EUR/JPY Price Analysis: Bulls flirt with trading range hurdle, around mid-163.00s on dovish BoJ

- EUR/JPY gains strong positive traction in reaction to the BoJ’s dovish pause on Thursday.

- The technical setup favors bulls and supports prospects for a further appreciating move.

- A break below the short-term trading range support is needed to negate the positive bias.

The EUR/JPY cross catches aggressive bids on Thursday and rallies to a fresh weekly high, around the mid-163.00s during the first half of the European session amid the dovish Bank of Japan (BoJ)-inspired selling around the Japanese Yen (JPY). However, a modest US Dollar (USD) is seen weighing on the shared currency and might keep a lid on any further gains for spot prices.

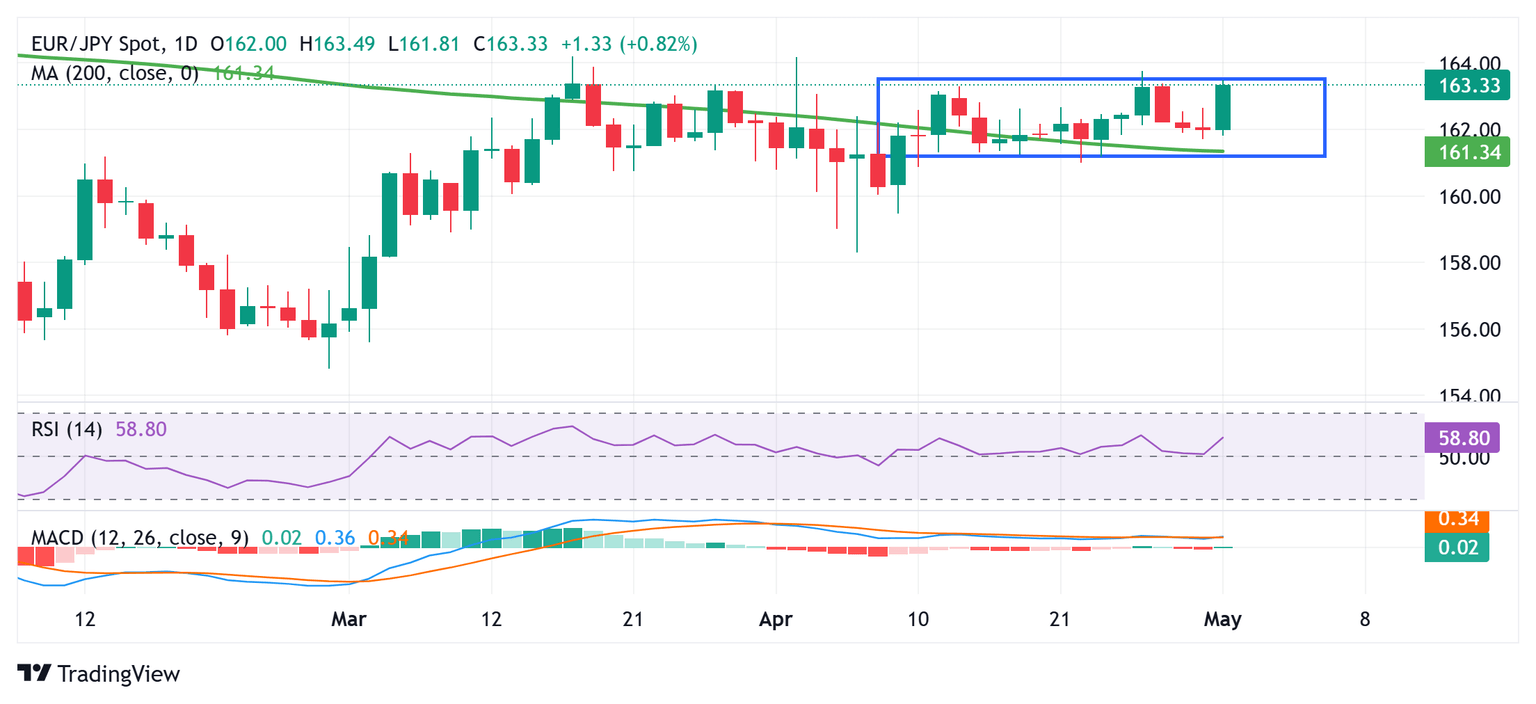

Looking at the broader picture, the EUR/JPY cross has been oscillating in a familiar trading band over the past three weeks or so. Against the backdrop of a sharp recovery move from the year-to-date low touched in February and the recent breakout above the 200-day Simple Moving Average (SMA), the range-bound price action might still be categorized as a bullish consolidation phase.

Moreover, technical indicators on the daily chart are holding in positive territory and suggest that the path of least resistance for the EUR/JPY cross is to the upside. Hence, a subsequent strength, back towards the 164.00 mark, looks like a distinct possibility. Some follow-through buying beyond the 164.20 area will be seen as a fresh trigger for bulls and pave the way for further gains.

On the flip side, the 163.00 mark now seems to protect the immediate downside, below which the EUR/JPY cross could slide to the 162.00 neighborhood en route to the 161.75 region (200-day SMA) and the trading range support near the 161.35 zone. A convincing break below the latter will negate the near-term positive outlook and shift the bias in favor of bearish traders.

The EUR/JPY cross might then weaken further below the 161.00 round figure, towards testing the next relevant support near the 160.40 area before eventually dropping to the 160.00 psychological mark. The downward trajectory could extend further towards the mid-159.00s en route to the 159.00 mark and the April monthly swing low, around the 158.30 region.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.03% | 0.02% | 0.79% | 0.13% | 0.27% | 0.10% | 0.00% | |

| EUR | -0.03% | -0.00% | 0.77% | 0.07% | 0.24% | 0.08% | -0.04% | |

| GBP | -0.02% | 0.00% | 0.75% | 0.10% | 0.24% | 0.08% | -0.03% | |

| JPY | -0.79% | -0.77% | -0.75% | -0.72% | -0.56% | -0.77% | -0.89% | |

| CAD | -0.13% | -0.07% | -0.10% | 0.72% | 0.15% | -0.03% | -0.14% | |

| AUD | -0.27% | -0.24% | -0.24% | 0.56% | -0.15% | -0.16% | -0.26% | |

| NZD | -0.10% | -0.08% | -0.08% | 0.77% | 0.03% | 0.16% | -0.11% | |

| CHF | -0.00% | 0.04% | 0.03% | 0.89% | 0.14% | 0.26% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.