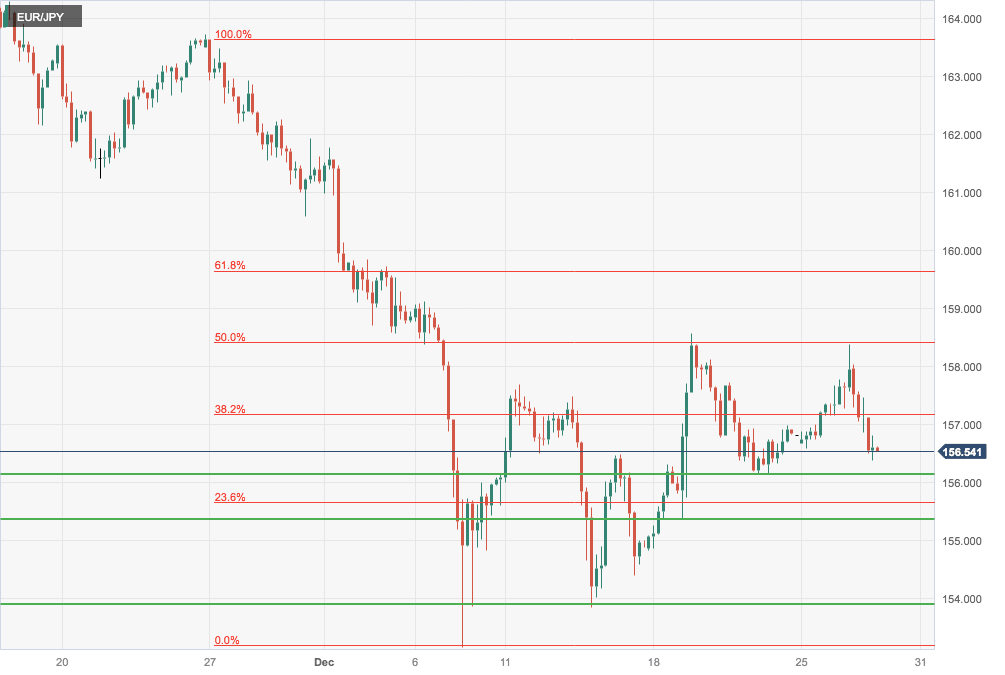

EUR/JPY Price Analysis: Bearish reversal stalls at 156.10 support

- The Euro downside attempts have been capped above 156.00.

- The pair is consolidating after the late November decline.

- Euro bulls will face strong resistance at 158.45.

The Euro is looking for direction on a light session on the last trading day of the year. The pair´s reversal from 158.45 has been contained at the 156.10 support area with 1.57.00 capping bulls so far.

Looking from a broader perspective, the pair is in a consolidation pattern, following a bearish impulse from November highs above 164.00

Technical indicators are mixed, with the RSI flat near the 50 level which shows a lack of clear direction. On the episode, the mentioned 157.00 is closing the path towards key resistance at 158.45, the 5o% retracement of the late November sell-off.

On the downside, immediate support lies at the mentioned 156.10, and below here, 155.35, and the December 14 low at 154.00.

EUR/JPY 4-hour Chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.