EUR/JPY Price Analysis: Bulls seek break and restest of 133.50

- EUR/JPY bulls taking up the lead in quiet Asian session.

- 133.50 is critical resistance, that if broken, opens the risk of a fast 15 pips pop to test 4-hour highs.

The following series of charts illustrates the bullish bias from a top-down perspective.

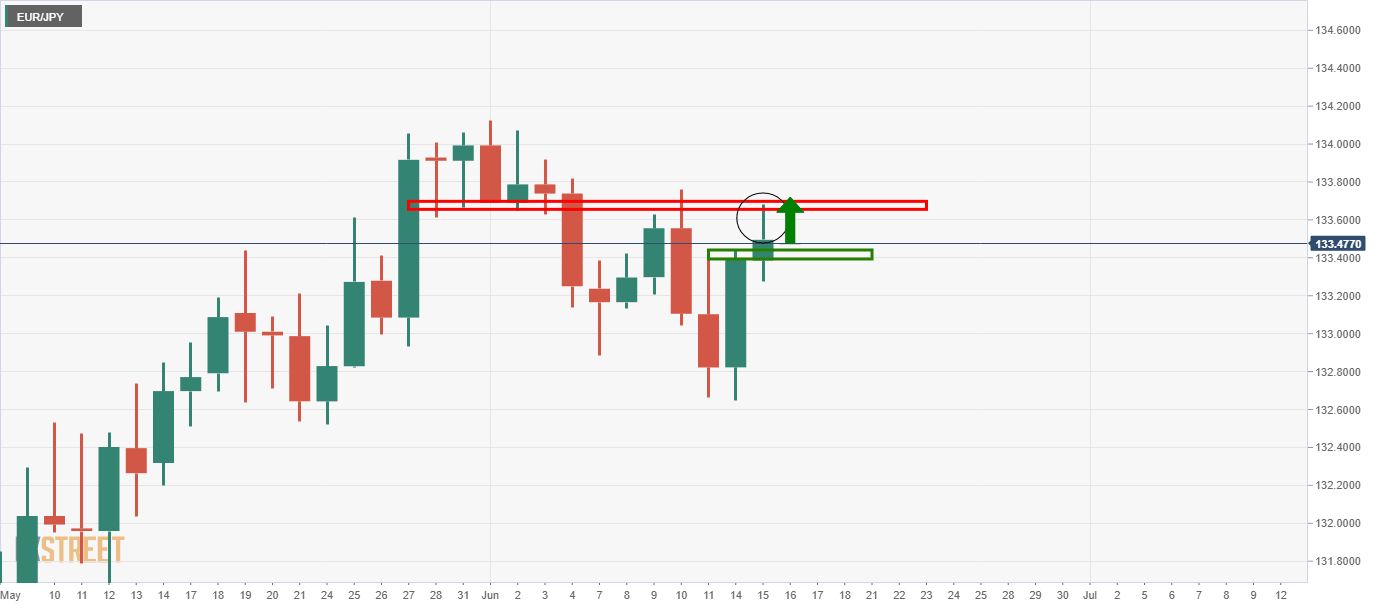

EUR/JPY daily chart

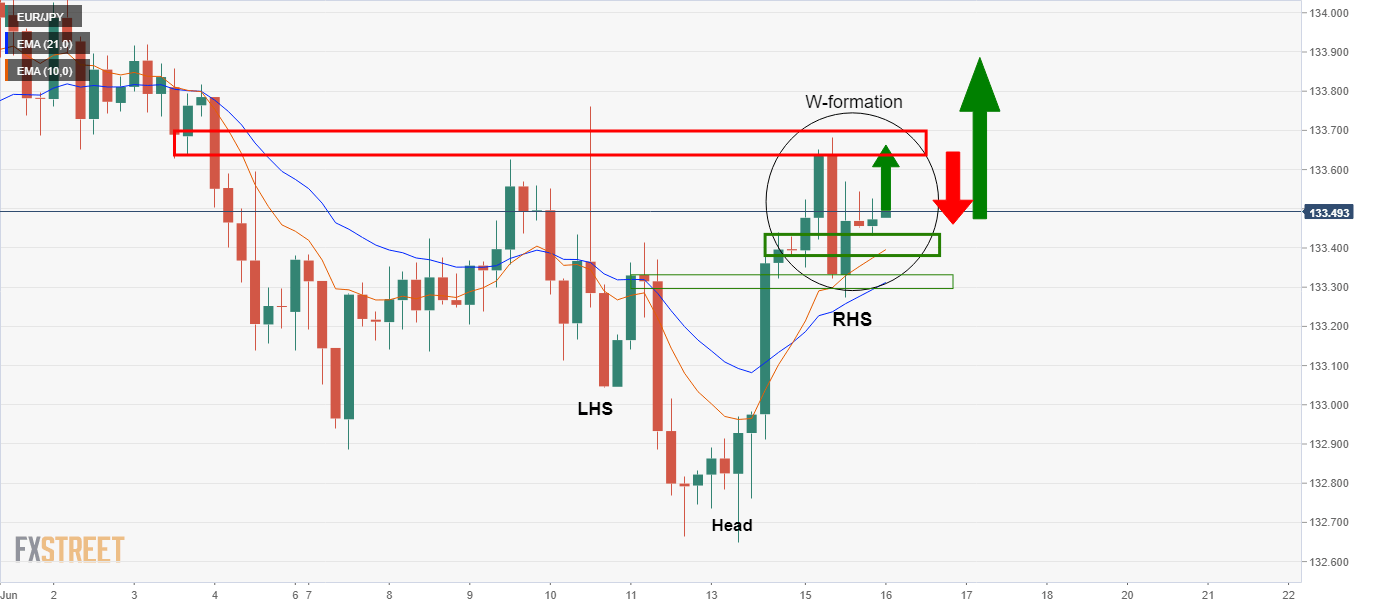

EUR/JPY 4-hour chart

The 4-hour chart shows that the price is forming an awkward reverse head and shoulders with a bullish tendency.

The price would be expected to fill in the daily wick and retest the old 4-hour highs and daily resistance.

In doing so, this would leave a W-formation on the 4-hour chart. Should the neckline hold on a retest, then there would be prospects for a break of daily resistance.

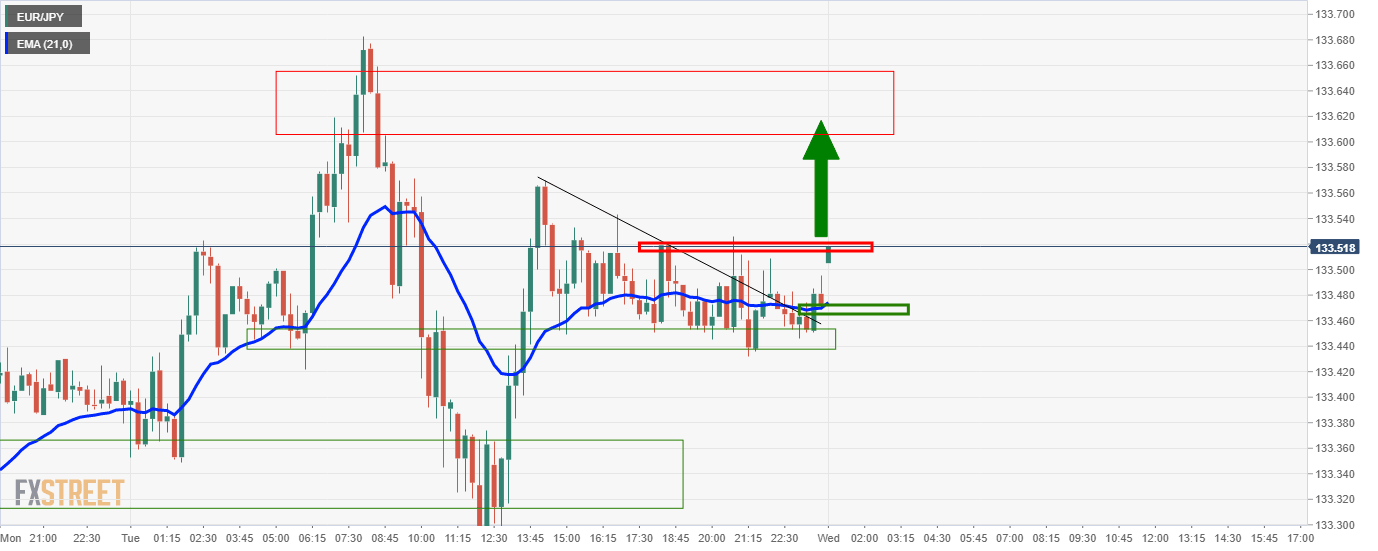

EUR/JPY 1-hour chart

Meanwhile, the cross has been a slow burner overnight but is coiled at potentially on the verge of a bullish breakout from the the 21-EMA to at least meet near to the 4-hour highs in the 133.60s.

The 15-min price action is already making headway from bullish structural support.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.