EUR/JPY Price Analysis: Climbs to near 162.70 followed by a psychological barrier

- EUR/JPY could meet the psychological resistance at the 163.00 level following February’s high at 163.72.

- EUR/JPY cross could find immediate support at the major level of 162.50.

- 14-day RSI indicates a bullish sentiment for the cross.

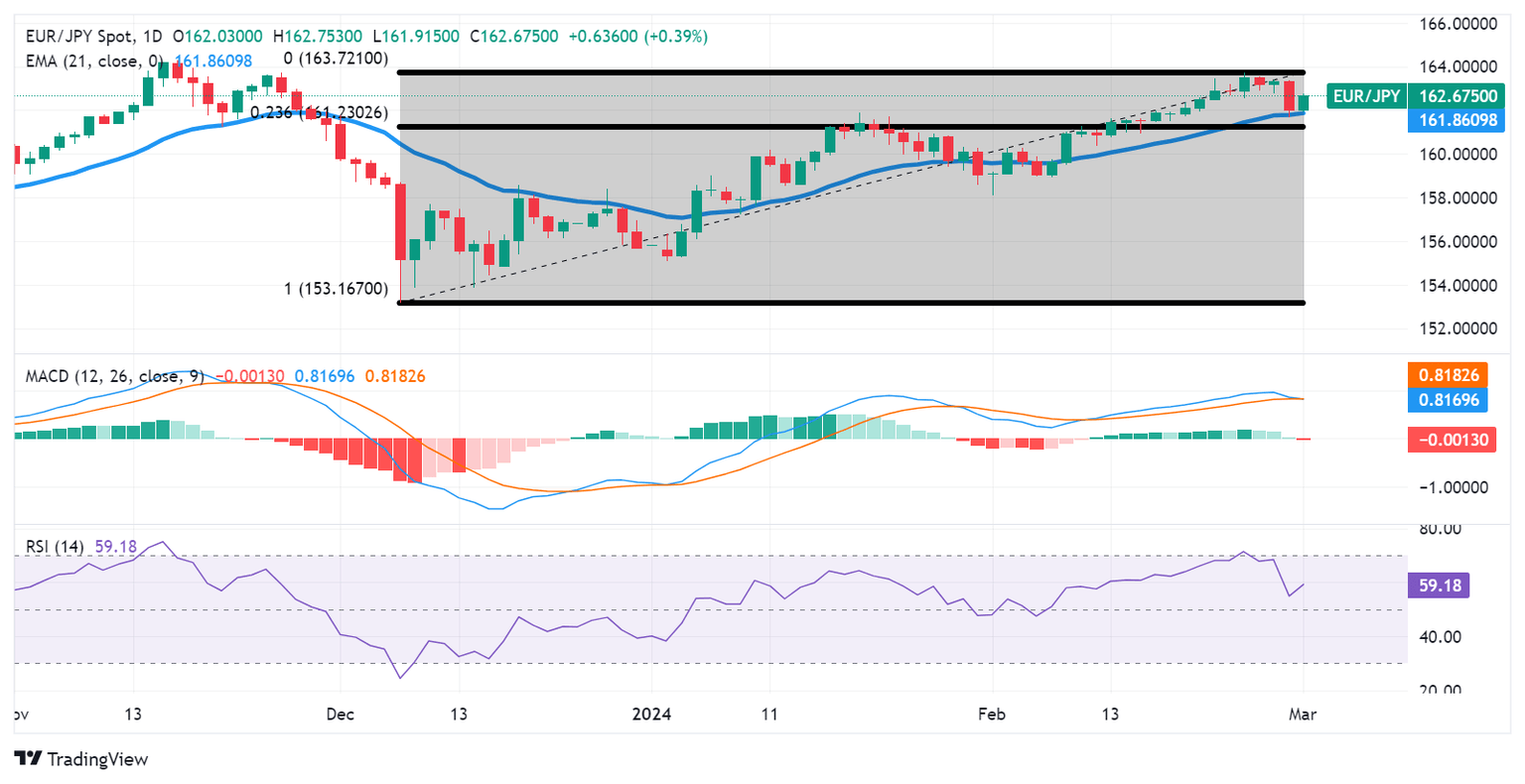

EUR/JPY retraces its recent losses, trading higher around 162.70 during the Asian session on Friday, following the psychological barrier of 163.00 level. A breakthrough above this barrier could lead the cross to explore the further resistance zone around the major level of 163.50 followed by February’s high at 163.72.

Technical analysis indicates a bullish sentiment for the EUR/JPY cross. The 14-day Relative Strength Index (RSI) is positioned above the 50 mark, signaling strength in the upward momentum.

However, the Moving Average Convergence Divergence (MACD) line is aligned with the signal line, indicating a convergence, while remaining above the centerline. Although the MACD is a lagging indicator, this configuration suggests a subdued momentum for the EUR/JPY cross at the moment.

On the downside, the EUR/JPY cross may encounter immediate support at the major level of 162.50, followed by the psychological level of 162.00. A breach below this support level could exert downward pressure on the pair, potentially testing the 21-day Exponential Moving Average (EMA) at 161.86.

Additionally, a further support zone for the EUR/JPY cross is anticipated around the major level of 161.50, with another significant support level near the 23.6% Fibonacci retracement level at 161.23.

EUR/JPY: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.