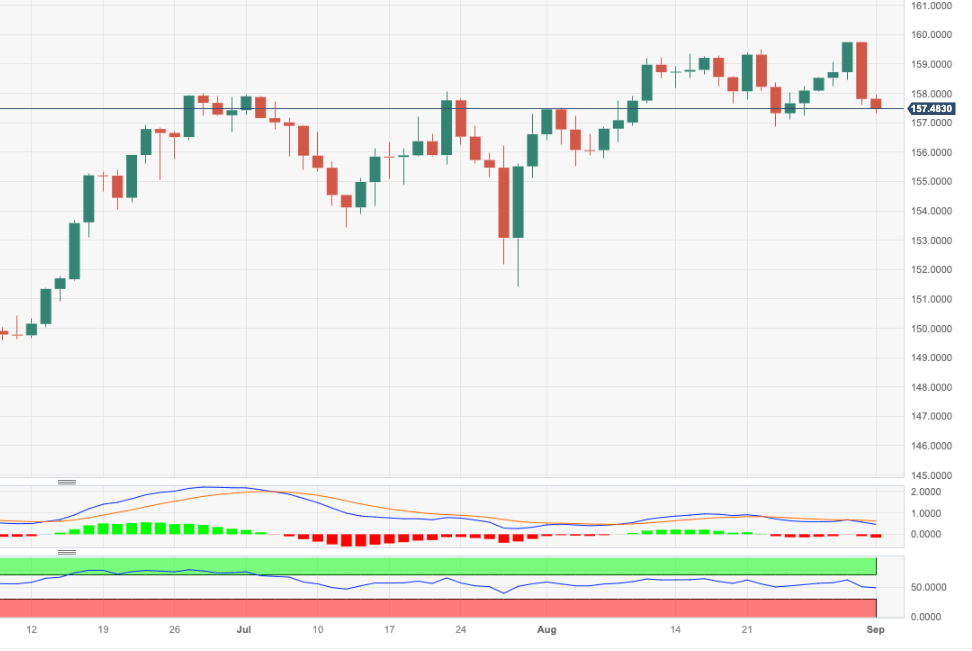

EUR/JPY Price Analysis: Correction could extend below 157.00

- EUR/JPY adds to Thursday’s strong pullback and tests 157.30.

- Immediately to the downside comes the weekly low near 156.80.

Further selling pressure forces EUR/JPY to add to Thursday’s losses and print multi-day lows near 157.30 on Friday.

In case the downward bias picks up extra pace, the cross risks an initial drop to the minor support at the weekly low of 156.86 (August 23), which appears so far propped up by the provisional 55-day SMA (156.90).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 147.98

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.