would be the Tenkan-Sen line at 157.21. Once cleared, the next support would be the Senkou-Span B at 157.05, before challenging the 157.00 figure. If the cross-pair drops below those levels, the bottom of the Kumo would be up for grabs at 155.60/65, ahead of the October 3 swing low of 154.34.

EUR/JPY Price Action – Daily chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.