EUR/JPY Price Analysis: Bears in charge after breaking key support levels, eye 153.00

- EUR/JPY starts Friday flat at 155.62 after Thursday's sharp plunge; downward bias sustained post-BoJ Governor Ueda's remarks.

- Cross pair remains bearish, as technical indicators signal further losses; Tenkan-Sen below Kijun-Sen.

- Key support levels lie at 155.00, followed by October 3 low of 154.34, and December 7 low of 153.11.

The EUR/JPY begins Friday’s Asian session almost flat after plunging sharply on Thursday, following perceived hawkish remarks by the Bank of Japan (BoJ) Governor Kazuo Ueda. At the time of writing, the pair exchanges hands at 155.62, virtually unchanged.

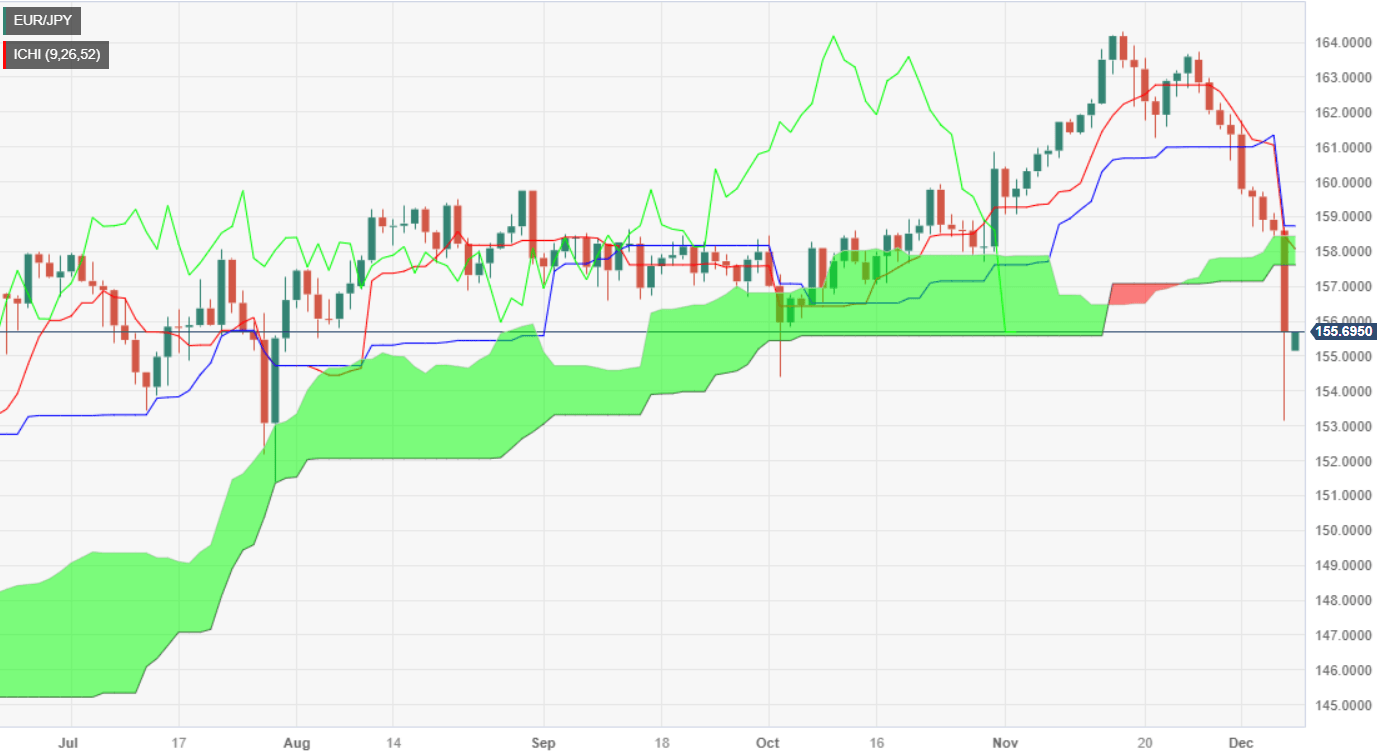

After Thursday’s 290-plus pip drop, the EUR/JPY remains downward biased. The cross pair shifted bearish after breaking key support levels. The cross slide below a fourth-month-old support trendline, and the Ichimoku Cloud (Kumo).

In addition to that, the Tenkan-Sen crossed below the Kijun-Sen, opening the door for further losses. Hence, the bearish bias remains intact, and the EUR/JPY first support would be the 155.00 figure. Further downside emerges if the pair drops below the October 3 swing low of 154.34, followed by the December 7 low of 153.11.

If EUR/JPY buyers would like to regain control, they must reclaim the bottom of the Kumo at 157.58, followed by the 158.00 mark.

EUR/JPY Price Analysis – Daily Chart

EUR/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.