EUR/JPY Price Analysis: Corrective downside is overdue

- EUR/JPY extends the rally beyond 134.00 the figure.

- The next barrier on the upside emerges at 134.40/50.

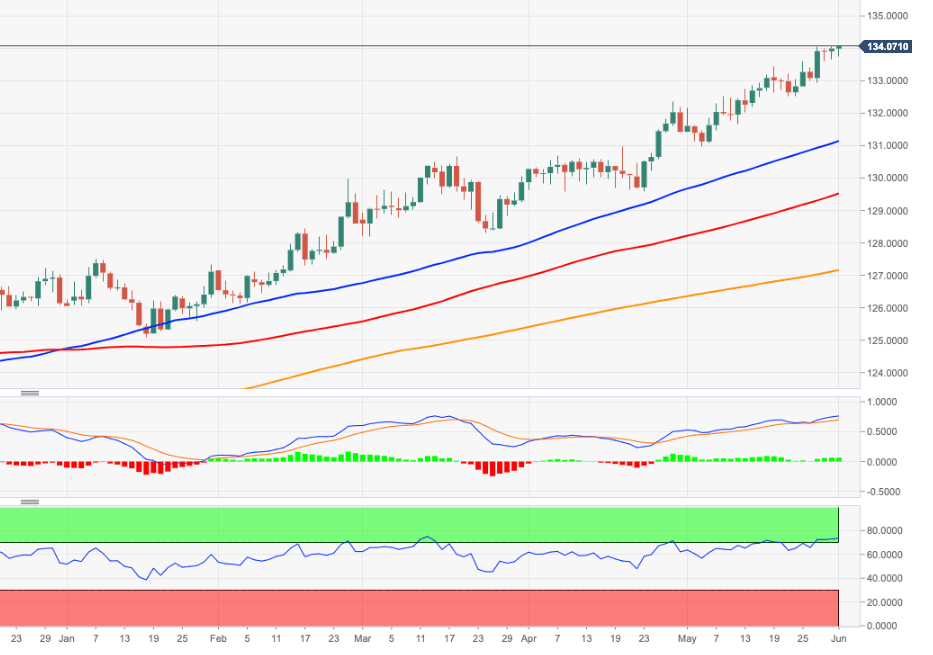

EUR/JPY keeps pushing higher and surpasses the 134.00 level, clinching at the same time new 2021 highs.

The upside momentum remains well in place and EUR/JPY could now attempt a visit to the September/October 2017 highs in the 134.40/50 band. Further gains appear likely as long as the cross remains underpinned by the immediate support line (off the March lows) above 131.00. This area is also reinforced by the proximity of the 50-day SMA (131.25).

However, the cross continues to navigate the overbought territory as per the daily RSI (76.35), which is indicative that a corrective move stays in the pipeline in the not-so-distant future.

In the broader picture, while above the 200-day SMA at 127.11 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.