EUR/JPY Price Analysis: Euro trades higher near 162 amid bullish moving averages

- EUR/JPY trades near the 162 zone following a modest advance on Wednesday

- MACD prints a sell signal, while moving averages reinforce bullish momentum

- Support aligns at 161.87 and 161.89, with resistance emerging near 162.40

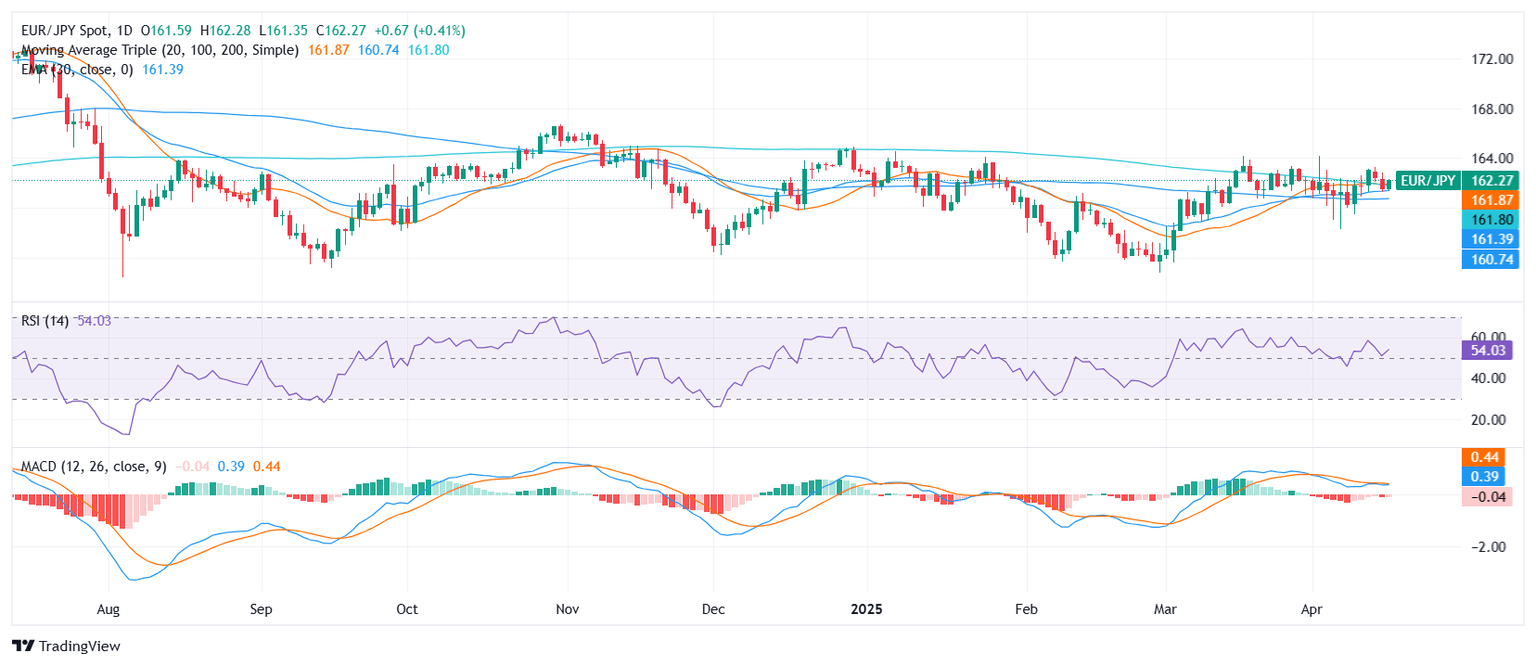

The EUR/JPY pair inched higher on Wednesday ahead of the Asian session, trading near the 162 area after a 0.29% daily gain. The session remained confined within a range of 161.351 to 162.279, with the pair supported by the broader bullish structure in trend indicators despite some mixed oscillator signals.

The Relative Strength Index (RSI) is holding at a neutral 53.29, suggesting stable momentum. However, the Moving Average Convergence Divergence (MACD) is currently flashing a sell signal, providing a counterpoint to the prevailing uptrend. Both the Williams Percent Range and the Awesome Oscillator are neutral, offering no strong directional bias in the short term.

From a trend perspective, the outlook remains constructive. The 20-day Simple Moving Average (SMA) at 161.871, the 100-day SMA at 160.718, and the 200-day SMA at 161.944 are all bullishly aligned. Additional support is echoed by the 10-day Exponential Moving Average (EMA) at 161.892 and the 10-day SMA at 161.677.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.